Hannover Re grows retro at January renewals, adds parametric earthquake cover

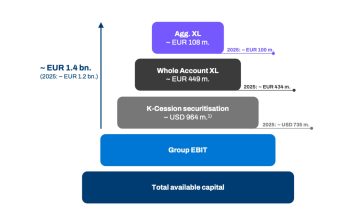

5th February 2026Large European reinsurer Hannover Re expanded its retrocession protections by around 17%, or EUR 200 million to EUR 1.4 billion at the January 1st, 2026, reinsurance renewals, with increased capacity for its capital markets backed K-Cessions quota share sidecar facility, and a new parametric earthquake cover.

Read the full article