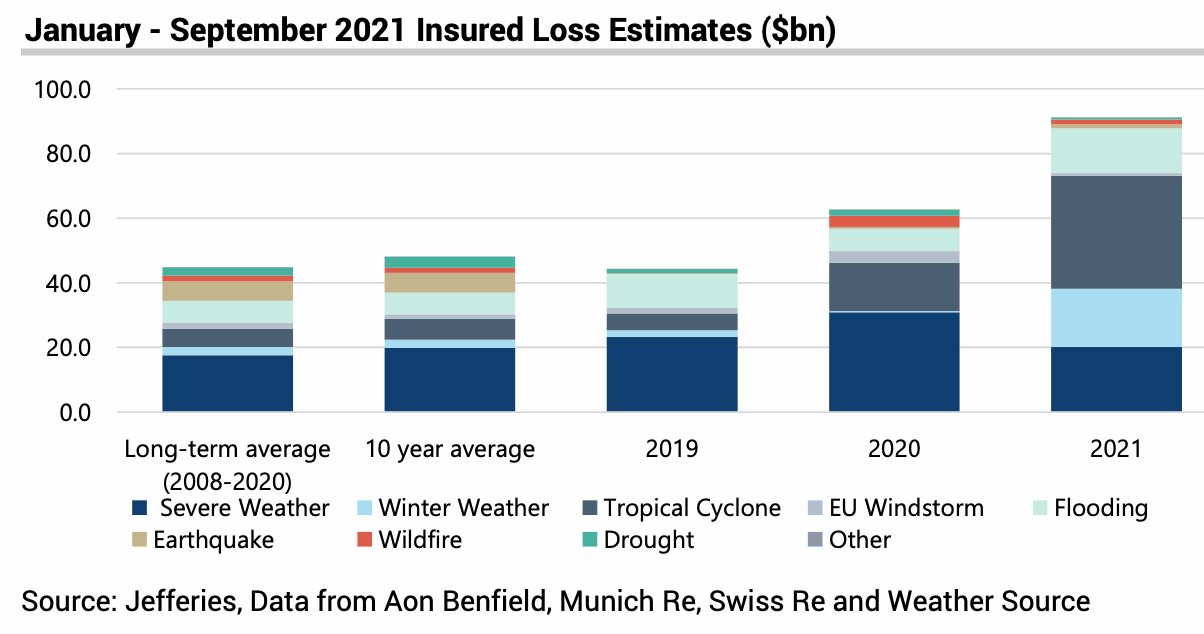

Global insurance and reinsurance market losses from natural catastrophes and severe weather events are now running at double the long-term average so far in 2021 and are at the highest level seen since 2017, according to analysts at investment bank Jefferies.

Already, 2021 global catastrophe and severe weather losses for the insurance and reinsurance industry are higher than seen in the full-years 2018, 2019 and 2020, the analysts estimate.

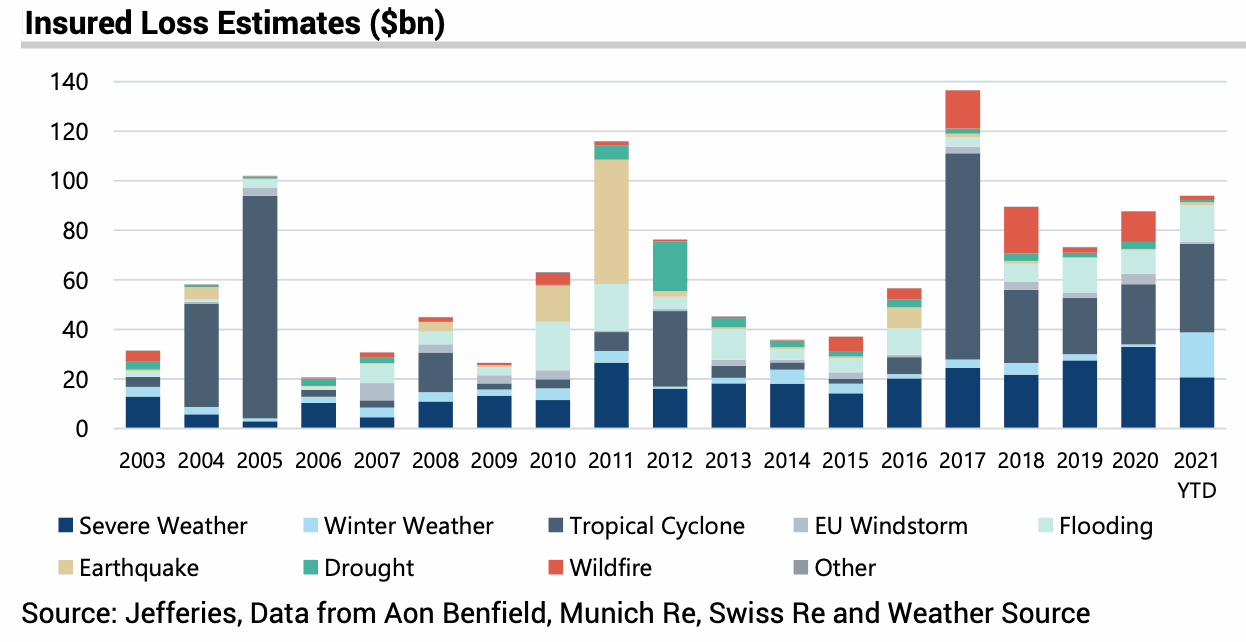

Jefferies chart, below, shows that insured catastrophe losses in 2021 already look set to make it the fourth highest annual total in the last two-decades.

Even excluding hurricane Ida, which is the largest catastrophe loss event of 2021 so far, the run-rate remains 32% ahead of the long-term average, on Jefferies data.

It’s also worth noting that Jefferies continue to peg hurricane Ida as a $32 billion industry loss, a figure that now looks set to come in too low as industry expectations continue to move upwards, when including the flood related damage from Ida’s remnants suffered further north.

September has been a far quieter month luckily for the industry, with industry catastrophe losses coming in at the lowest level for any month in 2021 so far.

But still, the third-quarter catastrophe loss burdens look set to be significant for global insurance and reinsurance writers, which continues to lend upwards-pressure to pricing for the end of the year.

Catastrophe budgets are set to be exceeded, resulting in more use of reinsurance and retrocessional protection through 2021, with inevitable ramifications for insurance-linked securities (ILS) fund strategies as a result.

Jefferies analysts say it is a “near certainty that budgets will be exceeded”, with now natural catastrophe losses in 2021 to-date running +103% higher than the long-term average (2008-2020) and more than 90% higher than the 10-year average.

Interestingly and of note for the industry, Jefferies believes that catastrophe losses in 2021 are more spread across a wider range of perils than other recent years, which may reinforce some of the concern over rising volatility and climate related influences.

The bottom-line is that with catastrophe budgets set to be exceeded, there’s a high likelihood of more reinsurance recoveries being made.

Jefferies analysts said, “Above-average losses are putting pressure on the adequacy of corporate natural catastrophe budgets. As we approach the 3Q results, we expect that reinsurance deductibles will be exceeded following material losses from single events like Hurricane Ida and European floods.

“Consequently, with a higher proportion of net losses falling on reinsurers, we expect these losses to drive further rate rises in property excess of loss contracts.”

That mirrors analysis of other analyst team and what we are hearing from market sources, with increasing expectations that January will see more property catastrophe reinsurance rate improvements.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.