A really interesting new weather risk hedging product designed to help the wind power industry hedge the financial risk of wind variability has just been announced in a joint statement by renewable energy risk analysis firm 3TIER® and Galileo Weather Risk Management. They’ve collaborated to create a financial instrument that could have a huge impact on wind energy producers and how they manage one of their core risks.

This is the first financial product which will help the energy industry address their wind variability risks, the risk of available wind not being sufficient to meet power output demands. It’s encouraging to see this sector finally having a weather risk product designed specifically around their needs. As we’ve written previously (here and here), the renewable energy sector is an obvious candidate for innovative weather risk transfer products.

The product is based on Galileo’s existing WindLock™ product which Galileo says ‘can be indexed to weather variables including temperature, rainfall, wind speed, and solar irradiance as well as commodities such as natural gas and power, and can be delivered on a global basis as either derivatives or (re)insurance’. In this case WindLock™ will be used to provide on-site settlements based on wind resource data from 3TIER. They say that the new market in financial wind risk products will allow wind project developers and financiers to lower financing pressures when involved in wind projects. Large premiums are often built into the financing costs of wind projects specifically to cover production uncertainty due to variable wind speeds.

Here’s some more detail from the announcement:

Galileo uses 3TIER’s wind resource time series to price and structure WindLock™ products based on expected variability with settlements based on wind speeds provided by 3TIER. Using 3TIER’s weather modeling expertise in generating historical time series helps avoid errors in on-site measurements and isolates wind speed from other factors that can impact power production.

WindLock™ products are indexed to wind-driven megawatt-hours allowing for the utilization of a power curve to provide accurate mapping of wind speed to generation. Galileo offers WindLock™ globally and products can be tailored to match project financing structures with protection commencing across a wide range of estimated production.

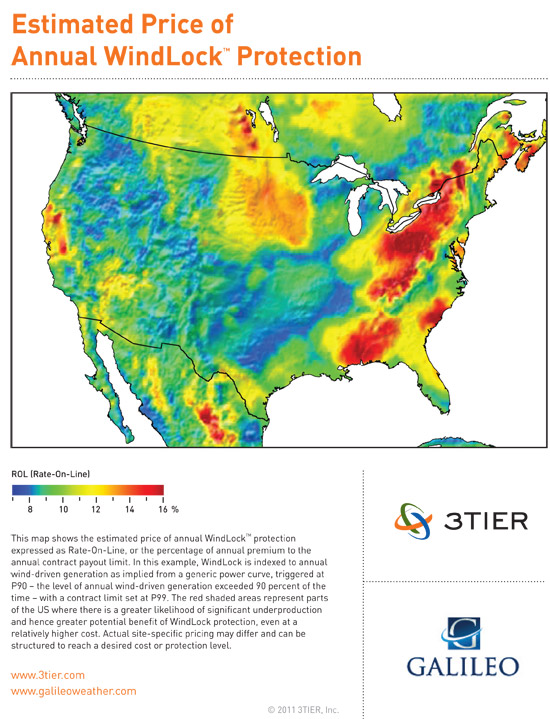

Regarding the likely cost of the product for companies seeking to hedge their wind variability risk, 3TIER and Galileo have kindly supplied a graphical map that shows the estimated cost of annual WindLock™ cover.

U.S. map plotting the Rate-On-Line, or percentage of the annual premium to the annual contract limit

Finally some quotes from the firms involved in this innovative offering.

“Wind energy is experiencing strong growth globally and the natural variability of wind has led to conservative financing and a relatively high cost of capital,” said Martin Malinow, Galileo CEO. “Working together with 3TIER, Galileo can now offer developers and financiers an important tool to manage the uncertainty of wind-driven earnings which will create greater capital market access and potentially a lower cost of capital for new projects or refinancings.”

“3TIER’s long-term investment in global capabilities and datasets, combined with our reputation for providing accurate and objective resource intelligence, ideally positions us to provide the global benchmarks upon which wind resource variability risk can be assessed and mitigated,” said Michael Grundmeyer, 3TIER vice president of business development. “Teaming up with a weather risk management leader like Galileo to use these benchmarks as the basis for hedging transactions represents a natural and significant step forward in the financial maturity of the global wind industry.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.