Hurricane Laura’s impacts wind and storm surge impacts in Texas and Louisiana are estimated to have caused insured losses of between $8 billion and $12 billion, according to CoreLogic.

The majority of that is expected to be from wind damage, as would be expected for the private insurance and reinsurance market, as the NFIP should pick up some of the water driven property damage claims.

The majority of that is expected to be from wind damage, as would be expected for the private insurance and reinsurance market, as the NFIP should pick up some of the water driven property damage claims.

In fact, CoreLogic said that the insurance and reinsurance market is expected to pick up wind and storm surge losses for residential and commercial properties in Louisiana and Texas of between $8 billion and $12 billion, but that insured storm surge losses would only contribute under $0.5 billion of the total.

The estimate compares closely to the figures we’ve been discussing, of the potential for industry losses to reach the double-digit billions of dollars.

As well as the modelled loss data we saw yesterday that suggested $8 billion to $14 billion as a likely insurance and reinsurance market loss range for hurricane Laura.

CoreLogic noted that hurricane Laura hit a more sparsely populated region, which should mean the industry losses are lower than early scenarios had been suggesting.

“There is never a good place for a hurricane to make landfall. But this was the best possible outcome because it spared the major population centers of Houston and New Orleans,” said Curtis McDonald, meteorologist and senior product manager of CoreLogic.

CoreLogic also said that hurricane Laura’s remnants are not expected to pose an extreme flood risk as they moves east across the United States.

Wind and storm surge are expected to be the primary causes of property loss initially, while tornado activity could also be a factor the storm progresses. CoreLogic’s analysis includes residential homes and commercial properties, including contents and business interruption insurance market impacts, but does not include broader economic losses caused by Laura.

Also read:

– Hurricane Laura assessment to take time, double-digit billion loss possible.

– Hurricane Laura industry losses seen as “manageable” by analysts.

– Hurricane Laura exposed insurers could tap reinsurance (ALL, TRV, PGR, HIG).

– Cat bond trading seen as light as hurricane Laura approached.

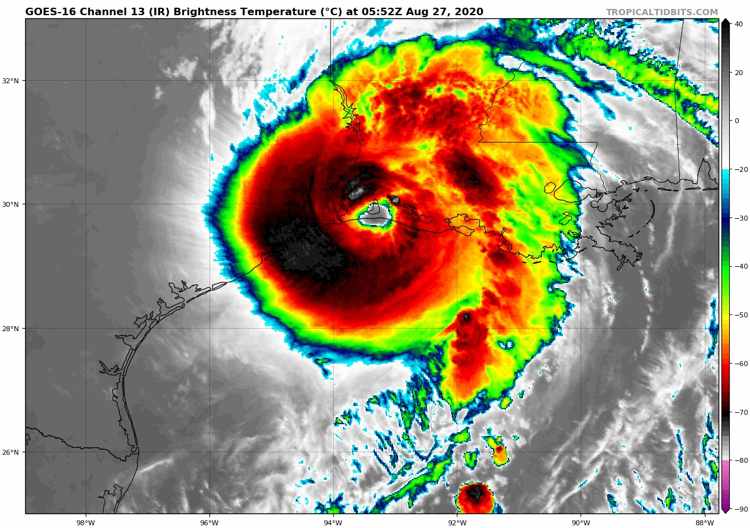

– Hurricane Laura makes landfall in Louisiana with 150mph Cat 4 winds.

– Hurricane Laura analogues cited at up to $6bn insured loss by RMS.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.