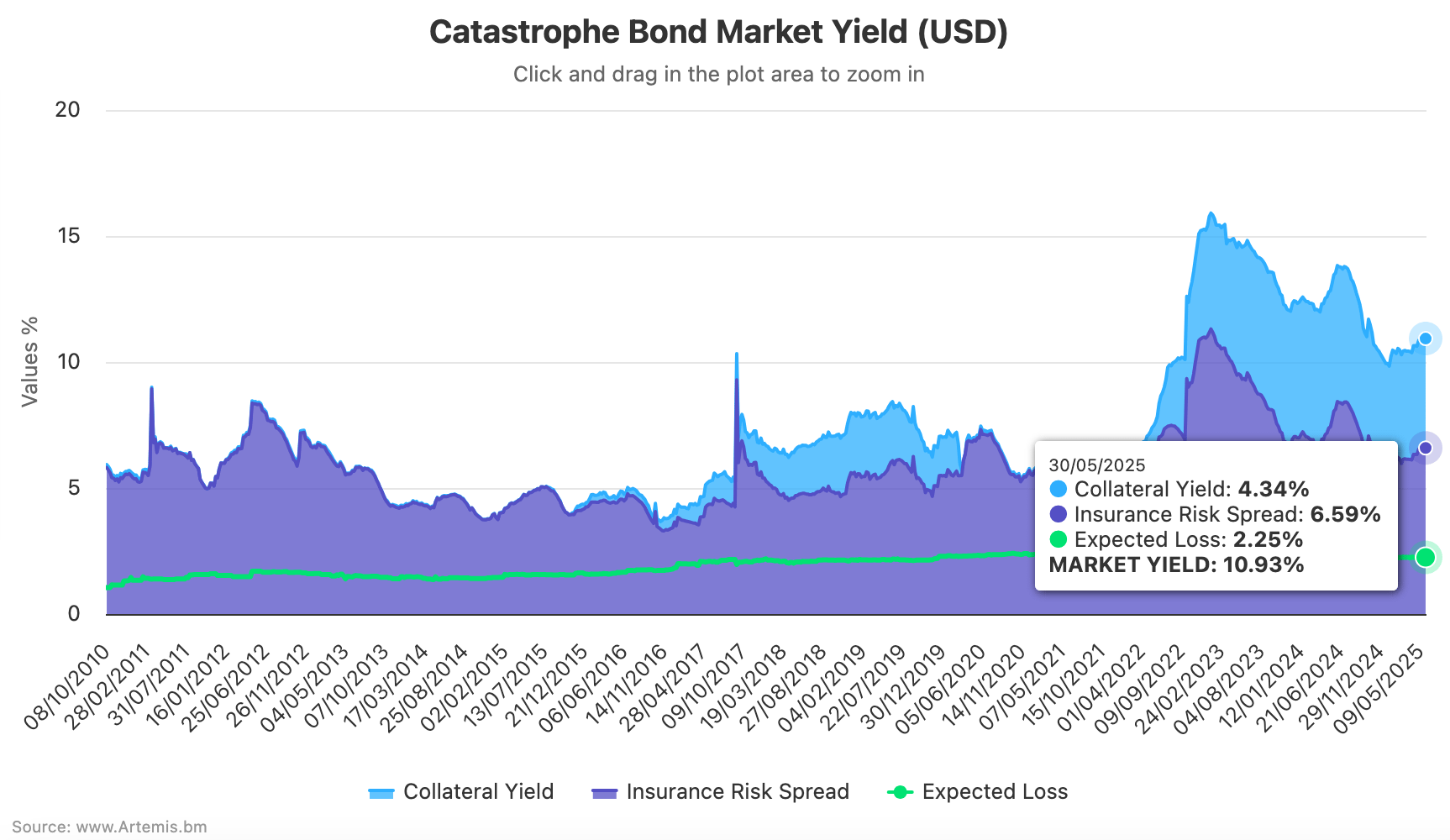

The overall yield of the catastrophe bond market rose slightly to 10.93% by May 30th 2025, as seasonal spread widening now nears its end and a returning trend of rising prices is anticipated, according to Plenum Investments.

Rising insurance risk spreads in the catastrophe bond market have now lifted the overall cat bond market yield by more than one percentage point since a recent low of 9.84% back in early January, according to the data from the cat bond fund manager.

However, the overall yield of the catastrophe bond market, by Plenum’s measure, is now almost 20% lower than the 13.54% it stood at back at the end of May 2024, with insurance risk spreads around 19% lower across the market.

You can analyse this in our interactive chart that uses Plenum Investments data to display the yield of the catastrophe bond market over time.

One month ago, as of data to May 2nd, the 10.86% catastrophe bond market yield was driven by its components of a 6.54% insurance risk spread and a 4.32% collateral yield.

Now, as of May 30th, the main components stand at an insurance risk spread of 6.59% above a 4.34% collateral yield, with expected loss relatively flat, so still remaining a historically attractive risk-return for investors in the cat bond market.

Plenum Investments commented that, “The seasonal spread widening is coming to an end. Since demand for primary market bonds is currently declining somewhat, we expect US hurricane bond prices to continue to decline slightly until the end of June. After that, we expect prices to rise again.”

Supply and demand factors have been driving the yield of the catastrophe bond market just as much as seasonality in recent months, with the two competing for dominance.

As we enter the hurricane season and primary issuance of catastrophe bonds naturally slows, as we always see, it will be interesting to watch how the market yield responds over the next couple of months.

Analyse catastrophe bond market yields over time using this chart.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.