Insurance-linked securities (ILS) fund strategies delivered a second month in a row of muted performance in March 2022, as some catastrophe exposure and continued price pressure in catastrophe bonds, dented returns for some strategies, but overall the sector remains positive for Q1, further underscoring the decorrelation potential for investors.

On average, insurance-linked securities (ILS) funds delivered a 0.05% return for March 2022, according to the Eurekahedge ILS Advisers Index.

On average, insurance-linked securities (ILS) funds delivered a 0.05% return for March 2022, according to the Eurekahedge ILS Advisers Index.

March saw a number of minor global catastrophe events, some of which have impacted certain private ILS positions, if not in terms of losses, then just in terms of aggregate deductible erosion.

The earthquake off the east coast of Japan was one event highlighted by ILS Advisers in its latest monthly update on the Index, as well as an outbreak of severe thunderstorms and tornadoes in the United States.

“It is the second year in a row the U.S. has endured a record number of tornadoes as early as March,” the ILS Advisers team explained.

However, they continued to say, None of these events were strong enough to cause much losses to the ILS market. They will however further erode multi-peril annual aggregates.”

But clearly the events seen in March have been sufficient to dent returns for some private ILS fund strategies, muting returns for some of the more collateralised reinsurance and retrocession focused strategies included in the Index.

The conflict in Ukraine after Russia invaded the country is another threat hanging over some ILS strategies, but with the majority of losses expected in specialty lines of reinsurance business, meaning while uncertainty is high, the potential for any impact to ILS funds or structures is uncertain.

Catastrophe bond spreads widened in March, ILS Advisers confirmed, while in the secondary market prices lost -0.38% for the month, resulting in a +0.17% total return for the Swiss Re Global Cat Bond Index, ILS Advisers explained.

The upshot of all of this was that pure catastrophe bond funds as a group averaged a 0.13% positive return in March, which given global volatility and uncertainty will have been a welcome return for investors in the month.

Despite the catastrophe activity experienced, private ILS funds still managed a flat return on average, which will still have been viewed as largely positive by some investors.

In total, 14 of the ILS funds represented in the Eurekahedge ILS Advisers Index were positive for the month of March 2022, while 11 fell to a negative return.

As ever, there was a range of ILS fund performance, spanning from -1.4% to +1% in March 2022.

Year-to-date, the average ILS fund return is +0.38% after the first three months of the year, which is still much better than the first-quarter of 2021, which sat at -0.21% at the end of March.

Given the global macro environment, the performance of this ILS fund Index through the first-quarter of 2022 further underscores the relative lack of correlation the ILS sector exhibits to global macro and economic events, as well as the sectors potential to deliver attractive returns to investors at a time of volatility.

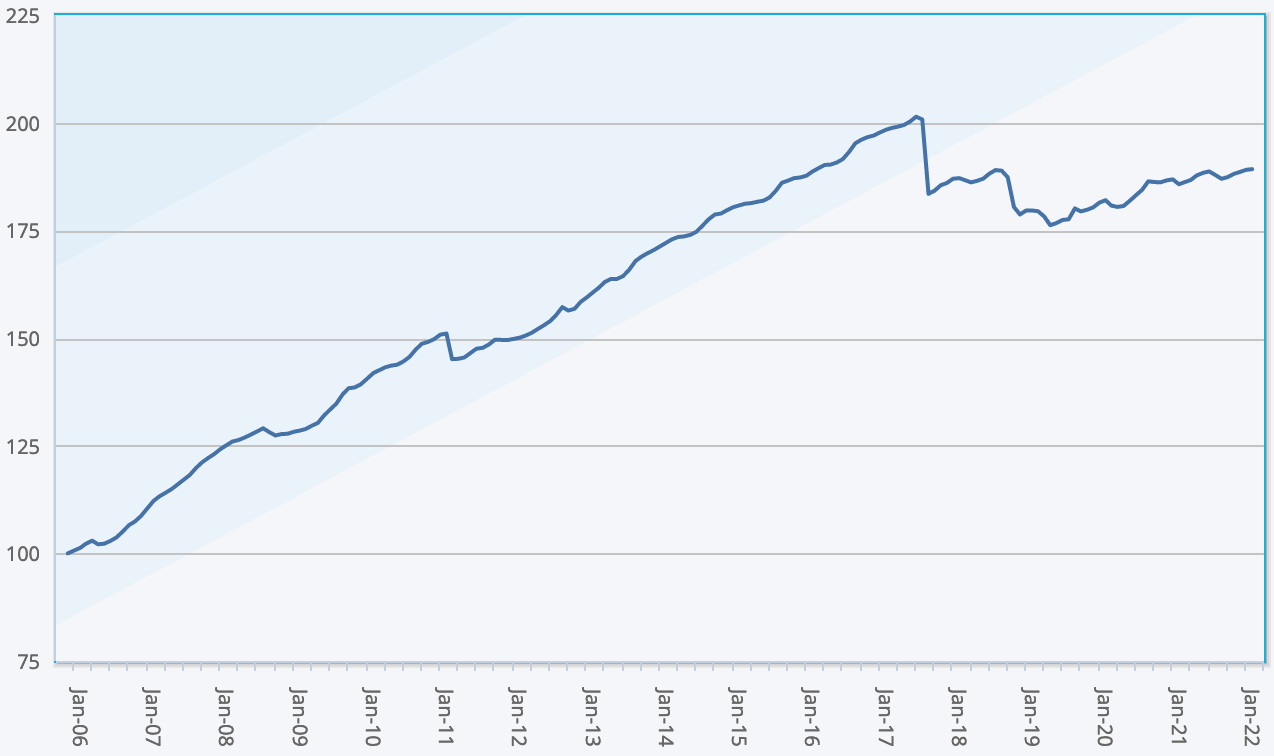

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.