Broking group Aon appears to be expecting another large longevity swap deal to complete before the end of the year, forecasting today that 2021 longevity swap volumes will reach £15 billion.

So far in 2021, we’ve counted £12.7 billion of UK focused pension scheme longevity swap arrangements, all of which are recorded in our Deal Directory.

But today, Aon explained in an update on the UK pension risk transfer market that, while activity can be lumpy in longevity swaps, that doesn’t mean there isn’t activity going on behind the scenes.

Tom Scott, Associate Partner at Aon Hewitt, the insurance and reinsurance brokers brand unit that focuses on these pension deals, explained.

““It has also been a busy 12 months in the longevity swap market, with disclosed transactions in 2021 expected to surpass £15 billion,” Scott said.

Which suggests there is another transaction either in the market, or recently completed, that could come to light before year-end.

“As in previous years, the swap market continues to be dominated by a relatively small number of ‘mega deals’. This means that between the announcement of these transactions, it may appear that the market has ‘gone quiet’,” Scott continued.

Adding that, “The reality could not be further from that – there is currently significant behind-the-scenes activity ahead of the completion of the next wave of transactions.”

Reinsurance capital availability has been a key driver of longevity risk transfer activity and in 2022 it’s expected capacity could be a little more limited, especially as global reinsurance firms have plenty of opportunities to deploy their capital into hardening P&C markets at this time.

By the end of the year, Aon believes that £30 billion of bulk annuity deals for pensions will also have been completed, making it a busy year for the pension risk transfer market.

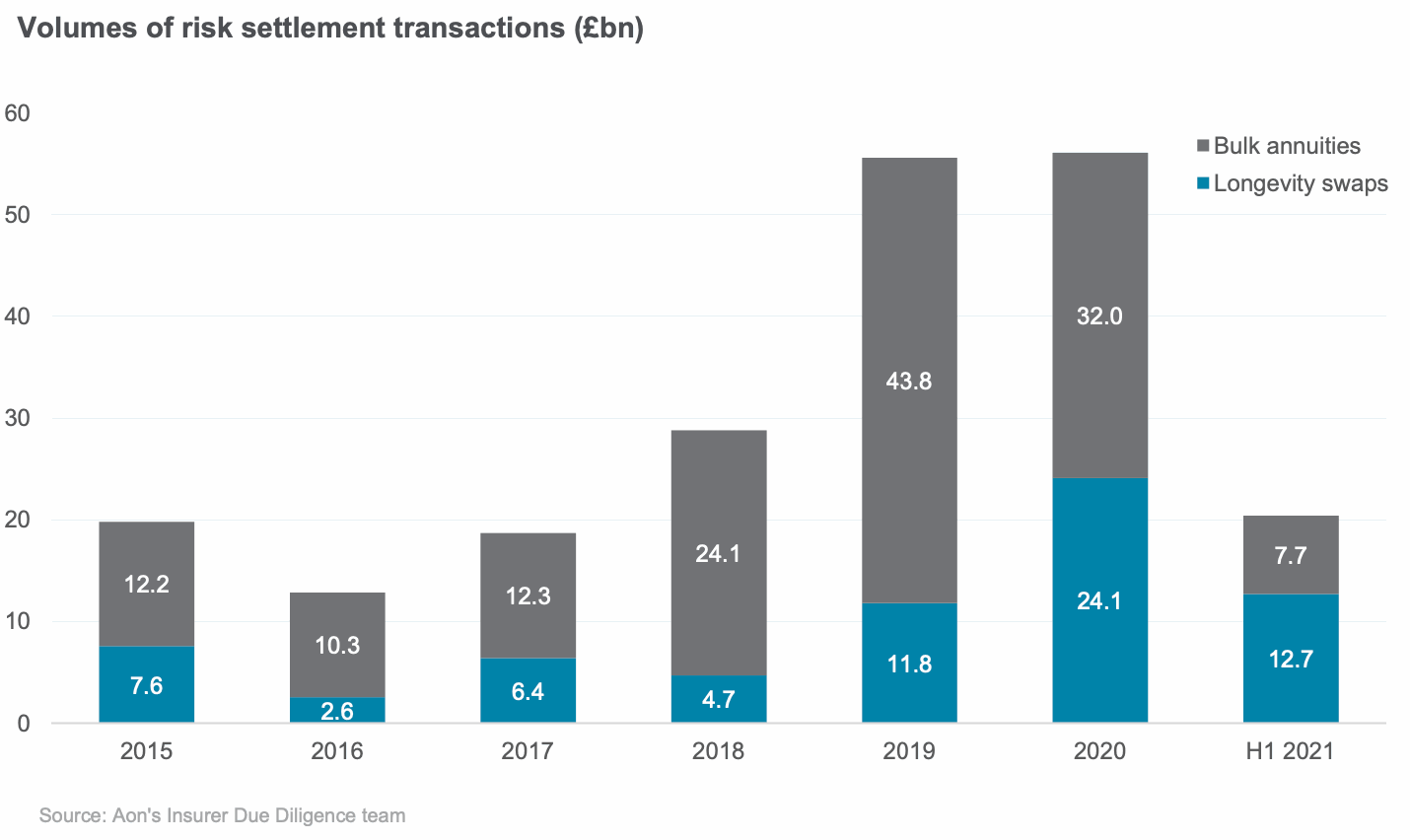

2019 saw around £12 billion of UK longevity swaps completed, while 2020 saw the total rise significantly to £24.1 billion.

As a result, 2021 has been a bit of a disappointment, in terms of volumes perhaps, with activity not having risen since the end of the first-half (as seen above).

But the lumpy nature of these very large deals means that activity levels can fluctuate significantly and if this one additional deal does complete before year-end, it will still make 2021 the second most active year in longevity swap market history.

Read about many historical longevity swap and reinsurance transactions in our Longevity Risk Transfer Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.