Reinsurance cedants and protection buyers are increasingly open to using alternative sources of reinsurance capital within their programs, a new survey from rating agency Moody’s has found.

A year ago, some 31% of the reinsurance cedants and buyers surveyed by Moody’s Investors Service said they were “somewhat likely” to increase their use of alternative sources of capital, such as insurance-linked securities (ILS), catastrophe bonds and collateralized protection, within their reinsurance program for 2021.

The latest results, which look ahead to the 2022 reinsurance renewals, provide a very positive outlook for the ILS marketplace, as cedants are even more interested in alternative capital at this time, the results show.

Now, reinsurance cedants appear even more open to using alternative capital sources such as ILS, according to Moody’s survey data.

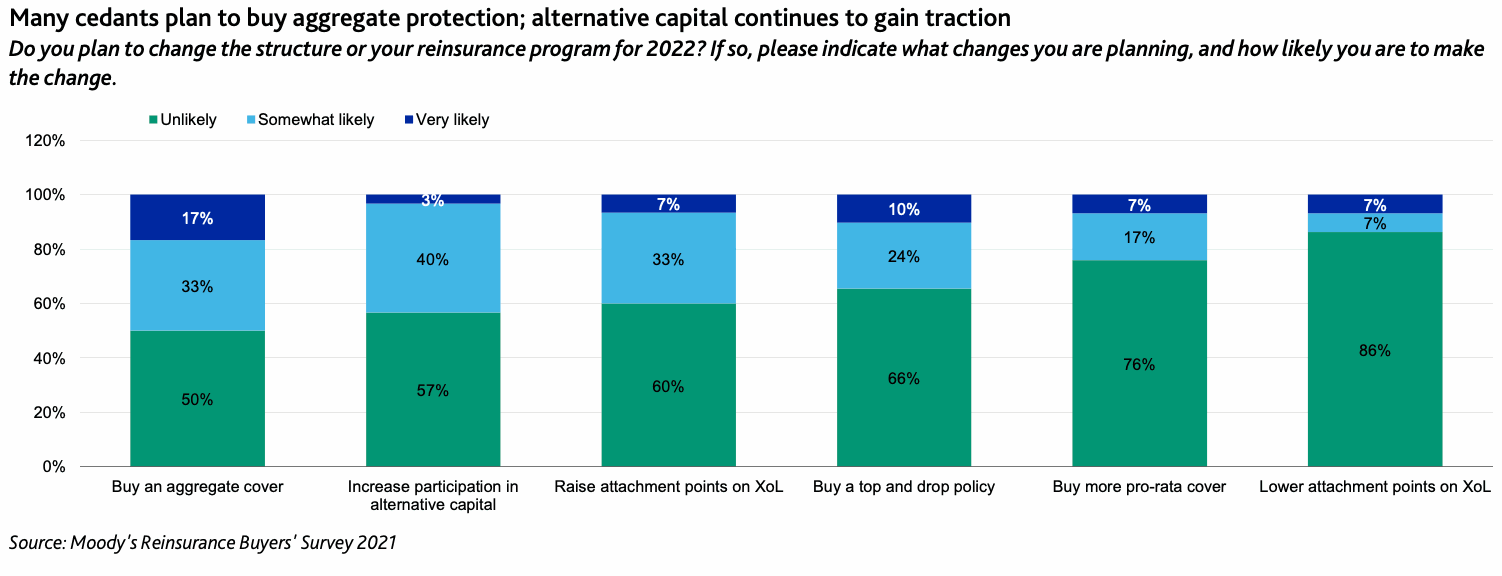

The new set of survey results show that 43% of reinsurance cedants and buyers are either somewhat likely, or very likely, to increase their use of alternative capital in their reinsurance programs for 2022.

40% responded somewhat likely and 3% said they were very likely to increase use of alternative and ILS capital at the renewals over the 2022 calendar year.

Also of note in the chart above, is that fewer respondents expect to raise the attachment points on their reinsurance in 2022, 40% compared with 48% a year ago.

That could suggest more reinsurance buying next year, but it is likely also a response to frequency loss activity and the concern over how climate risks could be becoming more of an earnings threat, needing more reinsurance buying lower down.

In fact, Moody’s noted that most respondents to its survey do not expect to buy more reinsurance in 2022, but that 38% of them anticipate making changes to their reinsurance programs.

Roughly half of respondents intend to buy an aggregate reinsurance cover, Moody’s said.

In terms of cedant and reinsurance buyer preferences for alternative capital, Moody’s also noted that respondents preferences remain relatively stable, with collateralized reinsurance and catastrophe bond the preferred structures on offer from the ILS market.

Also interesting to note, is that respondents view lower traditional reinsurance capacity as having a greater influence on prices than a lack of capacity from the alternative reinsurance capital market.

This is due to the resurgence on ILS capital in the marketplace, which has been growing steadily now across at least four consecutive quarters.

Moody’s noted that, “Just 10% of respondents cited a shortage of alternative reinsurance capital as a main driver of price firming, down from 26% in 2020.”

Adding that, “Increased availability of alternative capital has helped to mitigate price increases during recent renewal periods.”

Also positive for the ILS market is the fact cedants are expected to increasingly rely on reinsurance for covering catastrophe exposures, with now 40% of respondents expect natural catastrophe risk to increase moderately or materially in the coming one to three years, up from 32% in Moody’s last survey.

This is likely to adjust reinsurance buying preferences for those carriers that have yet to do so, which could drive more opportunity to the ILS market and also to catastrophe bonds.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.