A new study of institutional investors from around the world by global asset management group Schroders has found that 10% of respondents plan to increase their allocations to insurance-linked securities (ILS) over the next year.

Schroders annual Institutional Investor Study features the perspectives of 750 institutional investors, including corporate and public pension funds, insurance companies, other official institutions, private banks, endowments and foundations, that are collectively responsible for a huge $26.8 trillion in assets.

As a result, is 10% said they will increase their allocations to a still relatively niche asset class like ILS, it is positive for the market as that is 75 major investors from around the world that believe the timing is right to increase investments into insurance and reinsurance linked investment markets.

In general, Schroders study found an increasing focus on the benefits of diversification and relatively uncorrelated asset classes, also positive for ILS and reinsurance investing in general.

The study found that the vast majority of investors plan to increase their private assets exposures over the next 12 months, with diversification a key driver.

In fact, overall some 90% of investors responding to the study want to increase their allocations to one or more private assets classes over the coming year.

Given how niche ILS remains, and the fact it’s an asset class many investors continue to follow and seek to learn about, as demonstrated by our large readership of institutional investors from around the globe, eventually this appetite for diversification will drive more investors to explore ILS opportunities more deeply, ultimately driving more first-time ILS allocations as well.

Driving home the importance of diversification and the growing awareness of the need to target assets that exhibit lower correlation, Schroders study found that 47% of investors aim to continue to diversify into alternatives and private markets, while reducing listed exposures, a fact that is being driven by the economic and financial impact of the pandemic.

In fact, some 80% of investors highlighted a need to diversify portfolios as the main driver of their private and alternative asset class allocations, up from 78% a year ago and the 73% polled in 2019.

ESG (environmental, social, governance) remains an increasing factor in allocation decisions as well, and more than one-third of investors said that the impact of the pandemic had increased the importance of ESG considerations.

On ILS as an asset class specifically, 10% of the 750 investors surveyed said they plan to increase allocations to the ILS market over the next year.

Interestingly though, the response differs depending on where in the world an investor is located, with Latin American investors seemingly the keenest to ramp up exposure to the insurance-linked securities (ILS) market at this time.

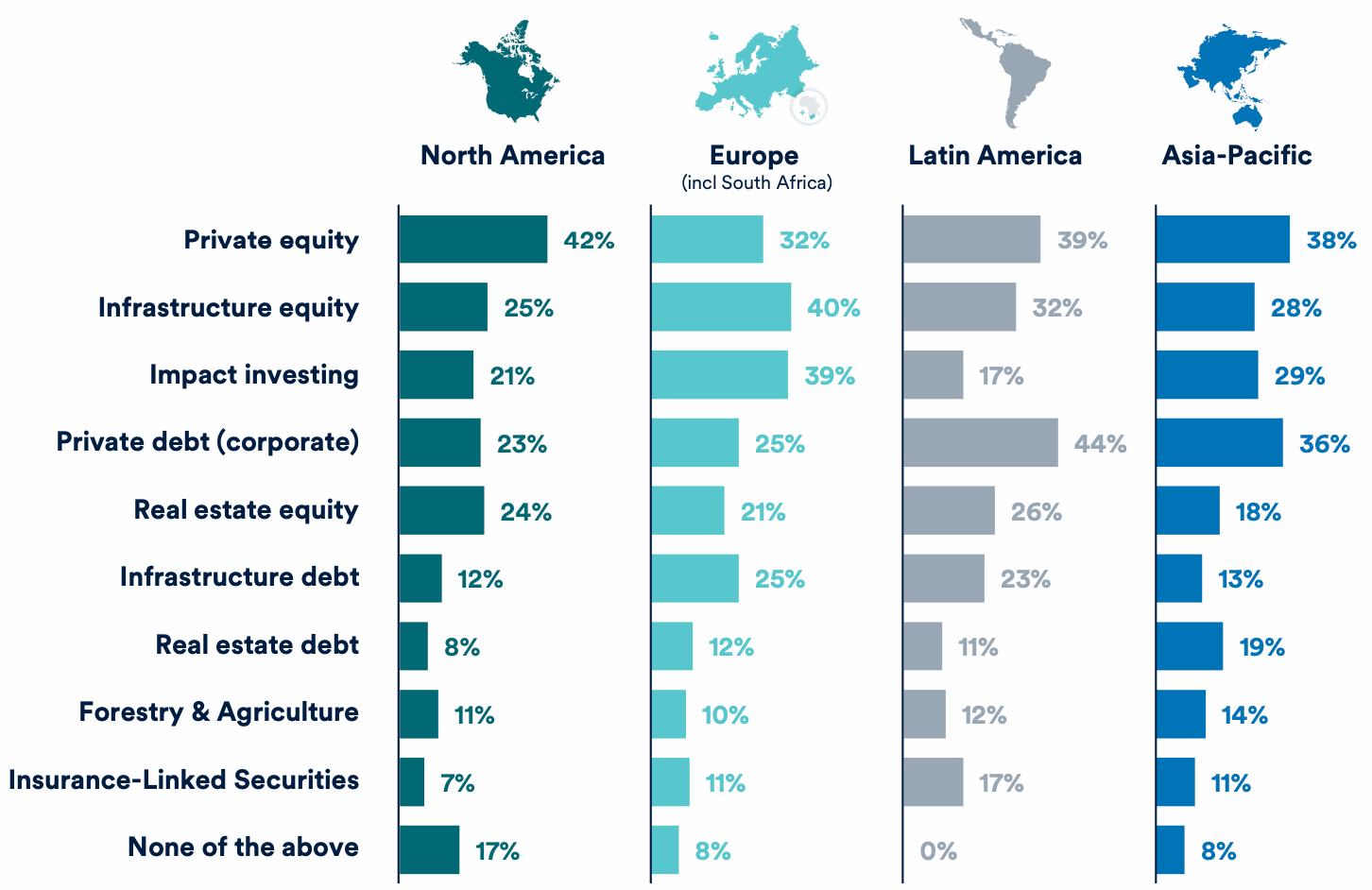

The chart below shows investors responses to the question of where they intend to increase allocations over the next year broken down by region.

17% of investors in Latin America said they’d increase their allocations to ILS, while 11% of those in Asia Pacific and Europe said the same, but only 7% of investors in the United States.

It’s encouraging for the ILS market to see such interest from Latin America, as well as from Asia Pacific, which have historically not been such significant sources of ILS asset flows.

Growth into more emerging investment markets will be a positive development for the ILS market in time, as more investors gain an understanding of the asset class and what it means to invest directly in insurance and reinsurance related risks.

The survey also found that obstacles cited by investors, related to private assets and alternative investments, continued to be that fees can be too high, that transparency can be lacking and that valuations can be too high.

Schroders said it is important to note that when they asked investors about the challenges related to private assets, illiquidity (42%) and complexity of the asset class (35%) did not feature among investors’ key challenges, which is again positive for ILS, an asset class that can be more complex and feature longer investment lock-ups.

“This may suggest that investors are now recognising that illiquidity and long lock-ups, whilst a concern, are also a key reason to invest in private assets,” Schroders explained.

Georg Wunderlin, Global Head of Private Assets, Schroders Capital, commented on the study, “Private assets continue to take a greater share of institutional portfolios. What is encouraging is the emergence of signs that the versatility within private markets is being recognised. However, while it is clear that institutional investors value real diversification highly, we think the variety and consistency of diversification within private assets may actually be underestimated.

“The opportunity is not only to diversify across publicly listed and private investments, but also to diversify within private assets. By combining different private asset classes investors can get exposure to very different return, risk and liquidity profiles and also make use of different underlying macroeconomic and industry-specific return drivers.

“Private markets are incredibly nuanced. They offer not only a wider range of risks, such as complexity- or illiquidity-based premia than many investors realise, but a huge number of private assets focused investment solutions can be tailored depending on investors’ preferences. A growing number of our clients are taking advantage of this potential as we remain focused on working in partnership with them to meet their evolving needs amid the ongoing challenges of the pandemic and broader market uncertainties.”

Maria Teresa Zappia, Chief Impact and Blended Finance Officer and Deputy CEO of BlueOrchard, commented on the growing ESG focus among investors,“It is clear that institutional investors have a significant demand for investment strategies working to foster positive change.

“What’s more, Covid-19 has indicated the importance of providing financing in real time to the core sectors of the economy. It has also shown how vital the combination of public and private resources is at times of crisis, when financing needs are overwhelming and the funding from the private sector alone would not suffice.

“Private debt in emerging and frontier markets also proved crucial, with dedicated initiatives targeting the sectors and regions most impacted by the pandemic.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.