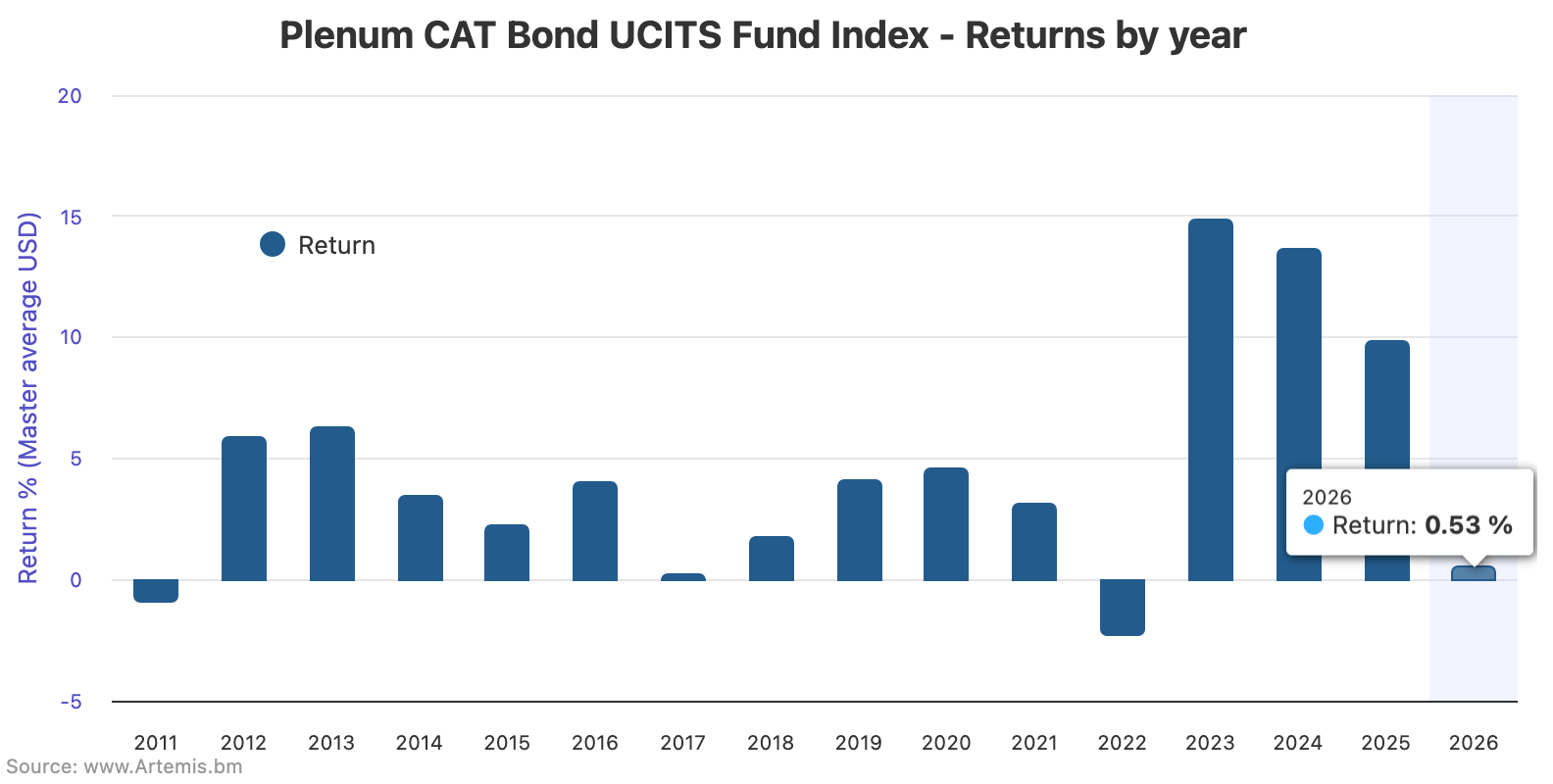

Catastrophe bond fund strategies in the UCITS format have started 2026 positively, delivering an average return of 0.53% for January, according to the Plenum CAT Bond UCITS Fund Indices.

Historically, it’s a better than average start to the year in performance terms for the catastrophe bond asset class, with many previous January’s having experienced lower levels of return, Swiss Re cat bond index data shows.

While it is also much better performance for the sector than a year ago, when the Los Angeles wildfires impacted cat bond fund returns.

Of course, catastrophe bond market returns are down compared to the last few years through the hard market peak and expectations for 2026 are that cat bond funds will generally deliver returns in the mid to high single digits, dependent on the loss activity we see.

That remains attractive to investors when compared to other fixed income asset classes and truly diversifying alternatives, which should mean investor interest for the sector remains robust this year.

All cat bond funds are expected to have delivered positive returns in January 2026, given there were no impactful events, resulting in an average for the month of 0.53%, according to this Index.

You can analyse the Plenum CAT Bond UCITS Fund Indices in our charts:

January 2026 saw relatively tight dispersion between the returns of lower and higher-risk UCITS catastrophe bond fund strategies, given the lack of impactful catastrophe events in the month.

Plenum Investments’ data shows that the lower-risk cohort of UCITS cat bond funds averaged 0.46% for January 2026.

While, the higher-risk cohort of UCITS cat bond funds fared better still, averaging a 0.57% return for the month.

On a 12-month rolling return basis to January 30th 2026, the average return of cat bond funds tracked by this Index stands at 10.31%.

For the lower-risk cohort the 12-month return stood at 10.28%, while for the higher-risk cat bond fund cohort it stood at 10.36%.

It’s going to be interesting to watch how that rolling 12-month return of cat bond funds comes down through 2026, as it inevitably will do. However, it may take a few months to see this properly, given there were some months that saw depressed performance in the first-half of 2025.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using this chart.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.