As we said should be expected last week, the insurance-linked securities (ILS) and collateralized reinsurance investment fund market has fallen to an August loss due to the impact of hurricane Harvey, with the average return across 34 tracked ILS funds coming out at -0.34% for the month.

It’s the single worst monthly return for the ILS fund market since October 2012, when superstorm Sandy struck the United States.

After falling to a -0.34% loss for August the average year-to-date return across the 32 ILS funds tracked by the Eurekahedge ILS Advisers Index has fallen to 1.87%.

Given September is likely to be considerably more negative, as the losses from hurricanes Irma and Maria will be factored into ILS fund returns in that months results, it’s safe to assume that the full-year 2017 return will now be among the lowest annual returns on record for this ILS market index.

ILS Advisers founder Stefan Kräuchi explained that while hurricane Harvey had a mark-to-market impact on some catastrophe bond positions, it is not expected to result in any cat bond losses. There may however be some erosion of certain cat bonds aggregate retention due to the industry loss from hurricane Harvey, he noted.

Private ILS positions, so collateralized reinsurance and private cat bond-like structures, are exposed to losses from hurricane Harvey, but ILS Advisers noted that there is very little loss information available at this time and it could take some months for the full impact to ILS funds to be fully understood.

Kräuchi said that; “ILS managers have to resort to modelled losses to assess the impact of the recent events on their portfolios. As a consequence, there is still a high level of uncertainty surrounding the model outputs.”

The ILS fund valuations from Index constituents are therefore rife with uncertainty and could be adjusted in the coming months as the true extent of reinsurance and retrocession losses from hurricane Harvey become clear.

As a result of this, Kräuchi warned that over the coming months, “Investors should expect further performance adjustment for most funds, either upwards or downwards.”

For the month of August 22 out of the 34 ILS funds tracked by ILS Advisers reported positive returns, with the remaining 12 falling to losses for the month.

Some funds had a particularly bad month it seems and the difference between best and worst performing ILS fund in August 2017 was a huge 7.65%.

Pure catastrophe bond investment funds coped best with the fallout from hurricane Harvey, with the group up by 0.51% for the month of August.

Meanwhile and as expected, the group of ILS funds which also invest in private ILS or collateralized reinsurance reported a -0.96% return for the month.

Given hurricane Harvey was more of a water than wind loss event in the end, it was always going to be this way, with collateralized reinsurance and retrocession taking losses while cat bonds mostly escaped any impact.

After the challenging month of August 2017, the ILS funds that invest in private ILS trailed pure cat bond funds annual performance by -1.16 percentage points on annualised basis, ILS Advisers reported.

We should expect more of the same for September, with cat bond funds likely to suffer a larger dip in performance due to the impacts of hurricane Irma in Florida, a more wind exposed market, but the combined impacts of Irma and hurricane Maria likely to send private ILS and collateralized reinsurance funds to a larger loss yet again.

September 2017 could be much more negative than August, in fact we’d imagine it may end up being the most negative month in the ILS market’s history. We’ll report on ILS fund’s September figures in around one month’s time.

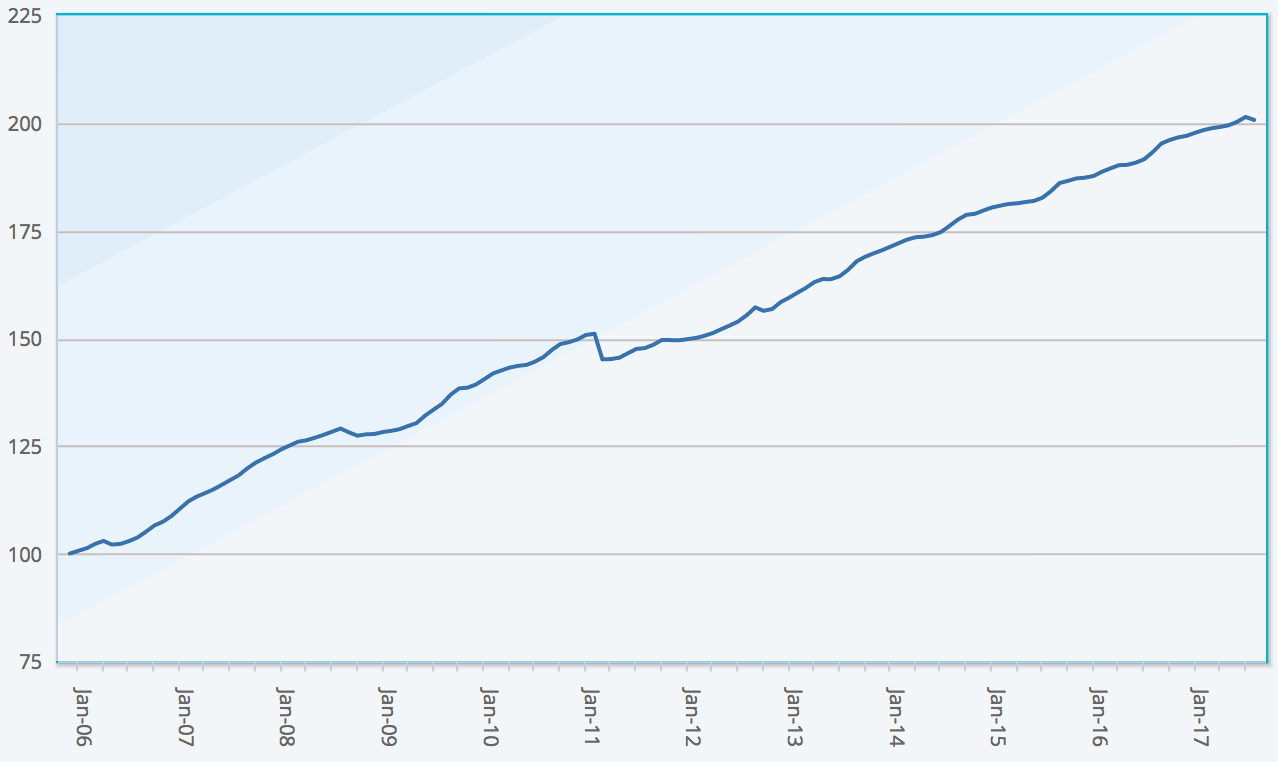

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.