The in run-off CATCo Reinsurance Opportunities Fund Ltd., the exchange listed retrocession focused investment fund strategy managed by Markel CATCo Investment Management, is expecting to receive an $18.8 million return of capital from a range of side pockets in May, with the proceeds set to be used to redeem more shares.

Markel CATCo Investment Management has been managing the run-off of its retrocessional reinsurance fund strategy over recent months, returning capital where it has been able to through a reverse tender offer and a series of share buy-backs.

With the retrocession investment strategy having been hit by numerous of the major global catastrophe loss events that hit the re/insurance and insurance-linked securities (ILS) sector in recent years, a significant proportion of its remaining capital continues to be trapped in side pockets.

But Markel CATCo had always forecast that it would likely find side pockets had been created prudently and that not all of the capital within them would be needed to support the loss claims associated with many of the catastrophe events, with some return of capital likely.

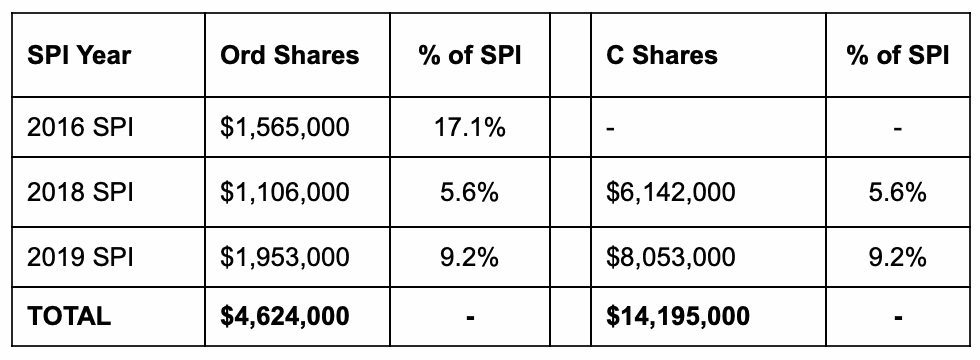

Now, Markel CATCo is expecting to receive $18.8 million back from side pockets established for the 2016, 2018 and 2019 underwriting years.

The breakdown of the side pockets and how much share capital is being returned from each can be seen below:

Markel CATCo said that this $18.8 million is expected to be received in May 2020 and will be used to undertake a second compulsory partial redemption of its remaining issued share capital.

This return of capital from side pockets will be welcomed by investors in the retrocessional reinsurance fund strategy, who may have been expecting that any side pocketed assets were completely lost to the catastrophe events that had occurred.

It’s a reminder that if catastrophe events are reserved for prudently, then there is often a return of capital to be had.

The return of capital from these side pockets will help Markel CATCo accelerate the running-off of its retrocession strategies and this return of capital likely also applies to the broader fund strategies the manager operated, as well as its exchange listed fund where we have greater visibility.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.