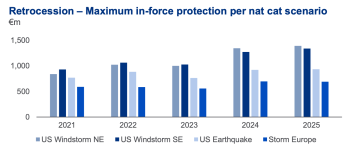

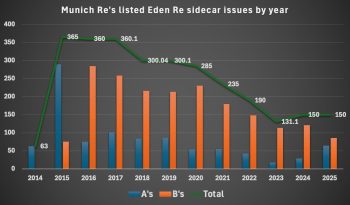

Munich Re retrocession and sidecar program stable at $1.55bn for 2025

26th February 2025Munich Re has renewed its retrocessional reinsurance program arrangements to provide $1.55 billion in protection for 2025, utilising both traditional retro and capital markets through its sidecars and catastrophe bonds at a stable level with the prior year.

Read the full article