Property insurers based and operating in the state of Louisiana have continued to see the claims tally from last year’s hurricane Ida creep higher, with the total loss now reaching $13.1 billion, according to the state’s Insurance Commissioner.

Insurance Commissioner Jim Donelon has reported that by the end of the first-half of 2022, insurers have now paid or reserved for $13.1 billion of hurricane Ida-related claims in Louisiana.

Insurance Commissioner Jim Donelon has reported that by the end of the first-half of 2022, insurers have now paid or reserved for $13.1 billion of hurricane Ida-related claims in Louisiana.

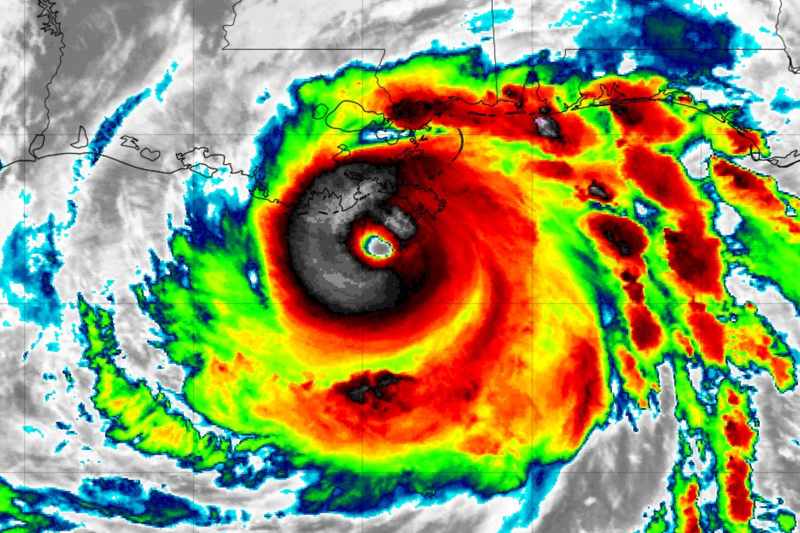

Hurricane Ida slammed into Louisiana on August 29th 2021, as a Category 4 storm and affected 25 parishes of the state.

Industry loss estimates for hurricane Ida came in a particularly wide-range, from just below $30 billion to as high as $40 billion, depending on whether losses further to the US northeast from flooding by Ida’s remnants was included.

Louisiana state took the brunt of hurricane Ida’s winds and storm surge though and given the complexity associated with the loss, as well as inflationary factors, the insurance and reinsurance market loss from hurricane Ida has continued to creep higher over the last six months.

At the end of 2021, it was estimated at $10.5 billion by the Louisiana Insurance Department.

By the end of the first-quarter of 2022, the estimate for Louisiana specific insurance claims from hurricane Ida had risen by 15% to $12.1 billion.

By the end of the first-half of 2022, the loss estimate has risen another more than 8%, to reach $13.1 billion.

The number of claims filed by policyholders after hurricane Ida has now risen to 460,709, which is a 6% increase in Ida claims filed since the start of this year.

Encouragingly though, 65% of those were closed with payment, resulting in $9.8 billion in payments for damage caused by the hurricane already made by insurers.

Reinsurance capital has supported those claims payments, with a relatively significant amount of the overall hurricane Ida loss falling to reinsurance and ILS capital providers.

The data includes claims from private insurance market personal and commercial policies only, not the NFIP.

Further loss creep is possible, as Insurance Commissioner Donelon explained, “If inflation or the discovery of previously unknown damage caused the cost of your repair to increase since you received the initial payment from your insurance company, you have the right to file a supplemental claim.”

In the current high-inflation environment, it is entirely possible this happens, as the original claims amount may prove to be insufficient to pay full repair costs, with inflated labour and material prices, resulting in the need for supplemental recoveries and therefore worsening the loss creep.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.