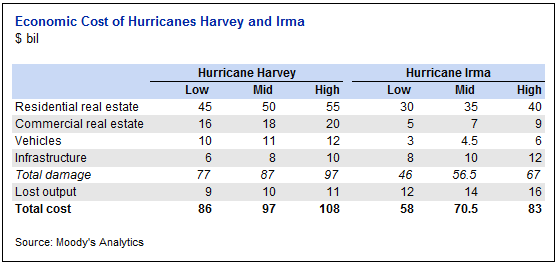

Economic losses from hurricane Irma are likely to rise to somewhere within a range from $58 billion to $83 billion, according to Moody’s Analytics, with lost economic output contributing as much as $16 billion given the wide area impacted by the storm.

The estimate of economic loss includes both property damage and lost economic output, although the economic property damage is expected to be lower than from hurricane Harvey.

Hurricane Harvey (estimated at up to $108 billion of economic costs) caused a considerably larger economic loss than Irma, with water driving much more of the costs as flooding covered Texas. Irma, as more of a wind event, is likely to result in a higher impact to the private insurance and reinsurance market.

Irma will also be more of a reinsurance than insurance event, it is assumed, with retentions lower in Florida.

Moody’s Analytics said that hurricane Irma will be, “Among the costlier natural disasters in recent history but likely behind Harvey and Superstorm Sandy.”

Moody’s Analytics gave its view on the damage caused by hurricane Irma:

With the largest economies in its path faring better than expected, the preliminary damages associated with Irma are milder than those of Harvey. Single-family housing incurred $30 billion to $40 billion in damage, which is significant but well shy of Harvey’s $45 billion to $55 billion figure. Wind tends not to be as destructive as water in natural disasters, and with Irma’s storm surge proving milder than expected across much of Florida, damage was kept somewhat in check. However, the storm’s tremendous footprint meant that while no one large economy was decimated, many face significant cleanup. For example, Jacksonville FL and Charleston SC, neither of which was in the hurricane’s direct path, were both caught somewhat off-guard by Irma’s storm surge, harming property in those areas more than expected and demonstrating the storm’s diffuse impacts.

Meanwhile, commercial real estate damage is noticeably milder than it was in Southeast Texas. While smaller restaurants and shops suffered severe damage in areas like Key West, their price tag is relatively modest compared with CRE holdings elsewhere in Florida. The industrial and office markets emerged largely unscathed, and damage to the large Miami multifamily market was minimal. As a result, the cost to businesses is significantly lower than Harvey’s, ranging from $5 billion to $9 billion.

Similarly, damage to vehicles is far milder given that flooding was not nearly as severe as in Texas. Total losses are expected to be in the $3 billion to $6 billion range, reflecting more favorable conditions and the large number of evacuees whose cars and trucks were out of harm’s way. However, damage to boats in the affected area pulls the number a bit higher than it would otherwise be.

Infrastructure damage is estimated at $8 billion to $12 billion, a bit steeper than for Harvey. This is because the widespread power outages in Florida indicate significant damage to the electrical grid there; a similar, albeit more severe, version of this is playing out in Puerto Rico as well. Further, damage from falling trees and repairs needed on the state’s many bridges will make for a steep price tag.

And on the impact to economic output:

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

While the initial damage estimate of $46 billion to $67 billion for these combined categories is noticeably less than Harvey’s $77 billion to $97 billion range, Irma’s effect on economic output will be more severe. While Harvey likely caused between $9 billion and $11 billion in output losses, the figure for Irma appears to be in the $12 billion to $16 billion range.

There are a few reasons why Irma will result in more output lost. First, the storm affected a far larger geographic area, shutting down Florida almost completely. The evacuation of much of the Sunshine State alone would have accounted for billions in lost output, even if the storm changed course and avoided Florida altogether. Combine that with evacuees’ inability to return to work due to road closures and the widespread power outages roiling Florida, and the economic disruption will prove significant. The state’s critical tourism industry will likely prove resilient—in fact, Walt Disney World in Orlando has already reopened—but most destinations will be bereft of visitors for at least a few weeks. One silver lining, however, is that hurricane season tends to be among the least popular times to visit Florida anyway, especially in hard-hit Naples and Marco Island, keeping losses in check.