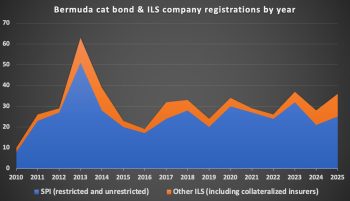

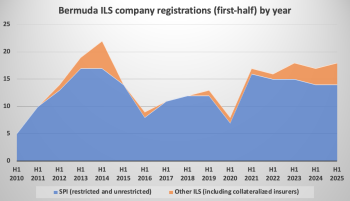

Collateralized insurer uptake lifts Bermuda cat bond, ILS registrations in 2025

26th January 2026Registration of new collateralized insurer class of companies in Bermuda soared to its highest level ever in 2025, helping lift catastrophe bond and insurance-linked security (ILS) related registrations above the prior year, while new cat bond issuance structures also rose compared to 2024.

Read the full article