While catastrophe bond and insurance-linked security (ILS) spreads have tightened during the second-quarter of 2021, hedge fund specialist manager K2 Advisors believes that they remain attractive relative to corporate credit and are a strategy investors should be focusing on.

Given the still uncertain world, as the recovery from the pandemic continues but challenges related to that and central bank policy remain, the hedge fund focused asset manager, which is a unit of investment firm Franklin Templeton, believes investors should be looking to focus their hedge fund investments on alpha generating non-directional strategies.

One of these is insurance-linked securities (ILS), an area that Franklin Templeton and K2 Advisors provide expertise and now also managed fund strategies, having launched its own UCITS catastrophe bond recently.

The K2 Advisors investment research team, co-led by Robert Christian and Brooks Ritchey, note that flows into the ILS market brought on a very active second-quarter of catastrophe bond issuance, something covered in detail in Artemis’ latest report.

They explained that investors are currently favouring lower-risk ILS strategies, primarily catastrophe bonds, which offer the most liquidity.

The K2 team expect a seasonal decline in cat bond issuance as we enter US hurricane season. However, we’re anticipating a high-chance that the third-quarter sees above average issuance as capital flows and demand persist and some diversifiers could also be seen.

K2’s team also note that the June 1st reinsurance renewals continued the trend of higher reinsurance pricing, which we believe will help to sustain the spreads in cat bonds above lows seen a few years ago.

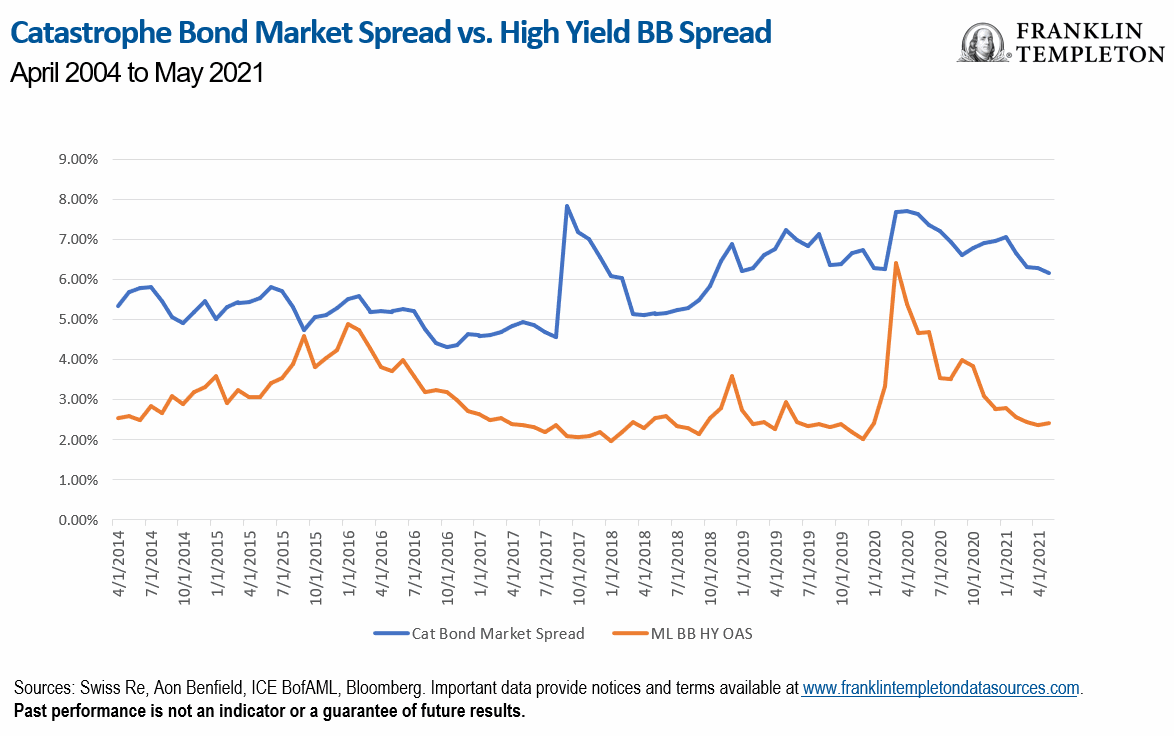

On pricing, K2 Advisors said, “While spreads have tightened, they remain attractive versus corporate high yield entering the key summer ILS risk period,” adding that, “ILS continues to offer attractive relative valuation.”

The chart below from K2 Advisors shows catastrophe bond market spreads versus high yield BB rated corporate credit, clearly showing how attractive the asset class should be at this time for investors.

You can see more data on catastrophe bond coupons and spreads above expected loss in our chart here.

The decline in spreads over 2021 so far is clear, as evidenced in the Franklin Templeton data and our own chart of cat bond issuance metrics.

While spread tightening continued through the second quarter, the overall multiple-at-market of new catastrophe bonds issued did not decline much in the period, remaining around the levels seen in early 2019.

Investors and catastrophe bond fund managers will be keen to see this relative stabilisation persist, as they will not want the market to return to multiple levels seen in 2017/18.

Earlier this year, K2 Advisors said that current cat bond and ILS market conditions present an attractive point of entry for investors, leading the hedge fund specialist manager to give an ‘overweight’ assessment for P&C ILS and catastrophe bonds within portfolios.

It’s encouraging that the investment manager believes spreads remain attractive on this relative value basis, as that should continue to build investor interest and appetite in the asset class.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.