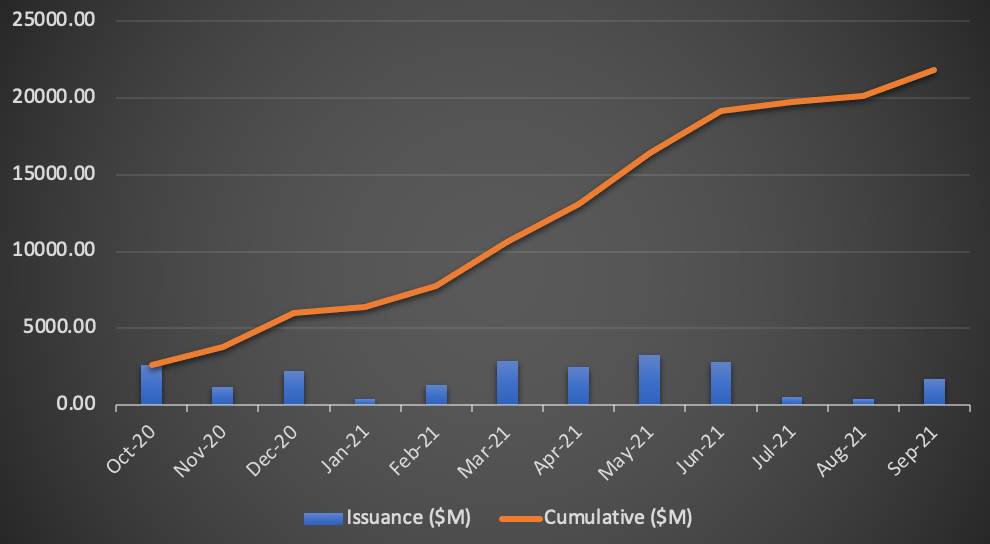

The catastrophe bond and related insurance-linked securities (ILS) market has set another new record, as the amount of issuance we’ve recorded across a twelve-month period to end of September 2021 reached a new all-time-high.

The catastrophe bond market has been experiencing elevated levels of activity over the last year, helped both by investor appetite for the more liquid and transparent forms of insurance-linked security (ILS), as well as cedents appetite for reinsurance and retrocession at the higher layers cat bonds tend to cover.

For the twelve-months to September 30th 2021, the Artemis Deal Directory has recorded more deal-flow that in any other 12-month period since we first began tracking this marketplace.

Bearing in mind the Deal Directory has existed online since 1999, but the list of deals has been under construction since late 1996, we believe this has been a record 12-month period for the cat bond and related ILS market, unprecedented in terms of issuance.

In total, including every transaction in our Deal Directory, so 144a property catastrophe bonds, life/health/specialty lines cat bonds, private cat bonds and mortgage ILS deals, the 12-month total issuance to end of September reached a stunning $21.9 billion of risk capital.

Subtracting the mortgage ILS deals we’ve recorded, which at $7.12 billion was also a rolling 12-month issuance record to the end of Q3, the total falls to $14.73 billion which is also a record.

That $14.73 billion of issuance, during a rolling 12-month period and including 144a property cat bonds, private cat bonds and life/health/specialty lines cat bonds, is well ahead of previous records, thanks to the pace of issuance seen in 2020 and 2021 so far.

If we subtract the almost $735 million of private cat bonds and $570 million of life/health/specialty lines ILS in cat bond form that we’ve recorded, leaving just pure Rule 144a property catastrophe bonds, we still get a rolling 12-month issuance figure of over $13.4 billion, which is again a record-high.

This bodes well for the full-year 2021 issuance, which as we explained the other day is well on its way to achieving a new record high as well.

Focus on catastrophe bonds and the higher-layer, more liquid, more transparent, cat bond structured deals, remains high and broker’s are forecasting a strong end to the year ahead.

Which suggests we could see full-year records eclipsed on almost all measures in 2021, paving the way for another busy year in 2022.

Stay tuned to Artemis to keep updated on all catastrophe bond and related ILS transaction issuance, as well as evolving trends in the cat bond and insurance-linked securities (ILS) market.

For full details of third-quarter 2021 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For full details of third-quarter 2021 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q3 2021 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.