Strong investor appetite enabled sponsors of traditional 144A catastrophe bond transactions to upsize target levels of reinsurance protection during the first-quarter of the year.

A factor of Q1 2021 catastrophe bond and related insurance-linked securities (ILS) issuance was the upsizing of property catastrophe deals.

Artemis’ data shows that during the period, 11 out of 13 tranches issued upsized from their initial target.

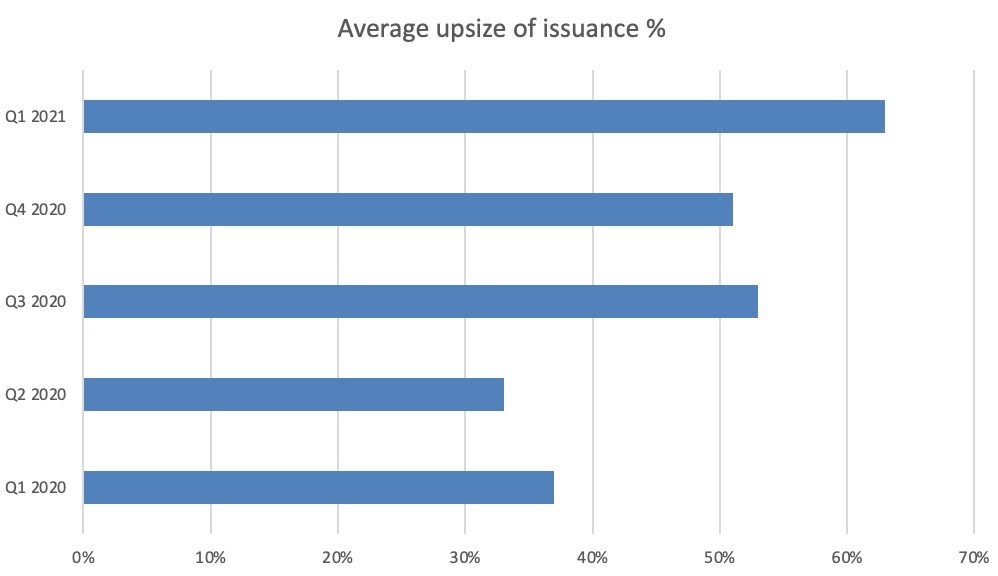

Driven by favourable market conditions and robust investor appetite for reinsurance-linked returns, sponsors secured an average upsize while marketing of 63% in Q1 2021.

As the chart below highlights, this is the third time in the past five quarters that, on average, 144A cat bond transactions issued have upsized by more than 50%.

During the most recent quarter, the $50 million Class B tranche issued via Sierra Ltd. (Series 2021-1) and the $150 million Class A tranche via Kizuna Re III Pte. Ltd. (Series 2021-1) were the only tranches to settle at their initial target price.

Starting at the lower end of the spectrum; both tranches of the Torrey Pines Re Pte Ltd. (Series 2021-1) transaction, sponsored by Palomar Specialty Insurance Company, upsized by 33% while marketing. With this deal, both the Class A and Class B tranches eventually settled at $200 million in size.

The California Earthquake Authority’s ninth transaction, Ursa Re II Ltd. (Series 2021-1), completed at $215 million after seeing its target size spike by 43%.

Both the Class A tranche issued through Sierra Ltd. (Series 2021-1) and the single tranche from Cosaint Re Pte. Ltd. (Series 2021-1) upsized by 50% while marketing, which saw both issuances eventually settle at $150 million.

FEMA’s largest deal to date, FloodSmart Re Ltd. (Series 2021-1), was placed in the market at a size of $575 million; after the Class A and Class B tranches upsized by 64% and 67%, respectively.

Japanese insurer Sompo’s latest market entry, Sakura Re Ltd. (Series 2021-1), completed at $400 million after both tranches upsized by 100% while marketing.

Finally, the two most dramatic increases in the quarter came from the $225 million First Coast Re Pte. Ltd. (Series 2021-1) transaction from Security First Insurance Company, and the $250 million Cape Lookout Re Ltd. (Series 2021-1) issuance from the North Carolina Insurance Underwriting Association, which upsized by 125% and 150%, respectively.

As the figures reveal, investor demand for the traditional 144A catastrophe bond product was robust in the first-quarter of the year, and the fact that all but two tranches issued upsized during the period shows that sponsors were more than happy to take advantage of current market conditions.

What’s more, as the market moves further into Q2 the landscape remains favourable for continued, strong investor appetite. And, with sponsors seemingly eager to secure greater levels of reinsurance and retrocessional protection from the capital markets, it will be interesting to see if the trend of deals upsizing while marketing continues.

Stay tuned to Artemis as we move through the second-quarter of 2021, which is forecast to be a busy period for new catastrophe bond issuance and we’ll detail every transaction in our Deal Directory.

We’ll keep you updated on all catastrophe bond and related ILS transaction issuance, as well as evolving trends in the cat bond and insurance-linked securities (ILS) market.

For full details of first-quarter 2021 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For full details of first-quarter 2021 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q1 2021 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.