Insurance-linked securities (ILS) returns are set to benefit from rising pricing in reinsurance and retrocession, which makes the market an attractive point of entry right now and leads hedge fund specialist manager K2 Advisors to an overweight assessment for P&C ILS and catastrophe bonds.

The hedge fund focused asset manager, which is a unit of investment firm Franklin Templeton, cautions though that the “risk of a distressed market environment” has been mitigated by inflows of new insurance and reinsurance capital from private equity investors.

Which led K2 Advisors to reduce its sentiment on private insurance-linked securities (ILS), so the segment of the market where collateralized reinsurance and retrocession tend to sit, down to overweight from strongly overweight. The asset manager also reduced its view on the retrocession market to overweight, from strongly overweight, for the same reasons.

Overall, K2 has a neutral view on the ILS asset class at this time, down from overweight in the final quarter of 2020.

But the reason for this decline is down to the slight reduction in weighting of private transactions and retro within the ILS space.

K2 remains strongly overweight industry-loss warranties (ILW’s) and overweight on catastrophe bonds, private transactions and retrocession.

So on the property and casualty reinsurance and retrocession side of the ILS market, the asset manager is positive and recommends overweighting them within an investment portfolio.

“The market offers attractive ILS spreads as we enter the lower-risk period prior to the next hurricane season,” K2 Advisors explained in its latest quarterly hedge fund outlook.

Adding that, “Both insurance and reinsurance pricing trends are positive as higher-than-average natural catastrophe insured losses, broader industry COVID-19-related losses and low interest rates result in higher pricing across the sector including ILS strategies.”

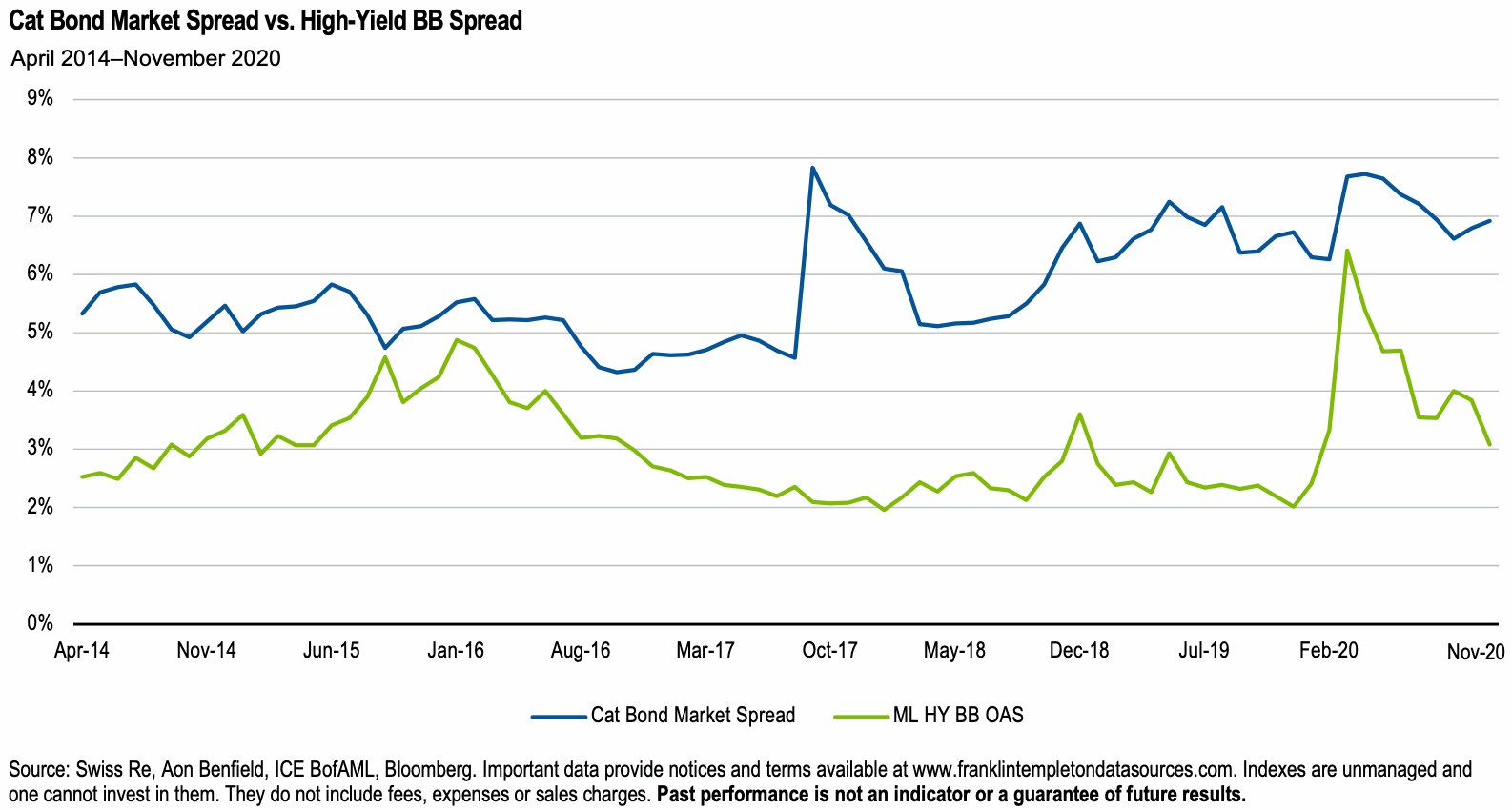

The gap between catastrophe bonds and high-yield corporate bonds is widening and spreads could keep moving in this way, as corporate bonds and debt is likely to tail off further in the coming months, many analysts believe.

As a result, “Cat bond spreads remain attractive versus US corporate high yield,” K2 explains, which at this time of the year, in advance of the US wind season, makes for an attractive investment alternative, not even mentioning the lack of correlation to corporates that is available in the catastrophe bond market.

K2 Advisors is particularly positive on the catastrophe bond market at this time.

Saying, “Overall, the market remains healthy, and cat bonds should continue to draw more interest into 2021. Cat bonds will likely benefit from the transparent and liquid structure, lack of correlation and wider spread versus US high yield corporate bonds.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.