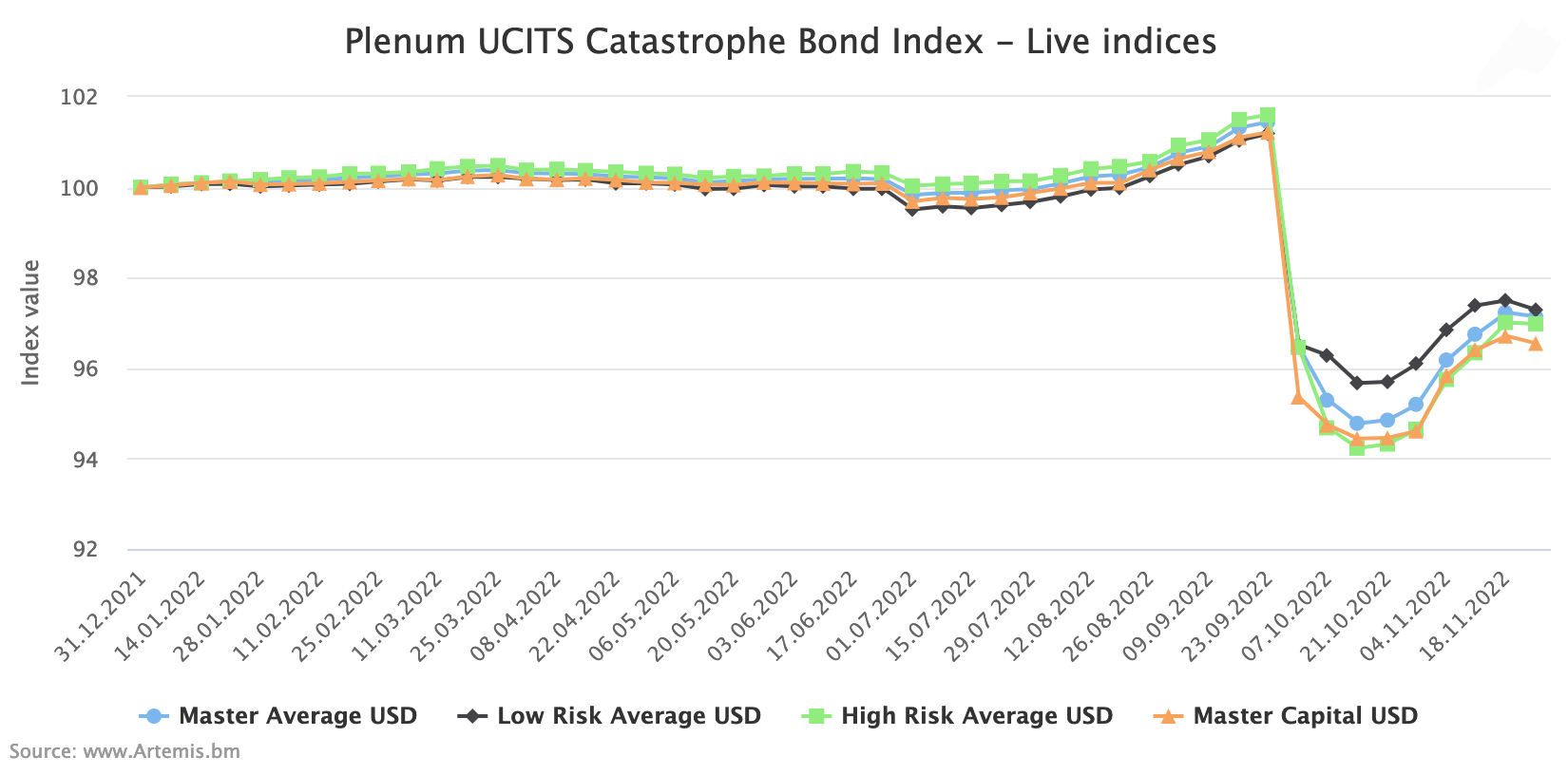

Catastrophe bond funds, as measured by the Plenum CAT Bond UCITS Fund Indices, lost ground for the first week since mid-October as the effects of continuing spread widening and the resulting price adjustments dented performance a little.

After a relatively strong recovery for a few weeks since hurricane Ian, the pure catastrophe bond investment funds have finally succumbed to some of the price effects in the cat bond market.

The Plenum calculated UCITS catastrophe bond fund indices fell by an average of -0.13% in the week to November 25th 2022, the last reported data available for the group of cat bond funds.

Interestingly, the lower-risk cohort of UCITS cat bond funds tracked by Plenum fell the most, being down -0.22% for the week, while the higher-risk cat bond fund strategies were only down -0.03%.

It leaves the average of the UCITS cat bond fund indices down -4.32% since hurricane Ian struck, still far better than the -6.58% these cat bond fund indices were down immediately after major hurricane Ian impacted Florida.

Higher-risk cat bond funds are down -4.55% on average since hurricane Ian, while the lower-risk cat bond fund strategies are now down -3.85%.

The resumption of a downward movement in the week ending November 25th is largely due to continued spread pressures in the secondary cat bond market, with many positions losing value.

Much of this is due to the pricing in of higher spreads at issuance and the price declines across the non-loss impacted catastrophe bonds is expected to be recovered as the positions move towards maturity.

It does mean for investors with capital to spare, buying up positions at depressed prices, in the knowledge they should earn that back as maturity nears, can make for an attractive investment opportunity at this time.

Cat bond positions that have exposure to hurricane Ian saw a little more recovery in the last week of record, indicative of the market finding the right price, rather than any significant adjustment in loss-expectations related to the storm.

But the price increases on some Ian-exposed cat bonds helped to offset some of the spread widening, so the spread-effect could have been more significant without those gains.

The catastrophe bond fund market does now appear to have found its level for the current expected losses from hurricane Ian, so we should expect some further week-to-week fluctuation, as price volatility persists across the broader market and the forward-price environment for cat bonds, as well as investors cost-of-capital expectations, get bedded into secondary marks.

Analyse interactive charts for this UCITS catastrophe bond fund index.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.