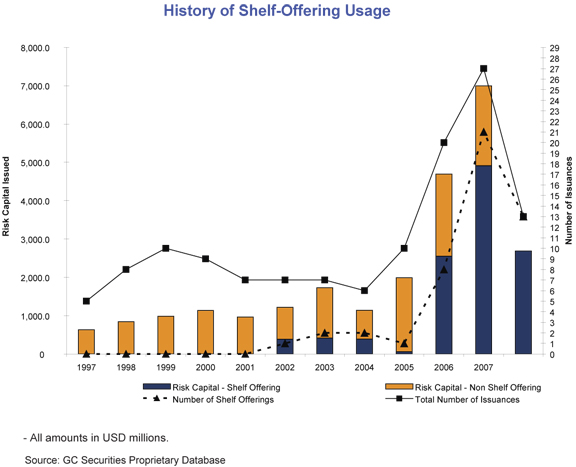

Guy Carpenters www.gccapitalideas.com blog has an excellent post on the portion of the catastrophe bond market known as shelf offerings. Shelf offerings emerged in 2002 and have since been becoming a greater proportion of deals completed each year. Issuing a shelf offering involves structuring a transaction platform which allows for multiple note issuance’s. The benefits are obvious, multi-year/peril structures can be much more closely matched to the actual portfolio of risk they seek to protect. The figure below (from the post at www.gccapitalideas.com) shows the growth in use of shelf offerings since the cat bond market began, the appeal is obvious as you see that in 2008 all deals brought to market where structures of this type.

Read more on these fascinating structures on the original post on GC Capital Ideas blog.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.