Catastrophe bond issuance in 2020 has now surpassed another annual record, as the total amount of risk capital issued in pure, syndicated property cat bond transactions so far this year has now reached almost $10.3 billion.

It’s the first time in all the years we’ve been tracking catastrophe bond market activity that issuance volumes have surpassed the $10 billion mark, for these pure catastrophe exposed bond issues that have been syndicated to the insurance-linked securities (ILS) investor community.

With the settlement or completion of issuance for some of the latest cat bonds to hit the market happening today, issuance of pure property catastrophe bonds reaches this new high of $10.3 billion.

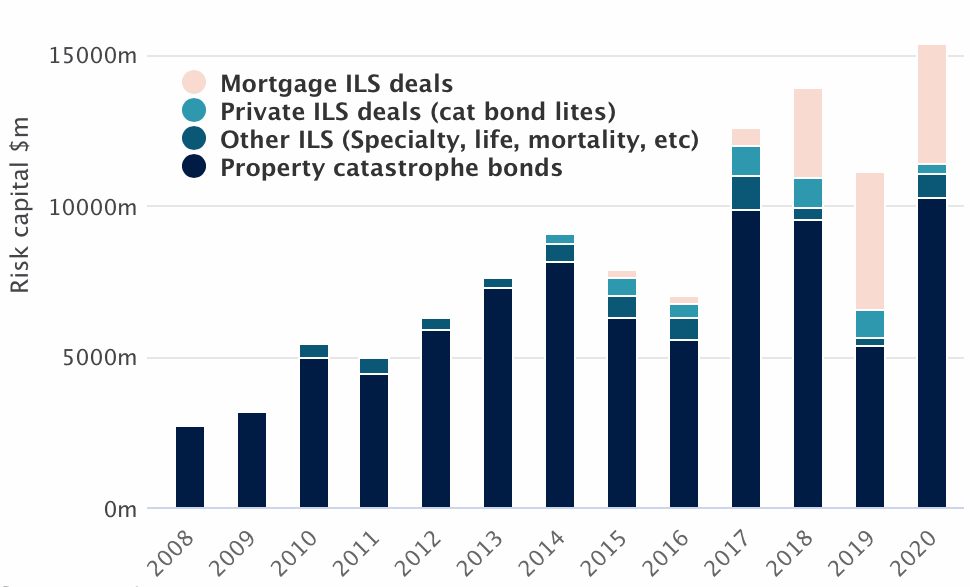

Within our Artemis Deal Directory, the most extensive publicly available source of information on catastrophe bonds and other similar insurance-linked securities (ILS), we have recorded an incredible nearly $15.4 billion of new issuance so far in 2020.

Which breaks down as follows: the almost $10.3 billion of broadly syndicated property catastrophe bonds as of today; just over $761 million of other line of business cat bonds (specialty, mortality, life/health); almost $351 million of private cat bonds (or cat bond lites); and close to $3.98 billion or mortgage ILS transactions.

Analyse cat bond and ILS issuance data using our interactive charts.

This isn’t the first record for the catastrophe bond and related insurance-linked securities (ILS) market in 2020.

As we’ve explained previously, the annual record for number of deals issued and tracked in our Deal Directory was beaten back at the start of November and the overall issuance record reached a record high later in November when it hit $14.24 billion.

This latest record though, is a bit of a landmark for the ILS sector as a whole.

Reporting on the cat bond market tends to differ depending on the source. Some brokers only include the broadly syndicated, largely Rule 144A compliant cat bonds that cover catastrophe risks in their reports, which is the group that we have now counted at almost $10.3 billion so far in 2020 and so a new all-time record.

Other brokers include the life/health, mortality bonds and any specialty lines exposed cat bonds.

We report on the mortgage ILS market as well, given its structural similarity, but now enable you to break out issuance by type of deal for easier analysis and comparison using our interactive charts.

But, never before has there been such a volume of pure property catastrophe bond issuance, of the broadly syndicated largely Rule 144A kind, which, in 2020 given the impacts of a global pandemic and after the challenging years the ILS market has faced since 2017, we feel this record is particularly noteworthy.

2020 has clearly demonstrated the key role that catastrophe bonds play in sponsors’ insurance, reinsurance and retrocession programs.

We’ve seen some landmark deals as well, plus a number of new sponsors come to market in 2020, all of which suggests that cat bond are primed for continued growth over time and will remain a vital source of reinsurance and retro risk capital going forwards.

For the cat bond and related ILS market to break so many records in 2020 is an incredible feat, which serves to further demonstrate the attractiveness of the ILS asset class and in particular the transparent, liquid investments that are available in the catastrophe bond fund marketplace.

Catastrophe bonds have demonstrated, their resilience to global events including an unprecedented pandemic, their ability to deliver returns that are largely uncorrelated to broader financial markets, while the ILS market as a whole has also demonstrated its ability to continue serving clients, both ceding companies and investors, while working remotely and under more challenging circumstances.

The catastrophe bond market has traded through the pandemic admirably, provided investors with the liquidity some needed when under pressure and delivered an unprecedented amount of risk capital, reinsurance and retrocessional protection in 2020.

Which all bodes well for 2021.

With the pipeline still looking like it could spring back to life after the end of year holiday and renewals, 2021 could also be a very interesting one for catastrophe bonds and more broadly for insurance-linked securities (ILS), as the market continues to deliver on its promises and provide the coverage sponsors seek.

Stay tuned to Artemis for news of every catastrophe bond and related ILS transaction that comes to market, as well as other structures including reinsurance sidecars.

You can view information on every catastrophe bond issued so far in 2020 and all prior years, totalling over 700 issues, in the Artemis Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.