Catastrophe risk capital is gaining importance as a measure of capital adequacy and is gaining momentum as a metric for insurance and reinsurance firms to optimise their capital management and profitability targets, suggesting an increasing demand for the capital markets and ILS in providing catastrophe focused capacity.

A new report from reinsurance broker Willis Re looks at global reinsurance buying and re/insurers risk appetite statements, as well as how the trends in use of types of capital are changing buying habits.

Willis Re’s report highlights a number of key trends that are driving re/insurers reinsurance buying habits, trends that are likely to also drive more appetite for ILS fund backed capacity and related collateralized reinsurance products as well.

Among these trends and perhaps the most important is the fact that reinsurance buying is increasingly focused on earnings protection and volatility reduction, which has been driven by investor relation efforts, the broker says.

That means reinsurance protection buyers are increasingly looking for coverages that provide aggregate, multi-year and frequency protection, as they seek to soften the impact of weather, catastrophes and other losses in their books.

Investors in insurers and reinsurers are becoming less tolerant of missed earning targets, Willis Re reports, which has led them to utilise increasingly sophisticated metrics, such as return on equity and economic capital, which is in turn informing their reinsurance or retrocession buying.

Willis Re notes that there are insurers who are increasingly finding their “purchasing is guided by “risk appetite statements” deployed to optimize capital management and profitability targets.”

This shift is likely to result in buyers taking a more sophisticated and metrics driven look at how they buy their reinsurance towers, which may open the doors for additional opportunities for ILS funds and other collateralized reinsurance markets to step in and make themselves into more important counterparties for the buyers.

The more flexible and sophisticated the range of coverage options is, the more likely it is these sophisticated buyers will consider markets sophisticated as well. ILS markets are well-positioned to capitalise on these trends to increase their capacity deployed.

Out of 260 insurers from 51 countries that Willis Re surveyed, 98% have either already adopted a formal risk appetite, or will do so within three years time, the broker said.

“Managing the volatility of underwriting results is of prime importance to insurers, and reinsurance strategy measured by risk appetite is key to that,” explained James Kent, global chief executive officer, Willis Re.

“This is particularly relevant for public companies where perceived volatility can severely impact share price, but also a wider range of insurers are now much more likely to consider a broad range of consolidated earnings metrics when assessing the impact of reinsurance. Our survey shows that the number of non-life insurers using rate of return on equity as their primary earnings metric has doubled in the past two years. This is in line with what we are currently experiencing in the field when realigning reinsurance programs to insurers’ strategies,” Kent continued.

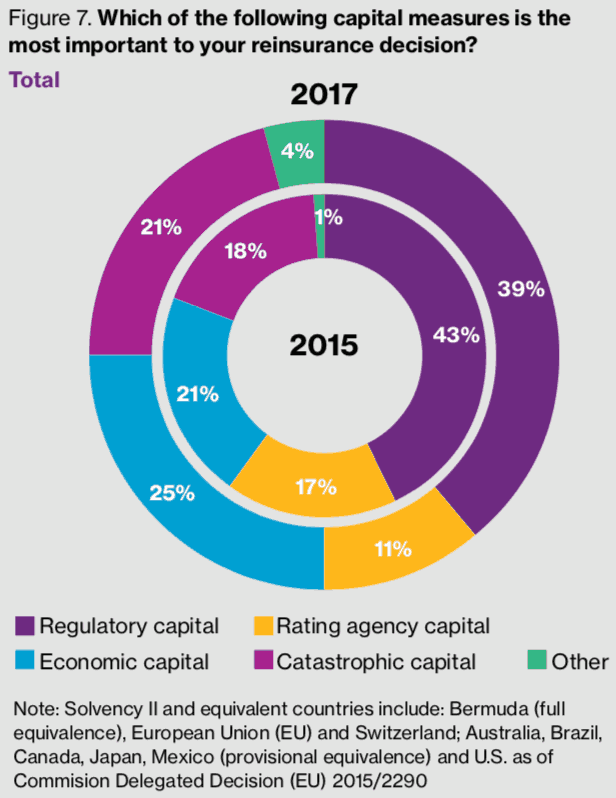

“Changes to the global regulatory environment have increased the emphasis on capital measures and targets,” added Alice Underwood, global leader, Insurance Consulting and Technology, Willis Towers Watson. “Although regulatory capital is still the most relevant capital measure, economic and catastrophe risk capital are gaining momentum. The use of internal capital models increased substantially from a third to more than half of insurers between 2015 and 2017.”

Overall, reinsurance is increasing in importance again, Willis Re notes, with its report stating, “In an insurance industry of increasing complexity and risks, risk appetite and reinsurance are gaining momentum as cornerstones of a successful operation, regardless of geography or size.”

80% of respondents to the survey said that their risk appetite statement helps them to optimise their capital and earnings, and as a result their reinsurance strategies as well, as reinsurance capital is an efficient way to manage their risk appetite goals.

Capital remains key, but following the advanced implementation of recent regulatory requirements, some of this need has been absorbed, the broker said.

Reinsurance capital, its availability, flexibility, cost, form and structure, are all part of a re/insurers capital management strategy and therefore intrinsically linked to their desire to meet the new metrics they have, and better manage their risk appetites.

Willis Re noted a change in which capital measures are considered most important, depending on the maturity of regulation in the local market.

Regulatory capital remains most important, but its dominance is slipping and both economic capital and catastrophe risk capital are gaining momentum as key drivers for insurers.

This is partly driven by increasing sophistication in how re/insurers manage their risk and capital, but also by the maturation of regulatory environments and importantly recent catastrophe loss activity, which has heightened re/insurers need for catastrophe risk capital.

The chart below shows the increase in importance of catastrophic capital as a measure for informing reinsurance buying behaviours.

If last year’s losses have increased the focus on catastrophe risk capital it is also part of the driver for continued ILS market growth, as evidenced by the increasing size of the catastrophe bond market and ILS fund assets under management.

Add in the focus on earnings and volatility protection and shift towards using more sophisticated metrics to measure performance, plus the pressure from shareholders to perform, and this all suggests that reinsurance as a tool to manage profitability and capital adequacy will increase, giving more opportunity for the capital markets.

It’s vital for ILS markets and collateralized providers to become more than just a low-cost, efficient alternative.

In order to really grow and become key partners to re/insurers, ILS capital providers need to provide products that help companies achieve their goals, through dampening volatility, providing catastrophic capital and assisting them to fill their reinsurance towers with more efficient, responsive and effective risk capital solutions.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.