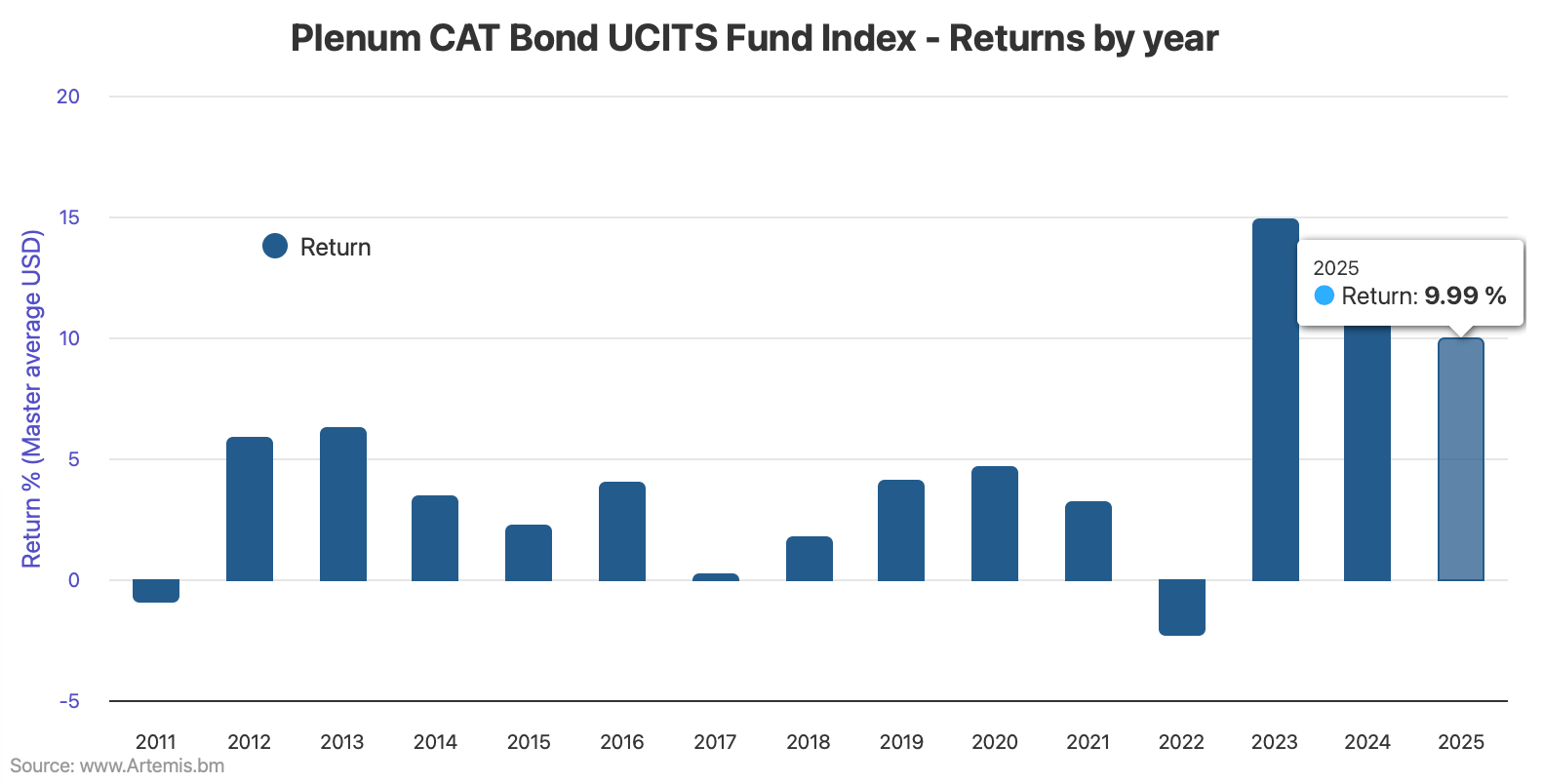

The latest data from the Plenum CAT Bond UCITS Fund Indices shows that the entire group averaged a 9.99% return for the latest available twelve month period, while the lower and higher-risk cohorts of UCITS cat bond funds each averaged a 10.02% return.

For this analysis, we’re looking at the closest date range to the 2025 calendar year at this time, with information available from December 27th 2024 to the latest pricing update for this Index at December 26th 2025, so a twelve month return.

When we last reported on the Plenum CAT Bond UCITS Fund Indices, the average 2025 return of catastrophe bond investment funds in the UCITS format had reached 9.60% by November 28th 2025 (for the period starting from Dec 27th 2024 pricing).

December saw returns slowing again, as is typical of the time of year given the absence of wind seasonality.

The average return for this Index, that tracks the performance of all UCITS catastrophe bond funds, was 0.36% for the period from November 28th to December 26th 2025, the latest pricing date.

Now, for the closest period to the year we have data available for so far, from Dec 27th 2024 to Dec 26th 2025, the average 12-month return for the entire group of UCITS catastrophe bond funds stood at 9.99%, just shy of double-digits.

You can analyse the Plenum CAT Bond UCITS Fund Indices in our chart:

From cat bond fund returns we’ve seen so far for 2025, the range appears to be from around 9% to as high as 14% for strategies that also incorporate some private cat bond deals.

Pure cat bond fund returns for 2025 seem to be largely grouping within a range for 9% to 11% annual returns, we believe.

Looking back to review monthly performance UCITS cat bond funds for 2025 year-to-date, the Plenum CAT Bond UCITS Fund Indices delivered a 0.40% return for January, 0.32% for February, 0.56% for March, 0.28% for April, 0.52% for May, 0.58% for June, 1.09% for July, 1.34% for August, 1.38% for September up to the 26th, 1.51% up to the end of October, 0.66% to November 28th and then the latest 0.36% to December 26th.

With positive returns delivered to investors every single month in 2025, it’s no surprise the UCITS cat bond fund sector has been growing at pace.

We expect that growth will have continued at an impressive pace through the fourth-quarter of 2025. We expect to have data on that in the coming weeks.

Back to the 12-month performance of the UCITS catastrophe bond funds.

For the period of Dec 27th 2024 to Dec 26th 2025, the lower-risk cohort and the higher-risk cohort of UCITS cat bond funds both averaged a rounded 10.02% return. The higher-risk cohort were very slightly ahead.

On an average capital-weighted basis, the returns for the 12-month period were slightly lower at 9.76%, Plenum’s latest Index data shows.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using this chart.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.