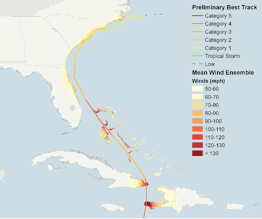

Hurricane Matthew claims loss reaches $606m in Florida

31st October 2016The hurricane Matthew insurance or reinsurance claims loss has now reached $606 million, according to the latest from the Florida Office of Insurance Regulation. With over 57% of claims filed still open the total can be expected to rise further, with the remaining claims potentially able to add as much as $800m to the total.

Read the full article