Longitude Exchange & Dedomainia collaborate on index-based longevity hedges

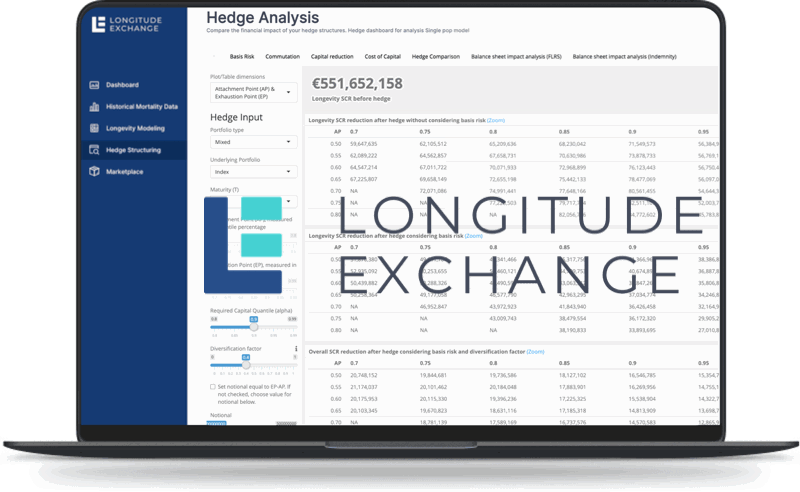

19th May 2022Longitude Exchange, the Bermuda-based digital marketplace for trading in index-based longevity risk, and Dedomainia, a technology company offering longevity swap solutions, are to collaborate on index-based longevity hedging.

Read the full article