According to our market sources, secondary market trading of catastrophe bonds under the approach of hurricane Laura was “relatively light” by comparison to other major hurricane threats, perhaps suggesting that the uncertainty in the forecast cone made it more attractive to hold onto certain positions.

Hurricane Laura, while a very significant and damaging hurricane that has now made landfall with 150 mph sustained winds, has not been through to be too much of a threat to the catastrophe bond market, given the relatively high attachment points of many cat bonds that were in the storms path.

Hurricane Laura, while a very significant and damaging hurricane that has now made landfall with 150 mph sustained winds, has not been through to be too much of a threat to the catastrophe bond market, given the relatively high attachment points of many cat bonds that were in the storms path.

Back on Monday Zurich-based catastrophe bond and insurance-linked securities (ILS) investment manager Plenum Investments said that, based on the forecast at the time, it felt the cat bonds it holds in its portfolio would be safe, given, “the moderate strength of “Laura” and the low concentration of values in what is likely to be the most affected region” which it believed made a negative impact on the cat bond market unlikely.

Plenum has a long-standing UCITS cat bond fund that likely holds positions in many of the bonds which would have been exposed to Laura.

Through Monday and Tuesday there was a feeling hurricane Laura’s track could have shifted more towards Houston, Texas, which could have changed the outlook for catastrophe bonds, as higher values in the metro region of one of the U.S.’ largest cities could have changed things considerably.

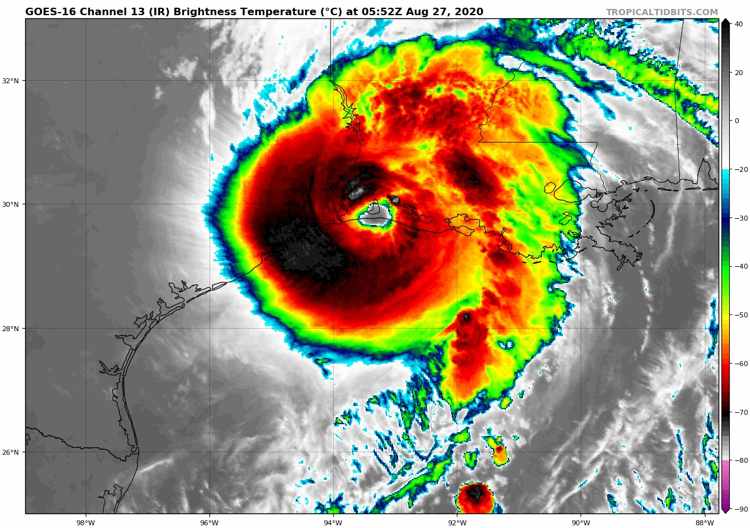

Hurricane Laura intensified rapidly through yesterday to Category 4 status, but greater certainty emerged in the forecasts at the same time and confidence grew in the landfall site being in less populated region of Louisiana.

Plenum stuck by its outlook, saying late yesterday that it continued to expect no impact to any of the catastrophe bond positions it holds in its fund.

Now, as hurricane Laura made landfall in a region of lower insured value concentration, it seems the ILS manager may well be right.

Given the uncertainty in the forecast for hurricane Laura through Monday and Tuesday, but then greater certainty emerging yesterday, it seems secondary market catastrophe bond trading was relatively light.

There was some trading of a handful of positions in the Texas Windstorm Association’s Alamo Re II Pte. Ltd. (Series 2020-1) cat bond on Monday 24th, as well as some trading of a number of potentially exposed annual aggregate multi-peril retro reinsurance cat bonds over the week, plus one trade of the Alamo Re Ltd. (Series 2019-1) cat bond yesterday at a more marked down 97.5 cents on the dollar.

That’s what we can see through FINRA’s Trace system.

But our sources suggest there was some more trading, although nothing particularly spectacular in terms of marked down pricing, suggesting most ILS funds and their investors held steady as hurricane Laura approached, taking a similar view to Plenum’s that the outlook could have been much worse.

With hurricane Laura now onshore, impacting the Louisiana region particularly hard, it does appear that per-occurrence catastrophe bonds exposed to the storm will likely escape from impacts.

However, some annual aggregate catastrophe bonds, that provide reinsurance across a year and aggregate losses across multiple events up to an attachment point, could see losses from hurricane Laura qualify and erode some of their deductible layers, which would effectively make them riskier for the remainder of the risk period they run across.

With similar storms such as 2005’s hurricane Rita seen as a roughly $13.5 billion industry loss today, according to Swiss Re, while 2008’s Ike that came much closer to Houston is seen as a $23 billion industry loss, the potential for significant costs for the reinsurance and ILS market remain.

But the cat bond market may be lucky and escape too significant an impact from hurricane Laura, as the relatively low-level of pre-landfall trading seems to suggest the market thought may be the case.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.