The average return of the insurance-linked securities (ILS) fund market was dented by the European flooding in July 2021, with some funds focused on private ILS and collateralized reinsurance contracts suffering losses from the event.

For the month of July 2021, the average ILS fund return was 0.20%, according to the Eurekahedge ILS Advisers Index.

For the month of July 2021, the average ILS fund return was 0.20%, according to the Eurekahedge ILS Advisers Index.

That was less than half the long-term average ILS fund for the month of July, which stands at 0.59%.

In fact, this July was the worst performance ever for that month since the ILS Advisers Index began tracking ILS fund performance.

Typically July can be more benign from a catastrophe loss point of view, as it’s before the peak hurricane season begins and other perils are largely out of season.

But the European flooding that impacted the region in July, in particular Germany, is estimated to have caused an insurance and reinsurance market loss of as high as US $10 billion, perhaps a little more once all damages are counted. Germany’s flooding alone is seen as roughly a US $8.5 billion industry loss.

The impacts of the European flooding will impact the collateralised reinsurance market and some private ILS arrangements, which means catastrophe bond funds had a better month in July.

Pure cat bond funds as a group gained 0.43% in July, ILS Advisers reported.

But the subgroup of funds whose strategies include private ILS or collateralised reinsurance only gained 0.04% as a group for the month.

The reason being that some private ILS contracts suffered losses from the European floods this month, ILS Advisers said.

As a result of this, 23 of the ILS funds represented in the Eurekahedge ILS Advisers Index were positive for the month while 5 fell to negative returns.

The performance gap was narrower than some recent months despite these private ILS losses, ranging from -1.2% to +2.0.

Looking ahead, August’s returns may be dented by hurricane Ida, although it now appears that at least some of the losses from that more significant catastrophe event will fall into September for many private ILS focused funds.

In fact, hurricane Ida has the potential to be an industry loss that creeps as well, due to the complexity and significant hazard footprint related to the storm and its remnants, which could make for interesting ILS fund reporting over the next few months.

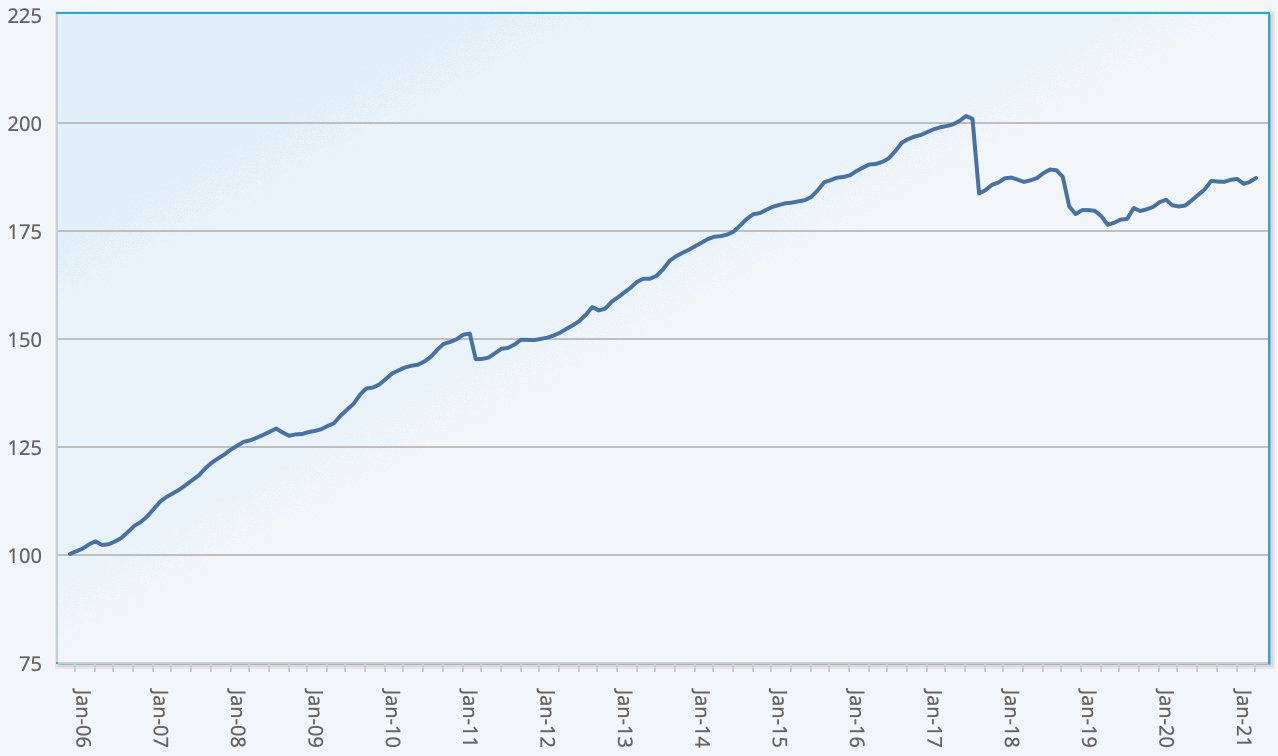

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.