Turkey earthquakes industry loss estimate raised 26% to US $6.2bn

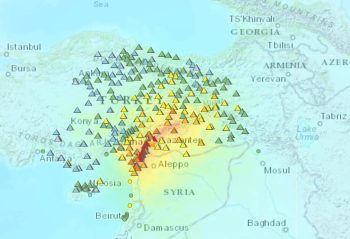

6th February 2024The insurance and reinsurance market industry loss estimate for the Kahramanmaras Earthquake Sequence that struck Turkey in February 2023 has been lifted by a significant 26%, by PERILS, to reach TRY 117 billion, which would have been US $6.2 billion at exchange rates when the disaster struck.

Read the full article