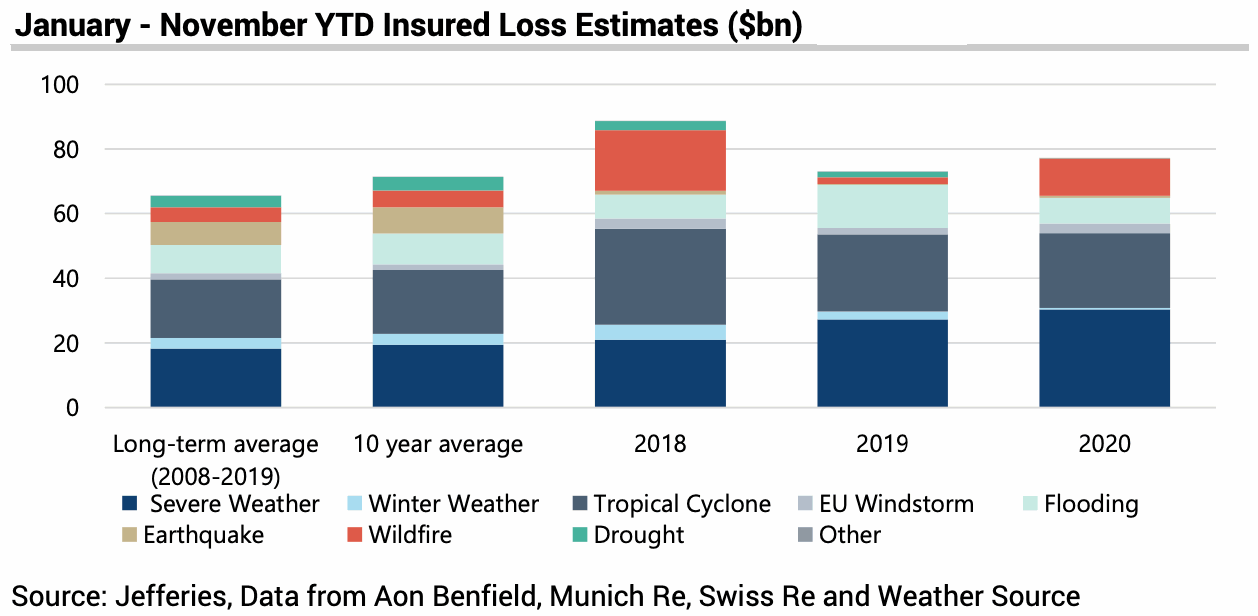

So far in 2020, global catastrophe and severe weather losses falling to the insurance and reinsurance market are running approximately 8% above the 10-year average, according to analysts at Jefferies.

Overall, insured losses from catastrophes and severe weather are roughly 18% higher than the long-term average, closing in on US $80 billion for the year, the analysts believe.

This is aligned with a recent announcement from global reinsurance firm Swiss Re, who pegged natural catastrophe losses at $76 billion so far this year.

November was a relatively average month for losses, but on top of recent attrition it was sufficient to take catastrophe losses above where they would typically sit by the end of November.

A month ago, Jefferies analysts estimated that losses were running around 7% above the 10-year average, but while November was a quieter month some re-estimates of prior month catastrophe losses has stretched that figure higher.

However, 2020 remains a story of attrition, as the frequency of severe weather and catastrophe losses is what is driving the above-average trend.

“It seems to us that while the frequency of insured events is higher than average, the severity of events remains in line or below the norm,” Jefferies analyst team wrote.

Because of this, primary carriers have retained a significant proportion of the losses year-to-date, while reinsurance capital has seen a little less ceded to it than might have been expected.

“Consequently, our expectation has been that insurers would retain a disproportionate share of losses. This was broadly demonstrated by the recent 3Q 2020 results, where insurers disappointed on catastrophe losses, while reinsurers were more in line with market expectations (but still above budget),” the analysts continued.

However, if impacts continue there is an increasing chance that aggregate reinsurance covers kick in at year-end.

The analysts said, “Looking to year end, this may change as aggregate covers hit their retentions, with possibly a higher proportion of 4Q losses hitting reinsurance balance sheets than the first 9 months.”

This could present some challenges to the insurance-linked securities (ILS) market, if there are aggregate reinsurance structures and private collateralized ILS deals which see their aggregate erosion reaching attachment points at year-end.

As this has the potential to drive ceding companies to seek to trap collateral associated with such contracts, as a way to retain the coverage in case of additional loss creep occurring from catastrophe events that struck in 2020.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.