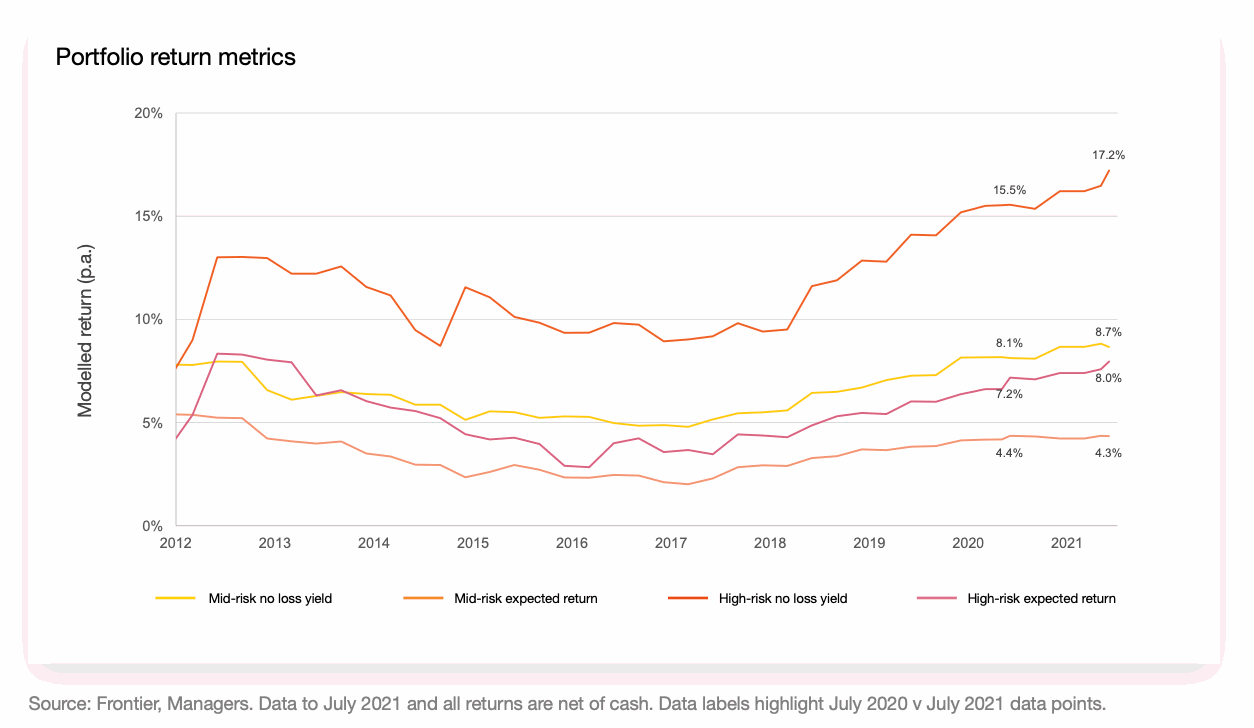

The forward-looking return potential of many insurance-linked securities (ILS) fund portfolios continued to rise over the last year and it’s likely this has accelerated through January 2022, as price rises in reinsurance and retrocession boost no-loss and expected return metrics.

Recent analysis undertaken by Frontier Advisors, an Australian independent investment consultant with an insurance-linked securities (ILS) specialism, shows that over the year to July 2021, the return potential of many ILS funds rose, with the higher risk ILS fund strategies rising fastest.

“Higher risk portfolios have experienced a greater increase in expected and mean returns as no loss returns in higher risk layers and structures has increased more significantly year on year. This is the result of several years of losses within these contracts,” Frontier Advisors explained.

In the chart above, it’s evident that ILS fund portfolio return potential has been rising steadily ever since the major hurricane losses of 2017.

This reflects the firming seen across global property catastrophe reinsurance and retrocession rates and is aligned with indices such as the Guy Carpenter Global Property Rate on Line Index.

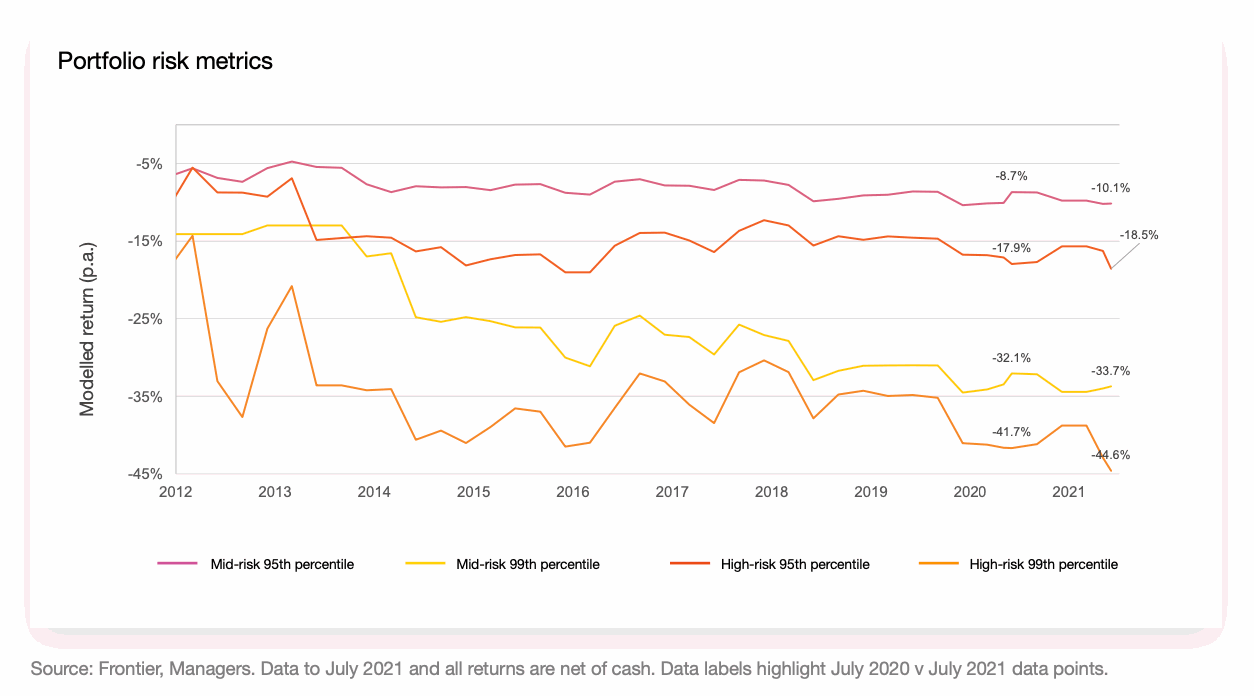

Alongside the above portfolio return metrics from Frontier Advisors, the below chart showing portfolio risk metrics, for different percentiles, seem to show that risk is perhaps not rising as fast as returns have been.

This suggests that, while ILS market return potential has been rising, ILS fund managers have not had to assume significant additional risk to support the improved return levels.

Which doesn’t necessarily mean they aren’t taking on more risk, just that it’s not showing up in the metrics at the pace of the rate changes.

Rate changes outpacing risk levels is always a good thing, we’d suggest, implying that portfolios of ILS may also be better hedged today than they were a few years ago.

That could be a result of the difficult learnings some ILS fund managers experienced through recent challenging catastrophe loss years.

It may also reflect, to a degree, the movement away from aggregate covers, as ILS funds have sought to re-focus more on peak perils and reduce exposure to secondary peril events.

“Frontier has observed a rotation away from aggregate and diversified portfolio structures to more concentrated portfolios focused on peak peril risks such as hurricane and earthquake,” the company explained.

But, also added that, “Some managers have maintained conviction for diversified, aggregate portfolios and we note no loss returns in these portfolios have experienced solid increases.”

These movements, in terms of the structures and types of reinsurance deals allocated to by ILS funds, would be expected to change the shape of their risk profile, especially against certain kinds of catastrophe scenarios, or loss year scenarios.

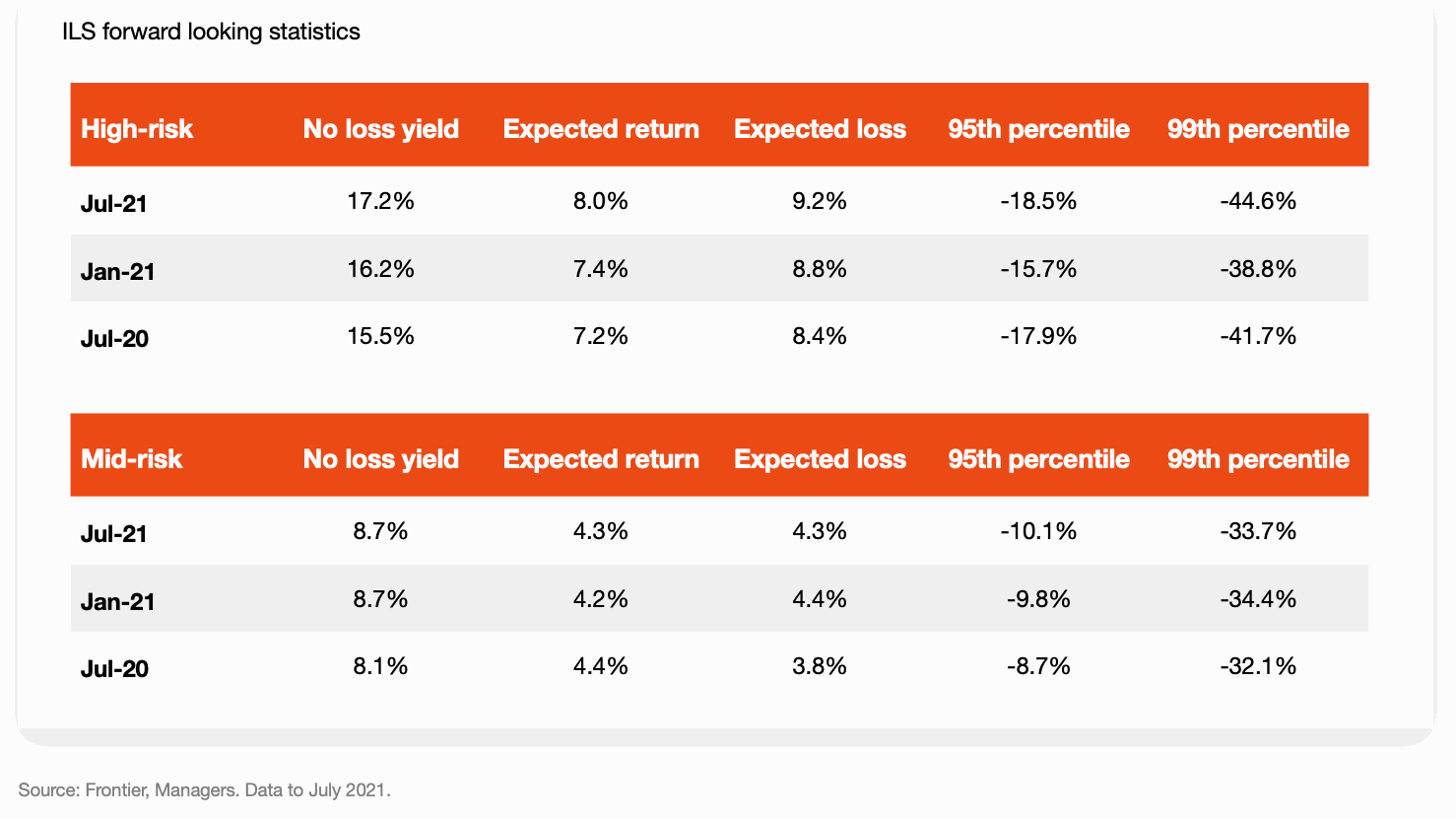

However, looking at the forward-looking return metrics that Frontier Advisors publish, no loss yield potential and expected returns are in the main up and significantly so for higher risk ILS portfolios.

But at the same time, expected losses have risen for those higher-risk strategies, so it’s also no surprise to see the 95th and 99th percentile results rising too.

Mid-risk ILS strategies though have improved expected returns, with slightly lower expected loss, which is a positive effect of the firming marketplace, as well as ILS fund managers increased selectivity when it comes to investing.

Two more interesting findings from Frontier Advisors latest ILS market analysis, is that mid-risk ILS fund managers have outperformed forward looking expected portfolio returns more frequently than high-risk ILS fund managers.

However, it’s also important to note that the high-risk managers were able to recoup losses at a faster rate than mid-risk managers, Frontier explained.

But, they also highlight that, “High-risk managers have also given back more of these gains in 2021, as losses have again increased in both severity and frequency.”

Also read: Cat bonds outperform many private ILS portfolios: Frontier Advisors.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.