Lloyd’s ambitious Blueprint to help ILS capital participate more easily

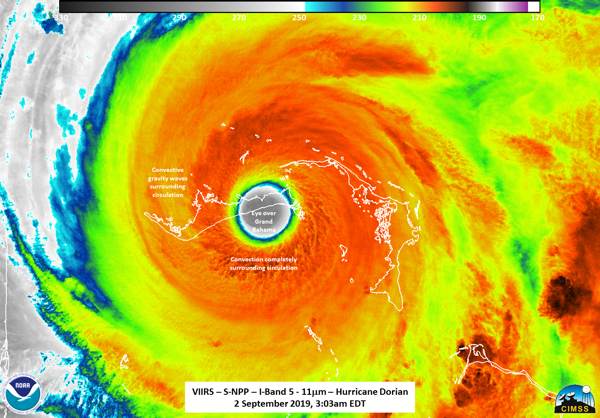

30th September 2019Lloyd’s of London has revealed an ambitious “Blueprint One” which lays out a strategy to “build the most advanced insurance marketplace in the world” part of which includes new capital rules and processes and a goal to make it simpler for ILS capital to access the market.

Read the full article