The insurance-linked securities (ILS) fund and collateralized reinsurance sector expanded both the scope of the coverage it was offering as well as its market share at a Florida June 1st reinsurance renewal where rate increases were seen as disappointing, according to broker JLT Re.

Not only were the ILS fund markets competitive on price this year, but also increasingly on the scope of the coverage they offered, particularly with reinstatements that are increasingly becoming part of the ILS offering.

This is putting ILS backed reinsurance capacity onto an ever more level-playing field with traditional reinsurance, helping ILS markets to grow their share while forcing traditional players to compete even harder to maintain their own.

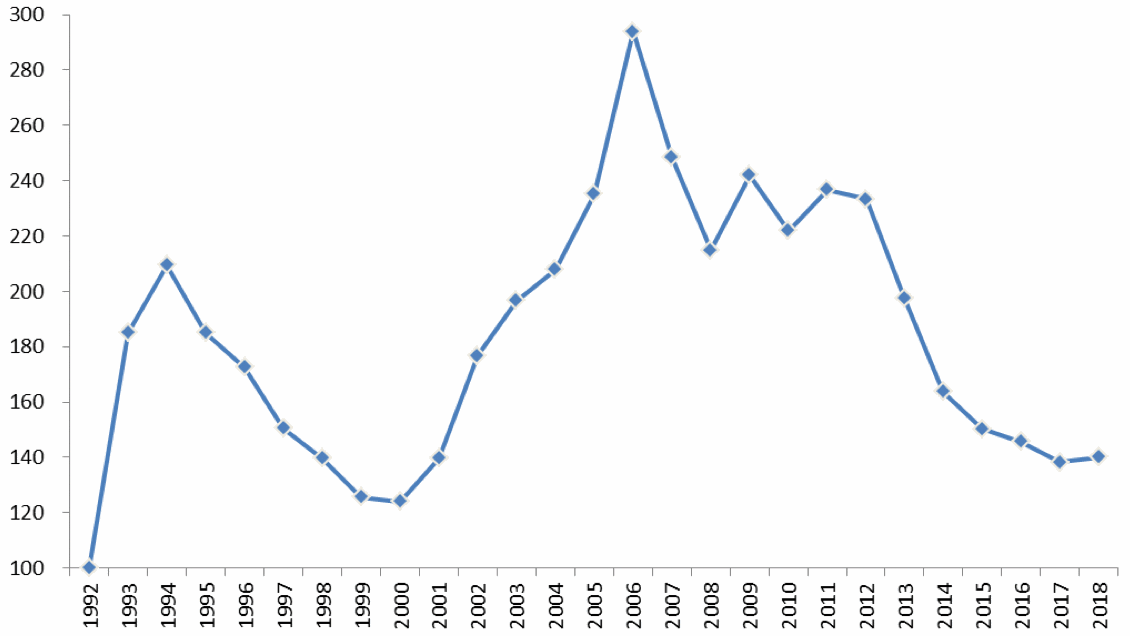

JLT Re said that the Florida reinsurance renewals at June 1st 2018 saw only “negligible” rate increases, with the broker reporting that its own Risk-Adjusted Florida Property-Catastrophe ROL Index increased by just 1.2% this year.

The JLT Re Risk-Adjusted Florida Property-Catastrophe ROL Index, 1992 - 2018

However, even this small rate increase has bucked the Florida reinsurance renewal trend somewhat, being the first rise in the JLT Re rate-on-line Index in seven years.

The 1.2% increase in the Florida reinsurance rates Index seen at June 1st 2018 compares to a decline of 5.1% a year earlier, but failed to match the increase seen in U.S. property catastrophe reinsurance renewals that completed at January 1st, suggesting that those markets who managed to raise capital and deploy it at 1/1 may have benefitted from the best rate opportunity we will see this year.

JLT Re said that Florida reinsurance pricing now remains 40% below 2012 levels, despite the first increase in years and is now sitting just 13% above the previous cyclical low of 1999 to 2000.

While rate increases will have been disappointing for many, those who targeted loss affected accounts, or have strong relationships with companies for who they paid out on losses in 2017, may have found their overall portfolio pricing rose a little more than the Index.

The catastrophe bond market has had a bumper start to the year again, with now almost $8.2 billion of issuance recorded in the Artemis Deal Directory in 2018. This has enabled new capital to continue to flow into ILS strategies, alongside the ongoing growth of collateralized reinsurance, which have continued to apply pressure to traditional business models.

JLT Re notes that the influence of alternative reinsurance capital remains particularly strong at the Florida renewal season, saying that ILS fund markets were, “vigorously looking to deploy capital at the Florida property-catastrophe renewal.”

But the broker highlights a point that is perhaps more significant than just weight and efficiency of capital, when it comes to the ongoing prospects for ILS market growth, the fact that there was more evidence of, “ILS players extending provisions into areas traditionally dominated by traditional reinsurers.”

Here, JLT Re cites the fact that more and more ILS players are finding ways to offer their customers reinstatement provisions, enabling the coverage they provide to become more closely aligned with that offered by the traditional market.

So JLT Re explained that ILS markets often, “Proved to be as competitive on price as the traditional market, with single-shot transactions such as top or drop aggregate cover and reinstatement premium protection occasionally coming in cheaper.”

Being competitive on price thanks to capital efficiency is one thing, but being able to compete on offering equivalent levels of reinsurance or retrocessional coverage as well is what could really propel the next phase of ILS market growth.

The more equal the options for coverage between ILS and traditional reinsurance, the more ceding companies will be tempted to try out the capital markets as a component of their reinsurance programs, which will gradually drive further penetration of ILS and overall growth of the capital markets share of property catastrophe risks.

As a result, JLT Re said that traditional reinsurers were on the back foot, under pressure to defend their market shares in the state of Florida, which will have exacerbated the price situation even further.

But the renewal market outcome should not have been a surprise, as with rate increases slowing ever since January and the retro market seeing price momentum receding through the year, along with the abundance of capital the Florida renewal was never going to result in the rate increases some were hoping for.

Looking ahead, JLT Re explains that the reinsurance market is well-positioned to deal with any losses that come along, as we enter the 2018 Atlantic hurricane season.

Reinsurance protection and the ILS market have demonstrated their worth, helping Florida state insurance carriers to emerge relatively unscathed from the losses of 2017, while their needs have also been met at the June 1st renewals.

JLT Re expects that buyers needs will also be met at future renewals in 2018 and beyond into 2019 as, “The value and efficiency of reinsurance protection is once again being demonstrated by allowing cedents to react speedily to underwriting opportunities.”

Register now for our upcoming Singapore conference. Tickets on sale here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.