Kairos and CHAZ Brokers develop parametric typhoon cover for offshore aquaculture firm

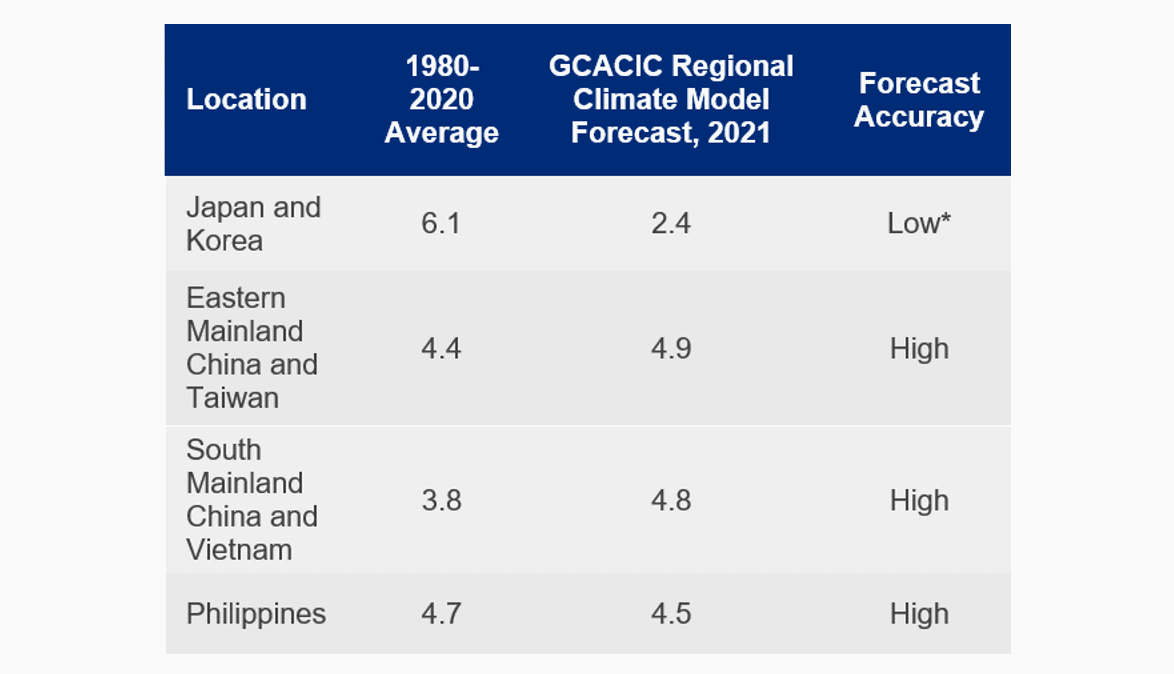

17th February 2025Kairos Risk Solutions, a regional risk consultancy firm headquartered in Singapore, in collaboration with Thailand-based insurance broker, CHAZ Insurance Brokers, has finalised a parametric insurance solution designed to protect an offshore aquaculture firm against the impact of typhoons in the South China Sea region.

Read the full article