The average return of the insurance-linked securities (ILS) fund market reached 3.51% for full-year 2020, which is the highest figure since 2016 measured by the Eurekahedge ILS Advisers Index.

Results are widely spread across the ILS fund market though, with some ILS funds performing much more strongly than others throughout the last year and with the COVID-19 pandemic a key differentiator, as some funds focused on collateralized reinsurance and private ILS have set aside relatively large reserves for potential claims that dented performance.

Results are widely spread across the ILS fund market though, with some ILS funds performing much more strongly than others throughout the last year and with the COVID-19 pandemic a key differentiator, as some funds focused on collateralized reinsurance and private ILS have set aside relatively large reserves for potential claims that dented performance.

According to the Eurekahedge ILS Advisers Index the average return of pure catastrophe bond funds and private insurance-linked securities (ILS) funds that invest in collateralized reinsurance as groupings was actually very close in 2020.

Pure cat bond funds averaged 3.42% for the full-year, while private ILS and collateralized reinsurance allocated funds averaged slightly higher at 3.69%.

It’s the narrowest gap between the two that has been seen for some time.

A year ago, 2019’s full-year returns saw pure cat bond funds up 3.32% while private ILS funds lost -0.81%.

For 2017 the gap was even more stark, as the group of ILS funds that invest in reinsurance contracts and private ILS underperformed the pure cat bond funds by a huge 9.33%.

So 2020 saw much closer performance between the two sides of the market this Index tracks, with pure catastrophe bond fund strategies exhibiting performance very similar to the private ILS side.

Performance of the ILS fund index was mixed across the full-year, with 8 positive months and 4 negative months recorded.

Cat bond funds have not faced any specific losses in 2020, although there has been erosion of aggregates and also some relatively significant swings in performance due to market supply and demand driven factors.

December 2020 reflected this, with private ILS rising by 0.61% for the month, while pure catastrophe bonds funds were down on price pressure at -0.15%.

ILS Advisers told us that a significant amount of the private ILS fund return for December was down to the listed CATCo fund recovering 7% during the month.

Absent that change and with slightly less pricing pressure in December, the gap between strategies would have been much narrower and pure catastrophe bond funds may well have been close to coming out on top for the full-year, it seems.

As we’ve been documenting, most recently yesterday, the drip of pandemic business interruption related reserving actions and losses have affected private ILS funds throughout 2020. While at the same time, pure cat bond funds have been unaffected given their named peril focus.

The main loss related impact to cat bond funds is down to aggregate erosion, as numerous smaller catastrophe and severe weather events dented performance in some cases.

For private ILS and collateralized reinsurance fund strategies, the aggregation of smaller cat losses has dented performance and caused small losses throughout some months of the year.

For the final month of 2020, performance was again very mixed, as catastrophe bond funds suffered from price pressure on secondary marks, while some private ILS funds took more reserving actions or booked small losses.

As a result, performance was varied, with 20 ILS funds tracked by the Index reporting positive returns for December 2020 and 12 negative performance.

The best performing ILS fund for December 2020 was up 6.6% for the month, a private ILS strategy, while the worst was down -2.9%, also a private ILS fund.

Overall, 2020 has seen a good year of performance for many ILS fund strategies though, on both sides of the pure cat bond and private ILS spectrum.

Some cat bond funds have performed much better than the average of the Index, especially those that have down-weighted aggregates in their portfolios.

While, on the private ILS and collateralized reinsurance side, some funds have delivered much higher performance, given higher risk/return strategies, or by avoiding too much impact from the pandemic because of their risk selection strategies avoiding the worst affected catastrophe reinsurance programs.

Looking ahead to the rest of 2021, a number of factors could play into ILS fund performance again this year.

First, the pandemic, which is clearly ongoing and with us for some time, so has the potential to throw up surprises. However exposure to pandemic business interruption should steadily roll-off from ILS funds positions, reducing the potential downside.

At the same time, reserves set and side pockets made for potential COVID losses in 2020 will in some cases either be realised as losses, or be released back to ILS funds, another factor to watch as the monthly results come in.

On the catastrophe and severe weather loss activity side, the severe convective weather season in the U.S. needs watching closely, as we’re in a La Nina year. Aside from that, it is of course impossible to predict what major losses could come the way of the ILS fund market in 2021.

Aside from loss activity, enhancements to terms and conditions, as well as reductions in aggregate covers in the market, should all play into performance through 2021 again.

On top of this, the improved pricing available in reinsurance, retrocession and catastrophe bonds should boost returns for some strategies, while also reducing risk a little for others.

As a result, 2021 is an attractive year to enter the ILS fund space, with COVID effects set to reduce and better pricing set to boost ILS fund performance.

Stay tuned to Artemis throughout the year for full-coverage.

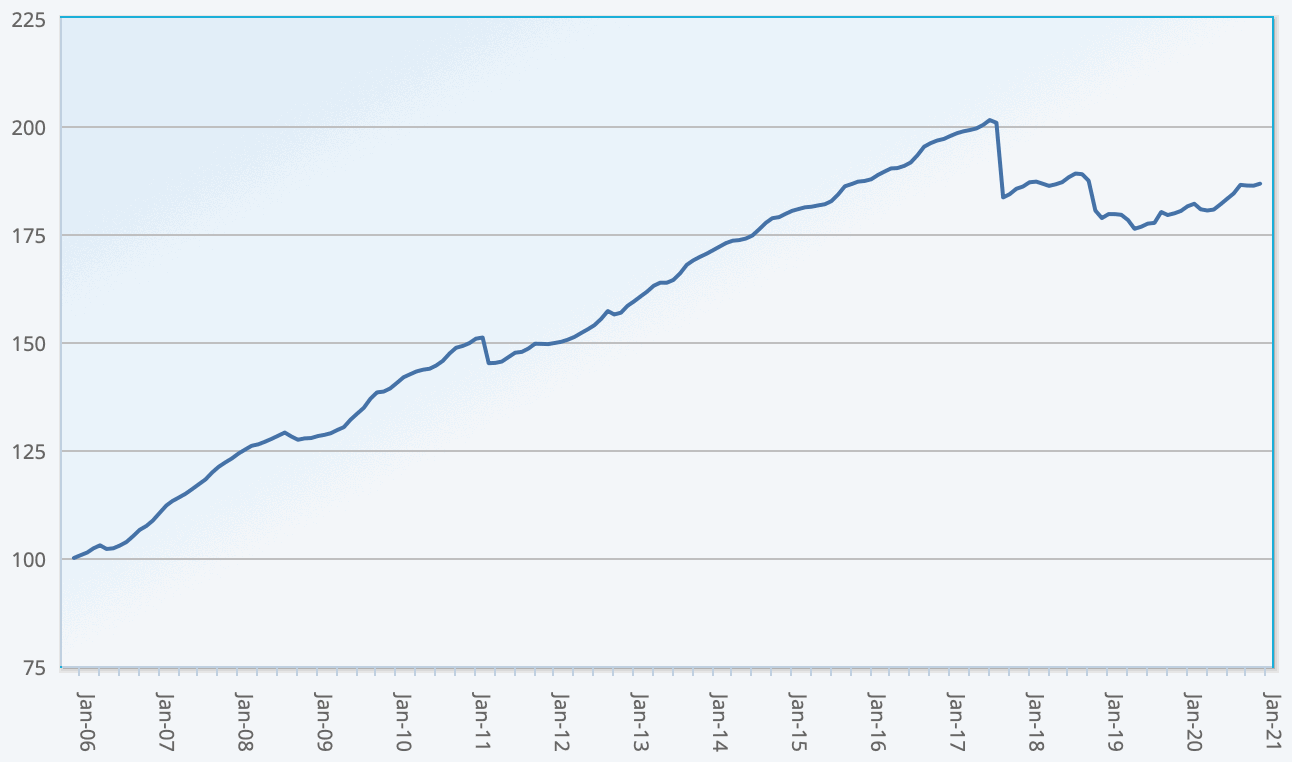

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 33 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.