Artemis’ data shows that robust investor demand for traditional 144A catastrophe bond-linked returns resulted in strong pricing execution for sponsors of transactions in the first-quarter of 2021, a trend that has continued into Q2.

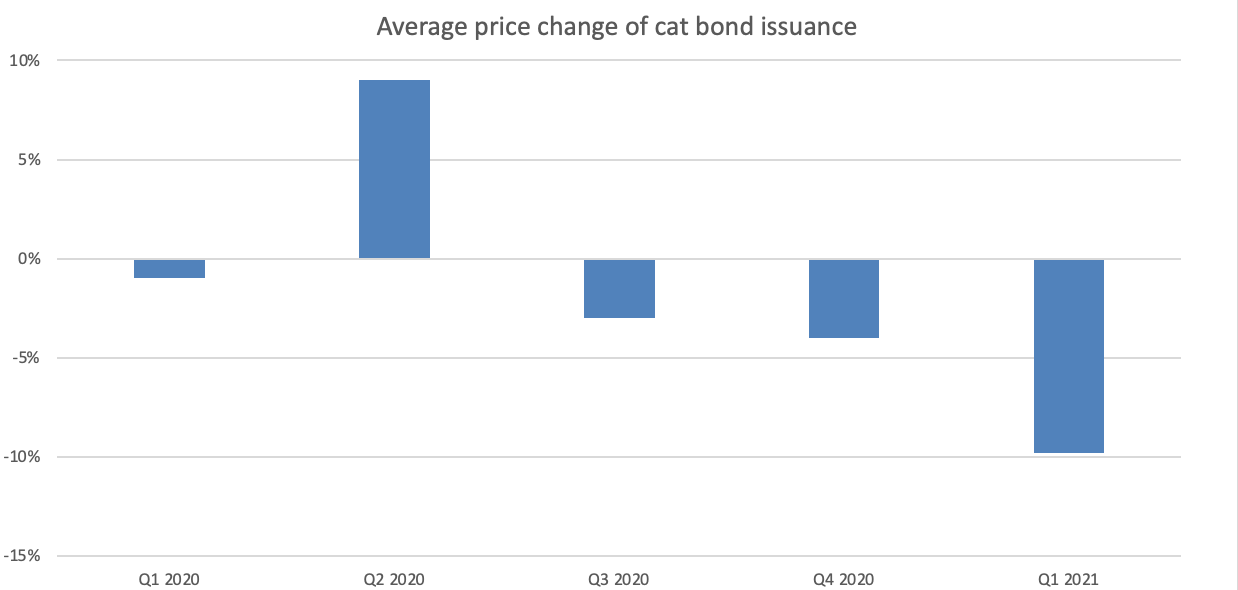

During the opening quarter of the year, the average price change of successfully issued traditional 144A cat bond notes amounted to -9.8%, as reported in Artemis’ Q1 2021 catastrophe bond and insurance-linked securities (ILS) market report.

In Q1, this notable average decline in pricing was a sign of strong investor demand, with all but one out of 13 tranches issued pricing below the mid-point of initial guidance while marketing.

As a result of this heightened demand, sponsors were able to lock-in multi-year reinsurance / retrocession protection at more attractive rates during the period.

Furthermore, the chart below shows that over the past five quarters, only Q2 2020 witnessed, on average, a positive price change from the mid-point of initial guidance.

Some of the price declines seen during Q1 really were quite dramatic, which is reflected in the year-on-year change from an average price decline of 1% in Q1 2020, to the -9.8% decline recorded in Q1 2021.

During the first-quarter of this year, the Class B tranche of Sakura Re Ltd. (Series 2021-1) notes was the only slice of issuance that priced at the mid-point of initial guidance.

In contrast, the Class A tranche of notes from the same transaction actually witnessed the steepest price decline while marketing, with pricing coming down by 18.2% to settle at a coupon of 2.25%.

The tranche of Kizuna Re III Pte. Ltd. (Series 2021-1) notes initially went out to investors with a price mid-point of 2.375%, but strong demand saw pricing decline by 15.8% to pay investors a coupon of 2%.

The Class A tranche of First Coast Re III Pte. Ltd. (Series 2021-1) notes also saw pricing decline by 15.8% while marketing as the coupon eventually settled at 6%, against an initial mid-point of 7.125%.

Both tranches of Sierra Ltd. (Series 2021-1) notes also experienced strong demand while marketing, as pricing for these two tranches declined by 13.6% from the mid-point, paying investors a coupon of 2.7% and 4.75%.

The Cape Lookout Re Ltd. (Series 2021-1) transaction saw its pricing fixed at 3.25%, representing a decline of 13.3% from the mid-point of guidance.

A percentage price change in the double figures also occurred with the latest Ursa Re II Ltd. (Series 2021-1) transaction, as pricing dropped by 10.7% to settle at a fixed coupon of 6.25%.

A lesser, albeit still negative price change of -6.3% was seen with the Cosaint Re Pte. Ltd. (Series 2021-1) transaction.

Additionally, the pricing dropped on both tranches of the FloodSmart Re Ltd. (Series 2021-1) issuance, by 6.3% in the Class A tranche and by 3.6% in the Class B tranche.

Torrey Pines Re Pte. Ltd. (Series 2021-1) was the only other 144A catastrophe bond issued in the quarter. With this deal, the Class A tranche saw its pricing come down by 5.9% and the Class B tranche by 4.5% from the mid-point of initial price guidance.

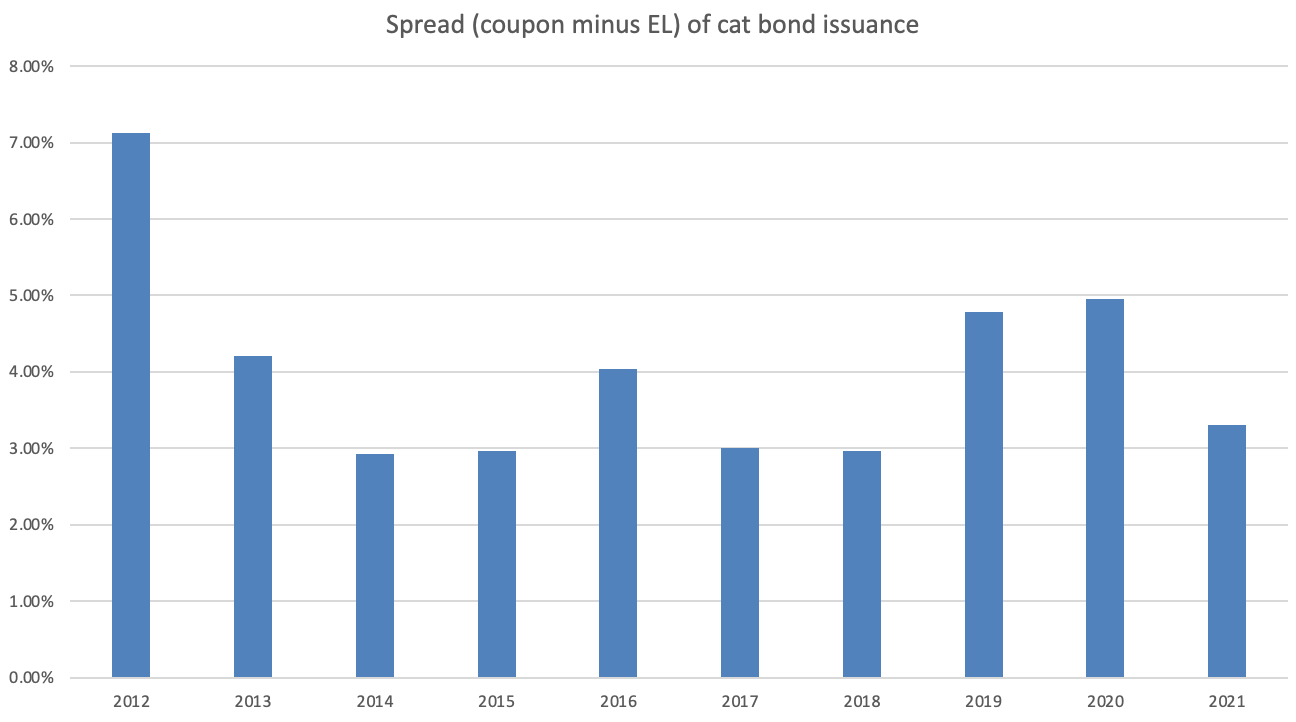

As the data reveals, the spread (coupon minus expected loss) on many cat bond notes dropped considerably during the first-quarter due to strong ILS investor appetite.

You can see above that the spread of cat bond issuance declined from more than 7% in 2012 to a low of 2.92% in 2014. And, with the exception of 2016, the spread hovered around the 2.9% – 3% range for the next four years, before approaching 5% in both 2019 and 2020.

As at the end of the first-quarter of 2021, Artemis’ data shows that the spread of cat bond issuance stayed above the 3% mark, but currently remains some way below the 4.96% seen at the end of 2020.

During 2020, rates and pricing in the ILS market for catastrophe bond coverage increased on the back of hardening reinsurance market conditions to levels not seen for a number of years, but there was evidence towards the end of 2020 that things were beginning to soften again.

While rates have held at higher levels in early 2021, demand for the catastrophe bond product is currently very high, which in turn has served to moderate rate increases and essentially push down the spread of cat bonds so far this year.

Early Q2 cat bond issuances have followed suit, with multiples falling through the deals issued so far and cat bond pricing seemingly now softening further.

Of course, with the Florida-focused mid-year renewals fast approaching it remains to be seen what happens to reinsurance rates and pricing for cat bond and ILS business, and whether expected increases are enough to reverse the current trend.

Stay tuned to Artemis as we move through the second-quarter of 2021, which is forecast to be a busy period for new catastrophe bond issuance and we’ll detail every transaction in our Deal Directory.

We’ll keep you updated on all catastrophe bond and related ILS transaction issuance, as well as evolving trends in the cat bond and insurance-linked securities (ILS) market.

For full details of first-quarter 2021 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For full details of first-quarter 2021 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q1 2021 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.