The total-return of the outstanding catastrophe bond market in 2023 has now surpassed 16%, beating the previous record and staying on-track to deliver an investment return that might surpass 20% by year-end, which could, in future, be a challenging record to beat.

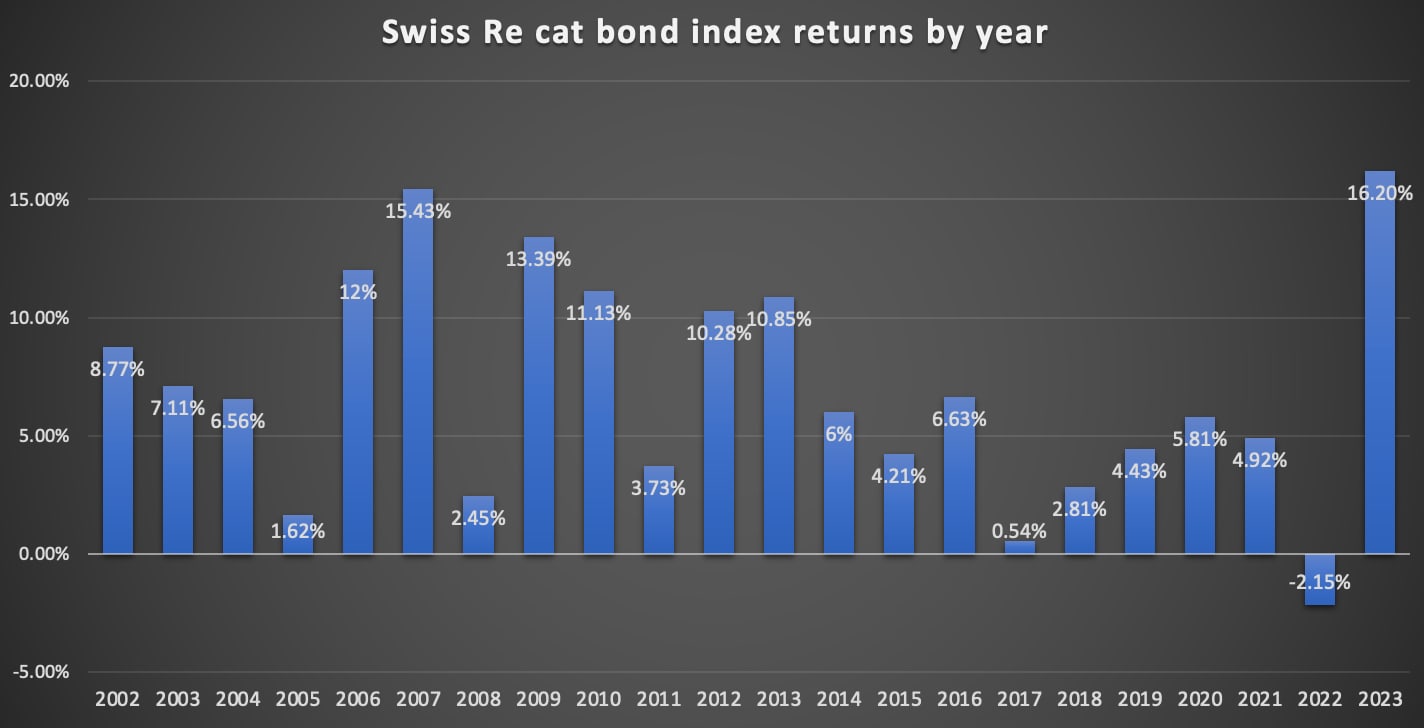

The Swiss Re catastrophe bond Index, the most widely used benchmark for the total returns delivered by the current pool of outstanding cat bonds, had reached 16.2% by the second week of October, setting a new record for the year.

As we’d previously reported, the Swiss Re catastrophe bond Index had reached 10.34% by the end of June, setting a new record for any half-year in H1 2023.

We then reported that the total-return of the catastrophe bond market reached above 14% for the first eight months of 2023, staying on its record-setting pace.

Just over one month later and the total investment return of the cat bond market had reached 16.2% in early October.

That’s now a new record investment return for the catastrophe bond market, as the highest annual total return of the Swiss Re Global Cat Bond Index on record had been 15.43% back in 2007.

With just over two and half months of returns to add to the 16.2% already delivered, the catastrophe bond market is now in-sight of a stunning ~20%, or even more, in total investment return for 2023.

That could set a record that is hard to beat in future, as the combination of factors such as the elevated spread environment thanks to higher reinsurance pricing, the much higher risk-free returns added thanks to the floating-rate nature of the cat bond asset class, and most importantly the recovery in value of many US wind exposed cat bonds post-hurricane Ian may never come together to be repeated in quite the same way again.

Looking at the chart above, it’s easy to see why investors currently assessing the catastrophe bond asset class as a potential venue to deploy capital into are so attracted to it right now.

The rate of returns generated by the catastrophe bond market in 2023 will not be sustained, even if spreads and the risk-free return on collateral remain at their elevated levels, as 2024 will not see the same recovery in value of the Ian-exposed bonds, but it is now easy to see that cat bond pricing should sustain a higher level of returns than we’ve seen over the last decade.

Of course, this is all dependent on catastrophe loss activity, as it does only take a single major natural disaster that the cat bond market is covering for the returns to be eroded significantly.

But, at the levels of return now being seen, even absent the recovery post-Ian, the catastrophe bond market is now much-better positioned to absorb an average level of losses in a single year.

That puts the catastrophe bond asset class on much stronger footing moving into 2024 and if we get through the end of the year with the new record high level of total returns set around the 20% level, it will set another benchmark and send a very strong signal across institutional investment markets world-wide.

Cat bond returns are still tracking track at these record levels despite some softening of catastrophe bond spreads during the recent quarters.

You can analyse the pricing and spreads of new catastrophe bond issuance in our charts displaying cat bond pricing and spreads, as well as cat bond multiples-at-market, by year and quarter.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature, based on the data in Artemis’ extensive catastrophe bond Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.