During the third-quarter of 2020 we teamed up with boutique consulting firm Synpulse to conduct a survey looking at the maturity of environmental, social, and governance (ESG) adoption in the risk transfer, reinsurance and insurance-linked securities (ILS) markets.

This was the first environmental, social, and governance (ESG) survey of its kind, looking at how companies in the risk transfer market have incorporated ESG factors into their strategies and operations.

This was the first environmental, social, and governance (ESG) survey of its kind, looking at how companies in the risk transfer market have incorporated ESG factors into their strategies and operations.

The full results will be presented over the coming weeks and participants in the survey will receive specific benchmarking information, so they can evaluate their own levels of maturity when it comes to adopting ESG strategies and practices against their competitive landscape.

The survey found that, as you’d expect, ESG is a significant topic within risk transfer, reinsurance and insurance-linked securities (ILS), and is slated to be a critical factor in the future success of market participants.

But the question is whether the market’s aspirations on ESG are being matched by their actions?

The survey results show that ESG has a huge strategic relevance for companies in risk transfer, reinsurance and insurance-linked securities (ILS) and is a significant consideration for 80% of the companies that participated in our survey.

An impressive 95% of respondents believe that ESG will only become increasingly important for their organisation in future, while 95% also said that adopting an integrated strategy for ESG will be critical to their success.

These are really significant response rates and underscore the importance being placed on ESG right now, which is particularly relevant in the insurance-linked securities (ILS) market as fund managers look to align with the demands and aspirations of their end-investors.

The survey results demonstrate that investor desire, essentially client demand, is especially important for the ILS fund manager community and its capital providers.

Meanwhile, ESG from a reputation and risk management perspective are important to all risk transfer and reinsurance market participants.

Synpulse, our partners in this survey and who is expert in ESG advice, strategies and consulting, explained, “This indicates the extent to which ESG has become rooted in the minds of the entire market, from (re)insurers to institutional investors and other stakeholders. No matter where companies are positioned along the risk transfer value chain, leaders of today and the future cannot neglect its relevance.”

While the perceived importance of ESG is high, the risk transfer market also believes its mandate, or business strategy, itself is aligned with ESG factors.

95% of respondents said that they believes their business fulfils a social and/or environmental purpose, something the full survey report will delve into more deeply.

While the responses ranged on how mature or ahead of their competitors some market participants feel they are, when it comes to ESG adoption.

In fact, 82% of non-dedicated ILS fund managers, so larger asset managers that also operate ILS fund strategies, see themselves as being ahead of the competition in ESG terms.

Where as among insurance and reinsurance company respondents, just 25% say they feel they are ahead of the competition.

The results suggest a degree of over-confidence among fund managers, which could originate from the idea that ILS is inherently ESG friendly, as well as the fact these non-dedicated ILS investment managers often have more significant resource behind them and departments dedicated to ESG adoption.

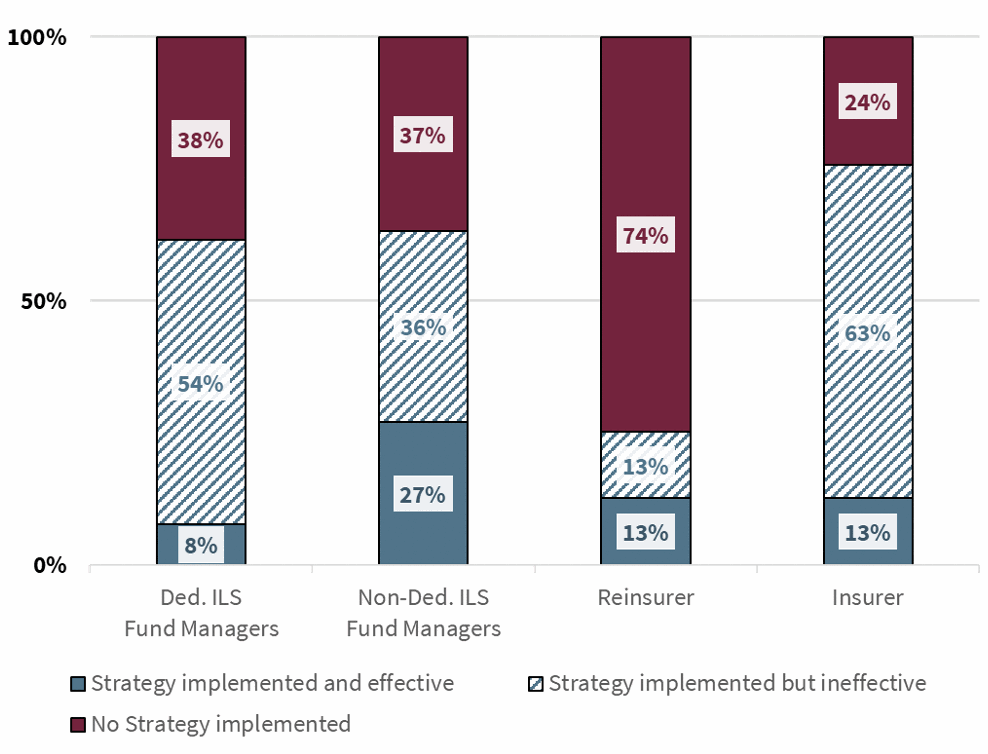

When it comes to how far along the industry is in its adoption of ESG strategies and practices, the survey results show that most companies in the risk transfer market, interestingly except for reinsurers, have already implemented an ESG strategy.

“So far, so good,” Synpulse explained. “The problem is, however, that the percentages of companies that have an implemented strategy they would describe as effective is very low, ranging from only 8% to 27% depending on the peer group. This means, in fact, that the majority of implemented strategies are considered ineffective and still require work.”

As a result, there is room for improvement, our survey shows and the full report highlights opportunities to improve, by implementing ESG frameworks more thoroughly and sustainably, defining tangible KPIs and measurable goals, and also embracing reporting.

The survey results and report make for exciting but also sobering reading.

It’s clear the risk transfer, reinsurance and ILS market recognises the importance of ESG and believes it is on the way to adoption. But the actual levels of adoption seem to fall short in many cases and there is a considerable amount of catching up to do.

The full risk transfer market ESG study will be available to download around mid-December and our email newsletter subscribers will be among the first to know, so sign up here to be informed when the study is published.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.