Hedge funds suffered in the first-quarter of 2020, as the Covid-19 pandemic drove billions of losses and also pushed investors to seek redemptions, resulting in a significant dip in hedge fund assets under management during the period.

It’s no surprise, given the significant volatility experienced through March in particular, as the global ramifications of the coronavirus became much clearer.

Preqin, a tracker of data on the alternative asset management space, said that hedge fund assets under management (AuM) tumbled some 9.4% to $3.31 trillion by the end of the first-quarter.

It was the first time that AuM of the hedge fund industry fell below $3.5 trillion since late 2018.

It was poor performance that drove the majority of this decline in AuM, resulting in $296.1 billion of lost assets, while investor redemptions totalled an estimated $47.7 billion during the quarter as well.

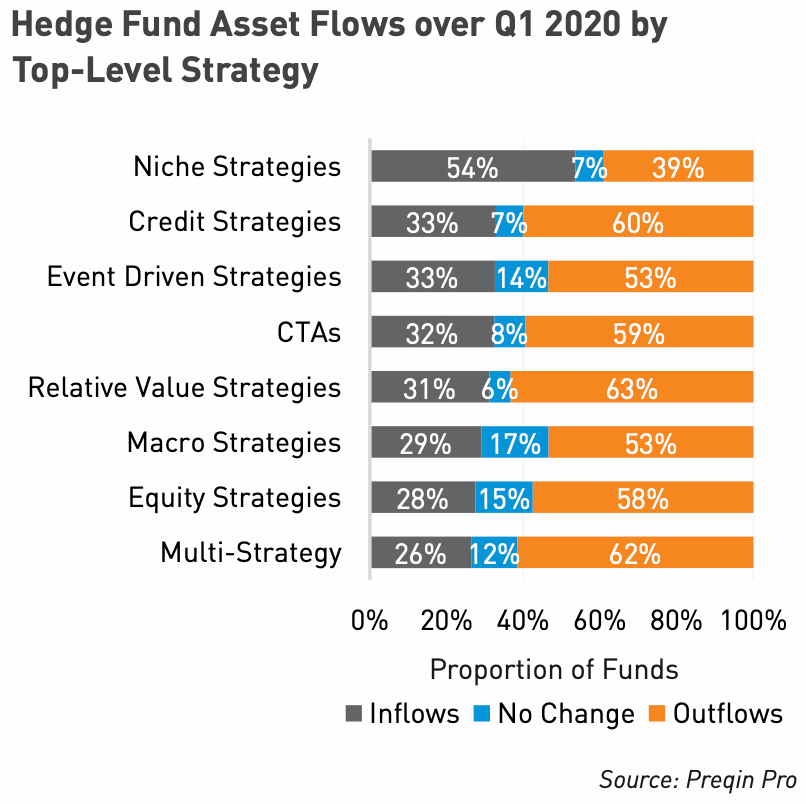

But this wasn’t evenly felt across the hedge fund space and the one area that inflows outpaced redemptions was in the niche hedge fund market, which tends to be where the most uncorrelated strategies and specialist segment asset classes are categorised, including insurance-linked securities (ILS) and reinsurance linked strategies.

Niche strategies actually recorded positive inflows for the first-quarter of 2020, by Preqin’s reckoning, helped by the fact that many of these strategies recorded relatively stable returns over the period.

With hedge fund strategies such as event-driven returns down more than -16% for the quarter, it’s no surprise that this segment lost roughly 21% of AuM during the period, as investors talked with their feet and left in their droves.

Meanwhile, segments that exhibited less volatility and less correlation did much better, which has helped the ILS market and reinsurance strategies not to be hit by the waves of redemptions that they could have been.

Of course, some redemptions have been seen in the ILS fund market. But most of the managers we’ve spoken with said these have been entirely manageable and not much higher than the typical levels of churn seen at the bigger ILS funds.

The catastrophe bond sector saw some exits, with the well-documented selling pressure enabling investors for who the strategy was less core to exit with almost all their principal intact. While at the same time this provided opportunities to specialist ILS fund managers who took advantage of the availability of below-par priced, often long-dated catastrophe bonds.

Some 54% of niche hedge fund strategies actually recorded inflows in Q1, compared with 7% reporting no change in AuM and 39% reporting some outflows.

It’s a reasonably similar experience to the ILS fund market, we understand from our sources. As the lack of correlation and relatively stable returns at a time of significant global volatility saw many investors staying put.

Alternative and niche investment strategies are likely to come further into focus as the pandemic volatility subsides, which could lead to more inflows into the sector as institutional investors look for asset classes that can be a more defensive play in times of crisis.

The return performance of ILS strategies over this period of global uncertainty could stand ILS fund managers in good stead for the future as well.

Preqin explained, “The data shows that funds that perform well are more likely to receive investor inflows.

“Any funds able to navigate the COVID-19-induced market disruption to produce a positive return are likely to build a strong track record that may help secure future investments.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.