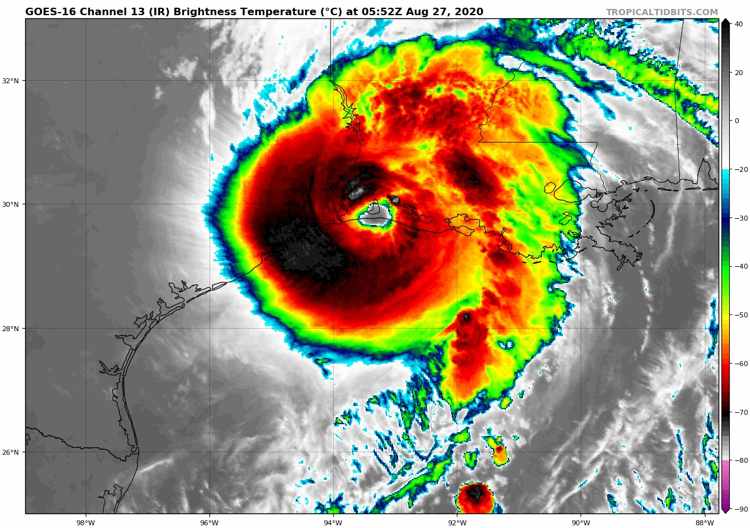

Hurricane Sally losses preliminarily estimated at $1.5bn to $3.9bn by AIR

17th September 2020According to our industry sources, a preliminary estimate of insurance and reinsurance market losses from hurricane Sally has been pegged at between $1.5 billion and $3.9 billion by catastrophe risk modeller AIR Worldwide.

Read the full article