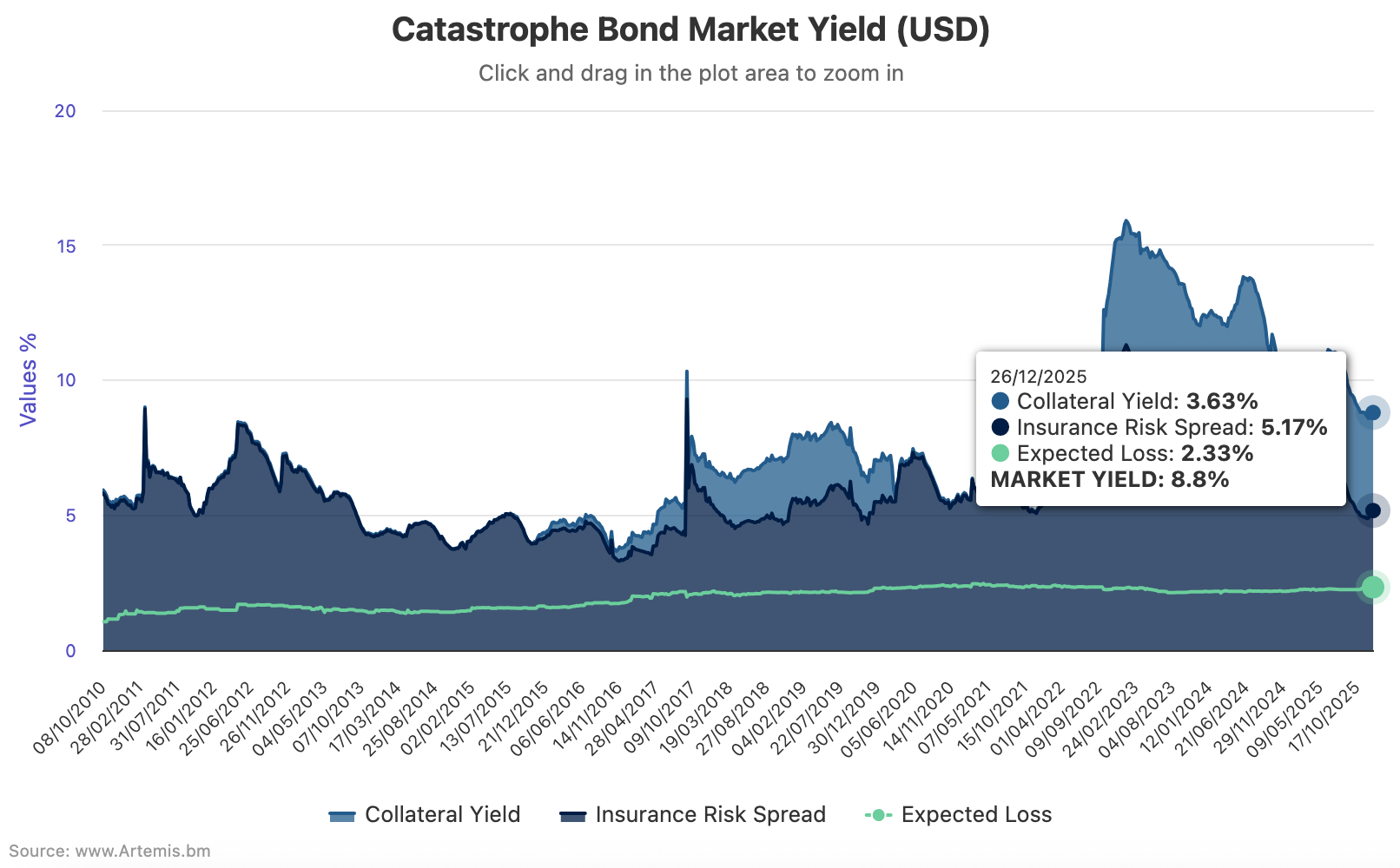

Catastrophe bond market insurance risk spreads, or the discount margin, increased by roughly 6% in the month of December 2025, as spread widening returned to more seasonal norms lifting the overall yield of the catastrophe bond market to 8.80%.

Seasonal spread tightening caused by the Atlantic hurricane season had been compressing catastrophe bond market spreads through recent months, a trend that began to slow in November as the wind season drew to its close for the year.

In December 2025, the catastrophe bond market began to experience typical spread widening and this has lifted the overall yield of the market in the month, from the 8.69% at November 28th to reach 8.80% as of December 26th, the latest data available from specialist cat bond manager Plenum Investments.

The risk-free rate of return on collateral in the catastrophe bond market reduced further in the last month though, meaning that all of the gain in cat bond market yield came from the widening of the discount margin as risk spreads increased.

Supply-demand factors will have remained an additional pressure in the market given the high levels of new catastrophe bond issuance seen at the end of 2025, but still the spread widening regime returned and was sufficient to raise yields for the asset class.

The overall yield of the catastrophe bond market had sat at 11.03% at the end of June 2025, then declined to 10.81% by August 1st, then 10.22% as of August 29th and further still to 9.43% as of September 26th, falling again to 8.81% by the end of October and then to 8.69% as of November 28th 2025, as tightening slowed.

The increase in the last month to a cat bond market yield of 8.80% indicates a reversal back to a spread widening trend.

You can analyse the yield of the catastrophe bond market over time in our interactive chart, which uses data kindly shared by Plenum Investments.

Commenting on developments in the cat bond market coupon over the last month, Plenum Investments explained, “In December, the market returned to its typical seasonal spread-widening regime, with month-to-month yields increasing by nearly 6%.

“By the end of December, the average yield had reached 5.17%. We expect yields to exceed the 10-year average again within the next two months, as they continue to follow their usual widening pattern.”

The insurance risk spread, or discount margin of the catastrophe bond market, had declined to 5.48% at September 26th 2025, then 4.99% at October 31st 2025, then 4.88% at November 28th 2025. But it rose 6% to reach 5.17% at December 26th 2025.

The risk-free return on collateral has been reducing slowly, from 3.82% at October 31st, to 3.80% at November 28th and now 3.63% as of December 26th.

The expected loss of the cat bond market as measured using Plenum Investment’s methodology rose from 2.25% at October 31st to stand at 2.33% at November 28th 2025, and has remained steady through December at that same 2.33% level.

Which means the amount of risk spread available over the expected loss, has risen from 2.56% at the end of November, to now stand higher at 2.84% as of December 26th 2025.

The yield over expected loss including the risk free rate stood at 6.47% on December 26th 2025.

As we reported earlier this week, consultancy Lane Financial suggested a forecast return for catastrophe bonds for 2026 after accounting for an expected level of losses might be around 6%, which is relatively aligned with this latest market yield data.

It’s going to be interesting to see how the discount margin develops over the course of 2026, as well as whether the interest rate regime compresses the risk-free return on collateral further.

Analyse catastrophe bond market yields over time using this chart.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.