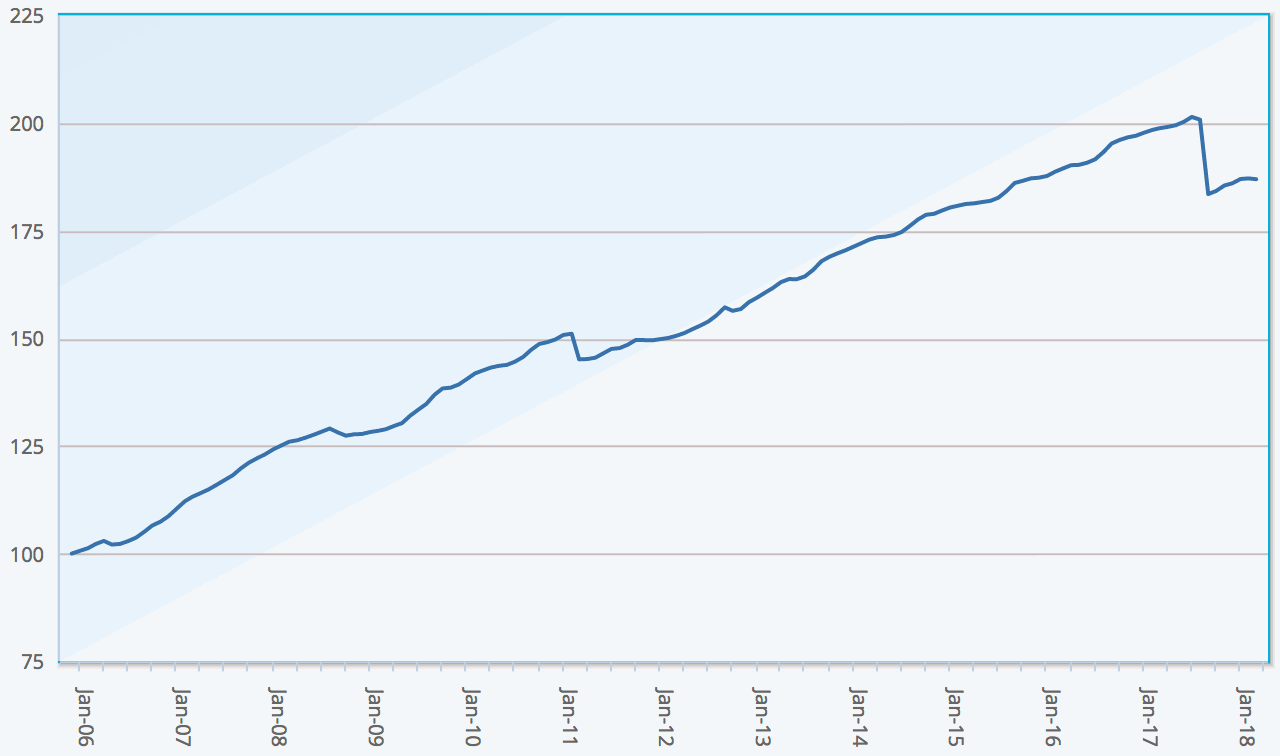

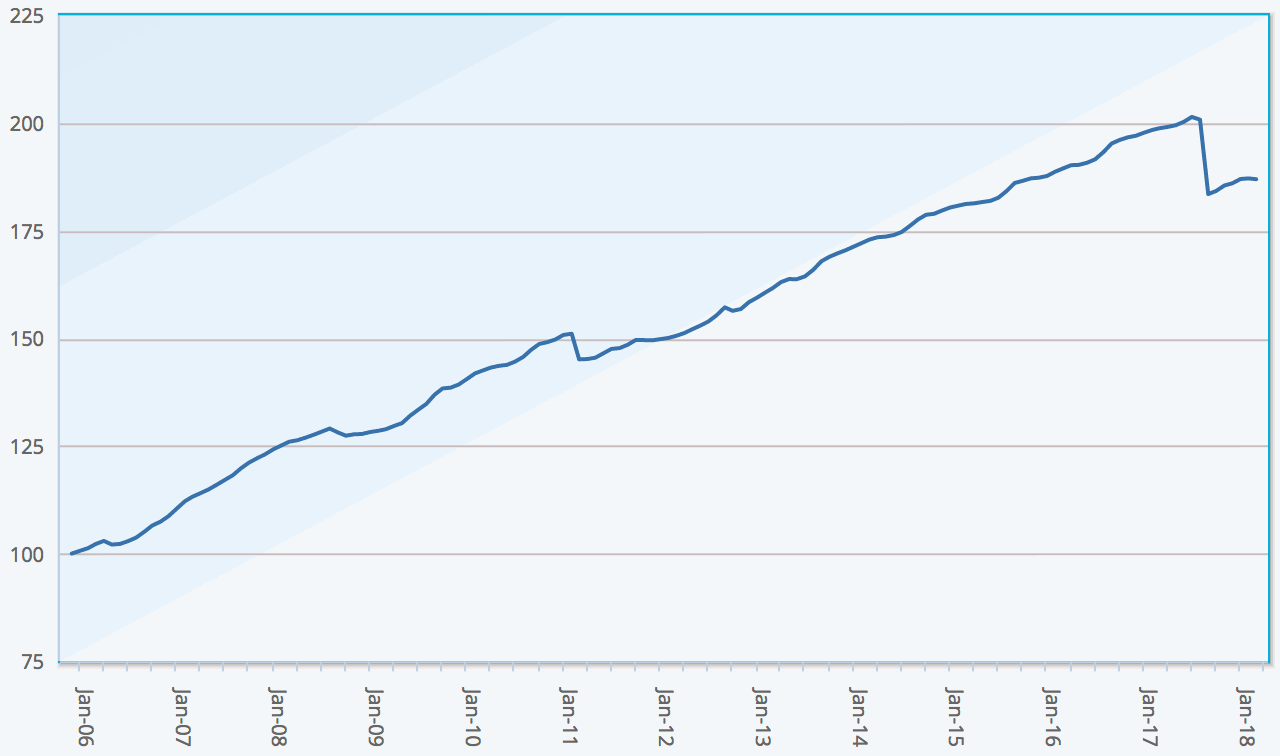

The ILS Advisers Index, which tracks the performance of numerous insurance-linked securities (ILS) and reinsurance linked investment funds, scraped to a positive return of just 0.08% in the month of February 2018, as the impacts of prior losses continued to reverberate around the ILS market.

The impacts of the severe hurricanes, wildfires and other catastrophe event of 2017 continue to affect ILS fund returns, with adjustments being made as updated loss estimates emerge from ceding companies and industry loss data providers.

The impacts of the severe hurricanes, wildfires and other catastrophe event of 2017 continue to affect ILS fund returns, with adjustments being made as updated loss estimates emerge from ceding companies and industry loss data providers.

During the month of February 2018 it became clear that ILS funds were suffering the negative effects of these adjustments to prior month loss estimates during the period, with a number coming in negative for the month.

As we explained recently, some ILS funds saw performance as negative as -2% during the month of February 2018, while others saw positive performance of around +2%, reflecting the diversity among ILS and collateralized reinsurance investments strategies.

Now, the latest update to the Eurekahedge ILS Advisers Index shows the impact of this negativity, with the average return across the cohort of ILS and reinsurance-linked investment funds it tracks reported as just 0.08% for the month of February.

That takes the average ILS fund return for the first two months of the year to 0.62%, which is actually not that far off average for this time of the year.

In February, 24 of the 34 ILS funds tracked by ILS Advisers reported positive returns for the month, but the difference between best and worst performing was 2.01%.

This was the first month for a while where private ILS funds outperformed pure cat bond funds, with those funds investing in private collateralized reinsurance arrangements increasing by 0.21%, while the pure catastrophe bond funds only managed 0.12% in February.

On an annualised basis the underperformance of private ILS funds continues to be stark, with the gap roughly 2.82% to the pure cat bond fund annualised average performance.

ILS Advisers explained how some instruments were affected by prior loss events in February, saying on cat bonds that, “Some of the bonds dropped in value due to higher losses estimates from previous events. The ResRe aggregate bonds are one step closer to trigger as the winter storm striking the U.S. at the beginning of March is likely to bring the loss to attachment level.”

While on the private ILS side of the market, “Some private ILS funds continued to adjust their valuation on the side pocket positions based on updated loss estimates from their cedents. The adjustment is likely to persist in coming months.”

In fact this is already evident for March ILS fund returns, as we understand some are already coming in negative given the further adjustments needed to side-pocket valuations, as loss estimates changed and industry losses are updated.

This is likely to continue to impact certain funds, but it will all even out in the end once the losses are fully understood and at that point there may also be some recoveries to be made from side-pockets, which could result in more positive months at times.

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.