In advance of the end of the quarter, Artemis can now report that issuance of property catastrophe bonds in the first-half of 2023 will close out June at an all-time high for the period of almost $9.7 billion, which beats the full-year total from 2022 and sets a new record for any half-year of cat bond issuance.

2023 always looked as if conditions were ripe for the catastrophe bond market to set new records, with issuance accelerating into the second-quarter and hitting a record-setting pace, as we reported back in May.

The use of catastrophe bonds to transfer property catastrophe risks in reinsurance and retrocession form has dominated recent months, driving issuance of pure 144a property cat bonds to a new all-time high, Artemis can now report.

This sponsor demand for coverage in a hard reinsurance market environment, finding value in catastrophe bonds, has been a key driver, with repeat and new sponsors both tapping the capital markets this year.

By the end of the first-quarter, property cat bonds were running a little behind the prior year, as our quarterly report detailed (look out for the new edition next week).

But Q2 has seen a particular strong environment for cat bond issuance, with high sponsor demand for cover met with abundant capital and fresh investor inflows, as well as high levels of maturities that produced capital to recycle into new deals, all converging to result in a stunning period of growth for the cat bond market.

Based on the transactions we have tracked in our Artemis Deal Directory over the year-to-date and including all property cat bonds that will settle before July begins, we can now report that property cat bond issuance will reach almost $9.7 billion, setting a new half-year record (that’s for any half).

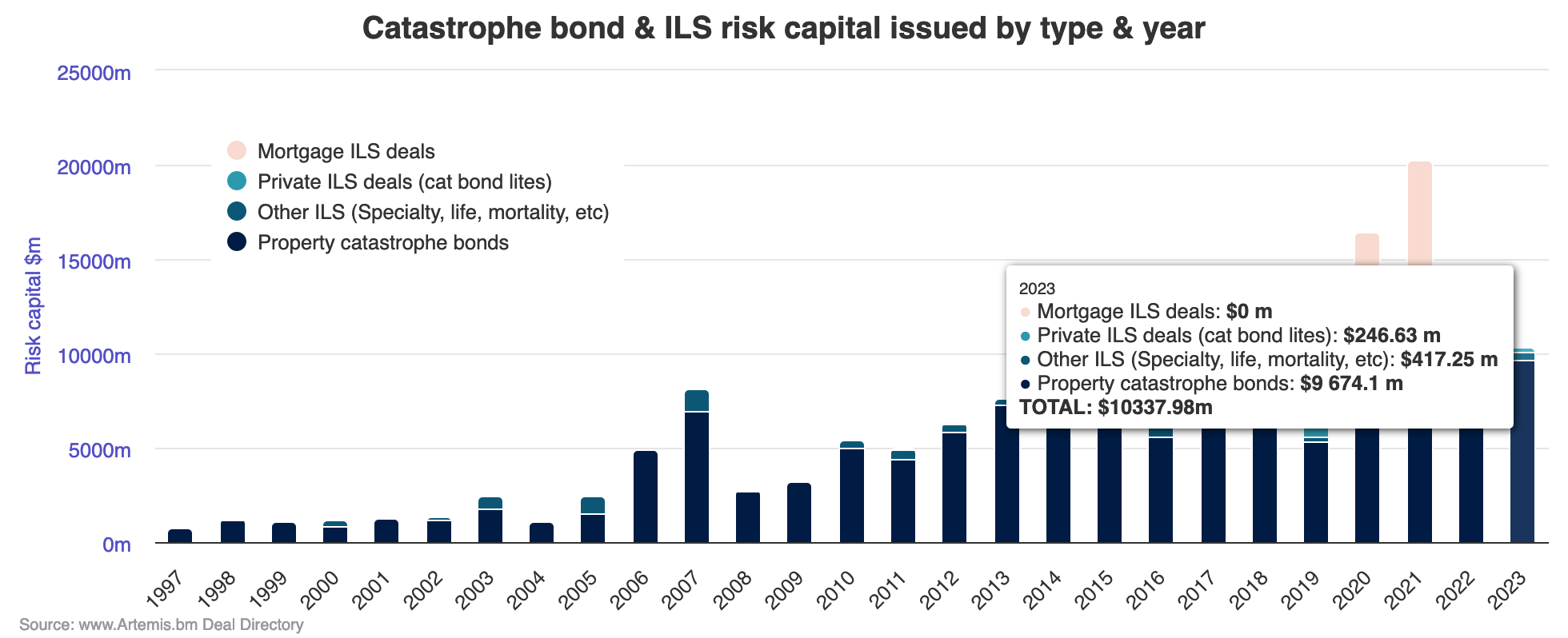

To show you how one of our charts will look like, once all deals settle (we only add data once a transaction has been issued), the chart below shows the split at the half-year point.

Impressively, this puts 2023 already as the year with the fourth highest level of property cat bond issuance on-record.

It also means issuance of property cat bonds in 2023 has surpassed the full-year total recorded in 2022 in just the first six months.

Now, this is only the 144a property catastrophe bond market we’ve mentioned so far.

Add in the cat bonds that provide coverage across other lines of insurance or reinsurance business, as well as the private cat bonds (cat bond lites) we have tracked, so essentially everything recorded in our Deal Directory that settles by end of June, and we get to a half-year total of $10.34 billion, also a new record for any half-year in the market’s history.

So this first six months of 2023 is now officially the strongest half, H1 or H2, of any year on-record, since we began tracking the cat bond market back in late 1996.

All of which adds up to a particularly impressive first-half for the catastrophe bond market.

Sources are now almost unanimous in calling for 2023 to see record levels of catastrophe bond issuance, with our sources continuing to suggest a strong pipeline ahead.

The cat bond market is growing strongly and will be almost $3.7 billion larger at the mid-year point than it was at the end of 2022, which given the significant maturities seen is testament to the strength of the catastrophe bond market and investment managers ability to produce the capital necessary to support sponsor demand.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.