The insurance-linked securities (ILS) fund market delivered a very slightly below-average 0.24% return for April 2021, as the effects of severe weather events in the United States caused impacts to some aggregate contracts during the period.

The Eurekahedge ILS Advisers Index was up by 0.24% for the month of April 2021, slightly below the 0.26% average return for that month, but the first positive April return for the ILS market, as measured in this Index, since 2017.

The Eurekahedge ILS Advisers Index was up by 0.24% for the month of April 2021, slightly below the 0.26% average return for that month, but the first positive April return for the ILS market, as measured in this Index, since 2017.

This puts the year-to-date performance of the ILS funds tracked by the Index into positive territory, at 0.02%.

Pure catastrophe bond funds led the way in April, delivering a 0.31% return for the month as a group, while the ILS funds that invest in collateralized reinsurance and private ILS contracts only managed a 0.2% return.

The reason for catastrophe bond funds outperforming in April was the aggregation of severe weather related losses through the start of the year and how this has weighed on valuations of some aggregate reinsurance positions.

A month ago, pure cat bond funds also outperformed in March as well, as winter storm impacts continued to flow to some collateralized reinsurance positions.

There will likely have been an element of winter storm Uri and Texas freeze influence on the impacts to aggregate reinsurance or retrocession positions in April as well, we suspect.

ILS Advisers explained that while there were no really major catastrophe events in April, severe thunderstorms and large hail caused losses in Texas and surrounds, while other severe weather events also caused an erosion of aggregates and some declines in valuations of positions, it seems.

“None of these events were significant enough to impact the reinsurance and ILS market, but the number of US severe weather events this spring is adding to losses for some aggregates contracts,” ILS Advisers explained.

In total 23 out of the ILS funds tracked by ILS Advisers for the Index reported positive returns for the month, while 3 were negative.

Thee gap between best and worst performing ILS fund was once again stark, at 3.22%, with the worst performing ILS fund falling to a -1.72% return for April 2021 and the best performing reporting an impressive 1.5% return.

We understand that May’s ILS fund results may be similarly diverse, with factors influencing them set to include some recovery of aggregate position values that have reset, further pressure for some aggregates that haven’t yet reset, as well as ongoing cat bond market price dynamics.

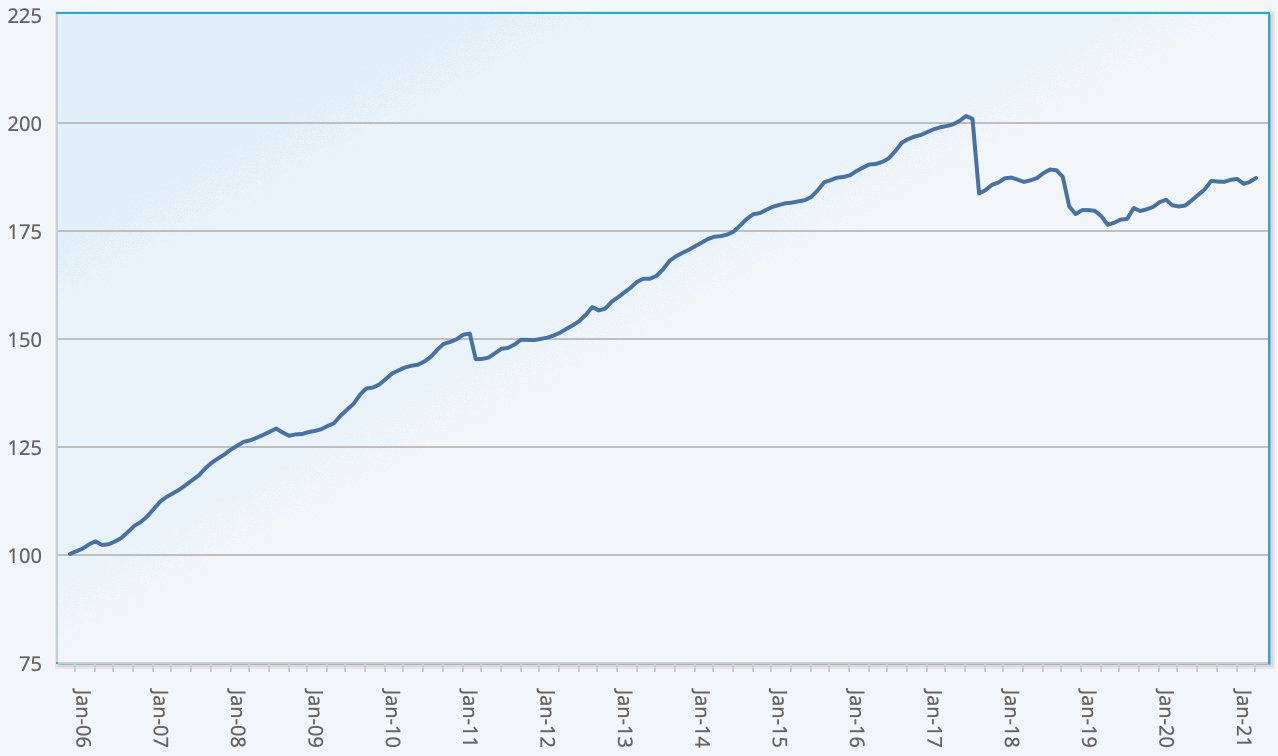

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 32 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.