The long-awaited, significant hardening of the reinsurance market, underpinned by price increases and improving terms and conditions (T&Cs), is vital following the disappointing response to catastrophe events over the past few years, according to experts from across the re/insurance and insurance-linked securities (ILS) space.

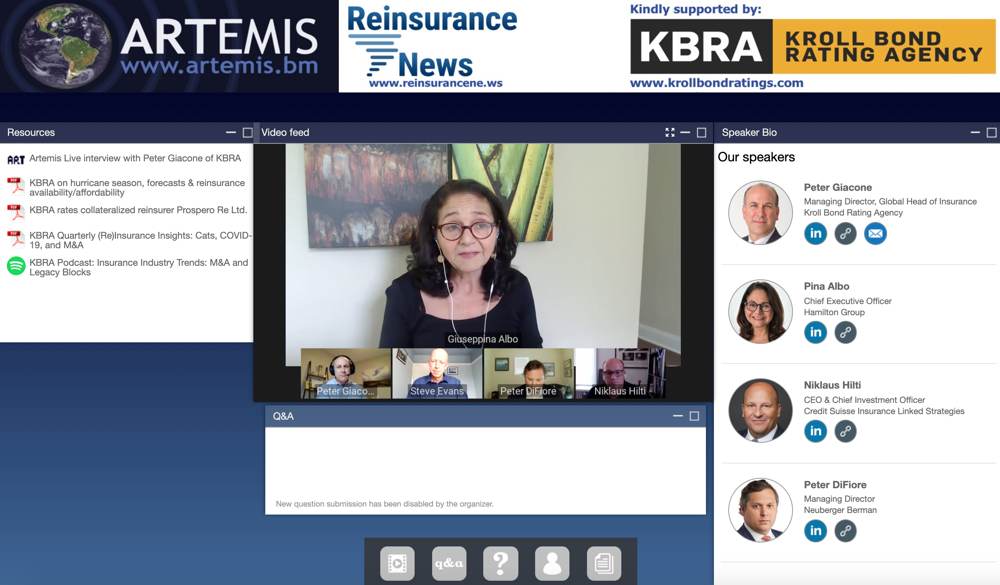

Artemis, in collaboration with sister publication Reinsurance News and in association with our partner Kroll Bond Rating Agency (KBRA), held a webinar recently which explored both the traditional reinsurance and ILS market in 2021 against the backdrop of a global pandemic.

Artemis, in collaboration with sister publication Reinsurance News and in association with our partner Kroll Bond Rating Agency (KBRA), held a webinar recently which explored both the traditional reinsurance and ILS market in 2021 against the backdrop of a global pandemic.

Many topics were discussed, from the ongoing businesses interruption (BI) issue and trapped capital, to ILS investor interest and both the immediate and longer-term potential impacts of the Covid-19 crisis.

Towards the end of the session, which featured Niklaus Hilti, Chief Executive Officer (CEO) & Chief Investment Officer (CIO), Credit Suisse Insurance Linked Strategies; Pina Albo, CEO, Hamilton Group; Peter DiFiore, Managing Director, Neuberger Berman; and Peter Giacone, Managing Director, Global Head of Insurance, KBRA, panellists offered some thoughts on their expectations and priorities for next year.

“For us, it’s really, finally a significant hardening of the market. I think this is important after the response to catastrophes over the last couple of years has been, let’s say, disappointing. Maybe a little bit there has been an oversupply of capital driving that, and I think with Covid-19, I really believe that the market is now getting significantly more disciplined,” said Hilti.

Adding, “Risk is going to be rewarded with higher premiums and I think for us, it’s really a continuation of better terms and better margin.”

According to Albo, although the market is currently not at historic all-time highs, it is clearly trending more favourably, with quarter per quarter positive pricing trends being seen across both insurance and reinsurance lines.

“And, we think that there are factors there that will keep this momentum going into 2021 and beyond, quite frankly,” she said.

Continuing to explain that, “We focus a lot on rate, but the other important aspect are terms and conditions. In the course of the soft market wordings have been broadened, hours clauses get extended, and what we’re now seeing, is in addition to the rates going the right way, people going back and looking at wording and saying, ‘well hang on a second, let’s pare this back, let’s look again at the definition of loss’. And that is also a very, very important aspect of what we’re seeing right now.”

For Giacone and KBRA, 2021 is expected to be an exciting year, and he noted the tremendous amount of opportunity for the company to be a value added service to both investors and issuers.

“We think this type of environment is driving a lot of change and a lot of evolution, a lot of creativity, and we want to be there to partner with the folks who are doing that and hopefully provide some service.

“It’s beyond just the ratings, I find, in talking to investors and issuers. There’s a lot of sophisticated investors out there, and you can categorise them as Peter did earlier. But, what we really find is beyond just getting to a letter grade, what’s just as important, equally important or more important, is the process, and also the report that we put out at the end that helps explain how we came to our conclusion.

“We find investors find that really useful in their discussion internally and externally. So, again, looking forward to an exciting year, we’ll continue to stay plugged in,” said Giacone.

At asset manager Neuberger Berman, DiFiore explained that the priorities in 2021 will be a continuation of seeking to deliver interesting products to its investors, that are going to provide valuable diversification to their portfolios.

“And, do so with a focus on managing risk appropriately and actively, and benefitting from the hardening in the market.

“On a counterparty side, working with our business partners and continuing to try and create innovative solutions that are responsive to their needs, and help us really expand the suite of tools that we can bring to them to help them address their problems. So, it’s just a continuation of what we’ve been doing,” said DiFiore.

If you weren’t able to join us live you can still register to watch this webcast on-demand.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.