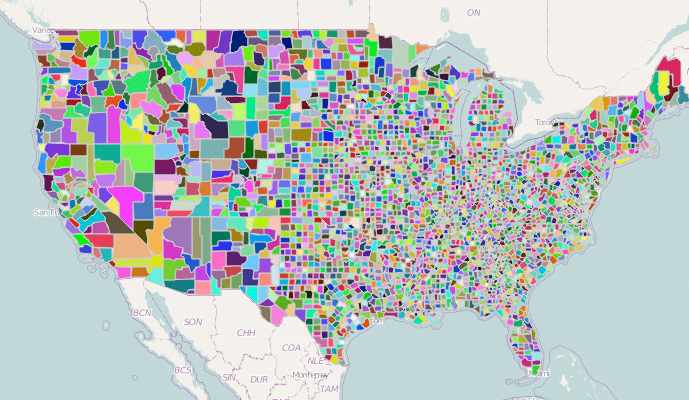

Property Claim Services (PCS) has announced that in the first-quarter of 2019 it will provide county-level industry insured loss estimates and claim counts across all U.S. states and perils, for events with insured losses of at least $1 billion.

PCS, a Verisk business, has revealed that it’s to provide a new level of granularity for U.S. property-catastrophe insured loss estimate data with its new product, and has worked closely with insurers in the U.S. and risk bearers from across the world to establish an enhanced solution that directly meets industry needs.

PCS, a Verisk business, has revealed that it’s to provide a new level of granularity for U.S. property-catastrophe insured loss estimate data with its new product, and has worked closely with insurers in the U.S. and risk bearers from across the world to establish an enhanced solution that directly meets industry needs.

According to PCS, it has already received county-level projected ultimate loss data from a broad range of insurance companies, with additional data continuously being submitted. So far, testing has focused on Texas, with numerous perils driving events of greater than $1 billion.

PCS states that it will complete further testing across the U.S. before its county-level industry loss estimates are made accessible.

“The market has sought a county-level solution for years, and past efforts have been helpful but couldn’t deliver the same level of reliability as the extension of the core PCS methodology down to county. This new PCS enhancement will equip insurers and reinsurers to benchmark performance and to manage risk and capital more effectively in the most catastrophe-prone insurance market in the world.

“PCS has long been the most relevant catastrophe loss reporting agent, with clear independence and a track record like no other. We’re thrilled that our clients collaborated with us on this new solution, and we’re eager to help them put it to work,” said Tom Johansmeyer, co-head of Strategy and Development, PCS.

The new solution’s historical events database will include hurricanes Harvey, Irma, and Maria of 2017, which contributed to the year becoming one of the costliest on record for global insurers and reinsurers.

Johansmeyer, continued: “Getting county-level resolution for PCS right involved a lot more than the operational exercise, although, of course, that’s where the rubber meets the road. You can’t get a solution out the door without operational excellence. However, you need extensive feedback from the market to ensure that a crack operational team is pointing their efforts in the right direction.

“We spent several months conducting deep interviews with key stakeholders across the global reinsurance and ILS community. The entire PCS team’s goal was to build and operate a county-level solution that would be directly useful to our clients, and we’ll continue to work with the market through our go-live next year to ensure that they’ll be able to get the most from our efforts.

“Collaboration across the market is crucial to any exercise that seeks to bring more original risk to market. For county-level, given the interest and demand we’ve experienced for years, we’ve been sure to engage the market closely.”

Ted Gregory, co-Head of Operations, PCS, added: “The operations team has been working with its usual tireless commitment to develop our new solution for county-level reporting in the United States, particularly while actively engaged in the management of several major catastrophe events from 2017’s unprecedented activity. And we’re thankful for the continued—and increased—support provided by the insurance industry in helping us reach this important milestone.

“New solutions from PCS require trust, effort, and collaboration. We never lose sight of that fact, and our ongoing efforts will show it.”

PCS notes that in its almost 70 years of servicing the global insurance and reinsurance markets of the world, it has published industry loss estimates for almost 1,900 catastrophe events, amounting to insured losses of more than $570 billion (not adjusted for inflation or any other factors).

In the past a modelled Country Weighted Industry Loss Warranty (CWIL) product developed by broker Guy Carpenter was particularly popular, with ILS giant Nephila Capital providing significant capacity through this structure.

With a county-level industry loss estimate based on data collected from insurers now available, rather than a modelled and weighted county breakdown of a loss, it will be interesting to see whether the appetite to hedge catastrophe and severe weather risks on a county basis returns and how both traditional reinsurance and ILS markets look to use this data within their hedging decisions.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.