Validus, one of the AIG reinsurance brands under AIG Re, is the first to complete a 144A catastrophe bond issuance in 2022, starting the year off with a successful $400 million Tailwind Re Ltd. (Series 2022-1) transaction, that renews a capital market backed source of retrocession for the company.

Validus returned to the catastrophe bond market in early December 2021, aiming to secure at least $275 million of collateralized aggregate multi-year retrocessional reinsurance protection through the renewal of its Tailwind Re cat bond issuance.

Validus returned to the catastrophe bond market in early December 2021, aiming to secure at least $275 million of collateralized aggregate multi-year retrocessional reinsurance protection through the renewal of its Tailwind Re cat bond issuance.

Later that month, we reported that Validus’ target for the second Tailwind Re cat bond had increased, with as much as $425 million of aggregate retro then being sought from the Tailwind Re 2022-1 deal.

In the end, as we reported at the end of last year, the Tailwind Re 2022-1 catastrophe bond was finalised at $400 million in size for Validus.

The reinsurer seemingly focused on price over size, foregoing the larger target in favour of securing its catastrophe bond renewal at the best possible pricing.

Validus secured the pricing for the first three tranches of notes of the Tailwind Re 2022-1 cat bond issuance at the bottom end of their initial coupon guidance, while the fourth and riskiest layer of the deal priced at the bottom of a reduced price guidance range.

For an annual aggregate retrocession arrangement this was a strong result, considering the dislocation in retro reinsurance, the reduction in available collateralized capacity for retro and the aversion to aggregates in some quarters at the recent January 2022 reinsurance renewals.

While some ceding companies were penalised with steep rate increases for aggregate retro coverage at the renewals, AIG’s Validus has seemingly fared much better, securing $400 million of protection priced at levels below expectation.

Validus’ return to the catastrophe bond market was very well-received by investors and funds, it seems, who supported the renewal of the reinsurers’ expiring catastrophe bond retro coverage at attractive pricing levels.

After the record catastrophe bond issuance seen in 2021, with $14 billion of transactions documented in our brand new quarterly report, Validus’ new cat bond gets 2022 off to a solid start.

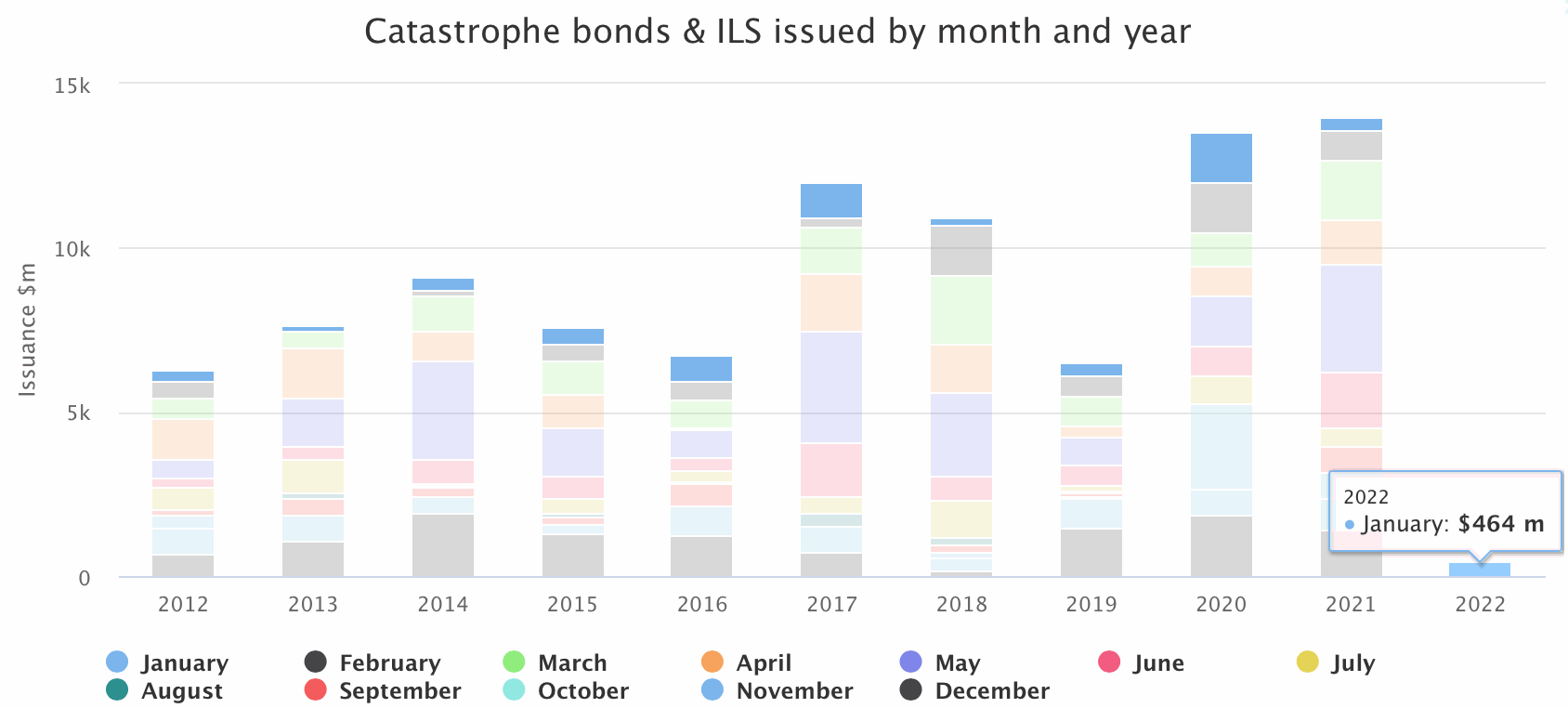

January can be a quiet month for cat bond issuance, as you can see in one of our new charts that displays catastrophe bond issuance by month and year.

In fact, January 2022 has already surpassed the prior year, with $464 million of issuance this year already thanks to Validus’ $400 million 144A cat bond, as well $64 million of new private cat bonds.

The record for cat bond issuance in January was set in 2020 at just over $1.5 billion, so already just a few days in we’re practically one-third of the way there.

An additional transaction launched this week as well, with Aetna targeting another $200 million Vitality Re health ILS issuance in cat bond form.

At $400 million in size, the Tailwind Re 2022-1 cat bond is a straight renewal for the $400 million Tailwind Re Ltd. (Series 2017-1) cat bond that matures early this month and was Validus’ first ever full cat bond issuance.

You can read all about this new Tailwind Re Ltd. (Series 2022-1) cat bond transaction from AIG’s reinsurance subsidiary Validus, as well as every other catastrophe bond issuance in our Artemis Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.