The difference between the best and worst performing funds among insurance-linked securities (ILS), catastrophe bonds and collateralized reinsurance strategies tracked by the Eurekahedge ILS Advisers Index widened to 4.05%, as loss adjustments drove the Index to a negative -0.24% return for March 2018.

ILS funds and collateralized reinsurance investment strategies have continued to be hard-hit by adjustments made to loss estimates for the 2017 hurricanes, wildfires and other catastrophe events.

ILS funds and collateralized reinsurance investment strategies have continued to be hard-hit by adjustments made to loss estimates for the 2017 hurricanes, wildfires and other catastrophe events.

On consecutive months now, the difference between best and worst performing ILS fund strategies has widened and in March the gap between performance was stark, at 4.05%, as numerous funds particularly on the side of the market investing in private ILS and collateralized reinsurance, reported significant increases to losses.

Stefan Kräuchi, Founder of ILS Advisers, explained, “The biggest loser in the Index is a private ILS fund that lost 3.66% for the month. Interestingly the biggest gainer is also a private ILS fund that increased by 0.39%. This again shows a wide variance of performance post events among private ILS funds.”

The upwards revision in loss estimates for hurricane Irma and the California wildfires are seen as the main causes of the broad negativity experienced in the ILS fund market, with the private ILS funds experiencing the bulk of the impact and the pure catastrophe bonds not as negatively impacted.

“The upward revision of previous event losses had more impact to the private ILS than cat bonds on whole. Some of the side pockets have been significantly marked down,” Kräuchi said.

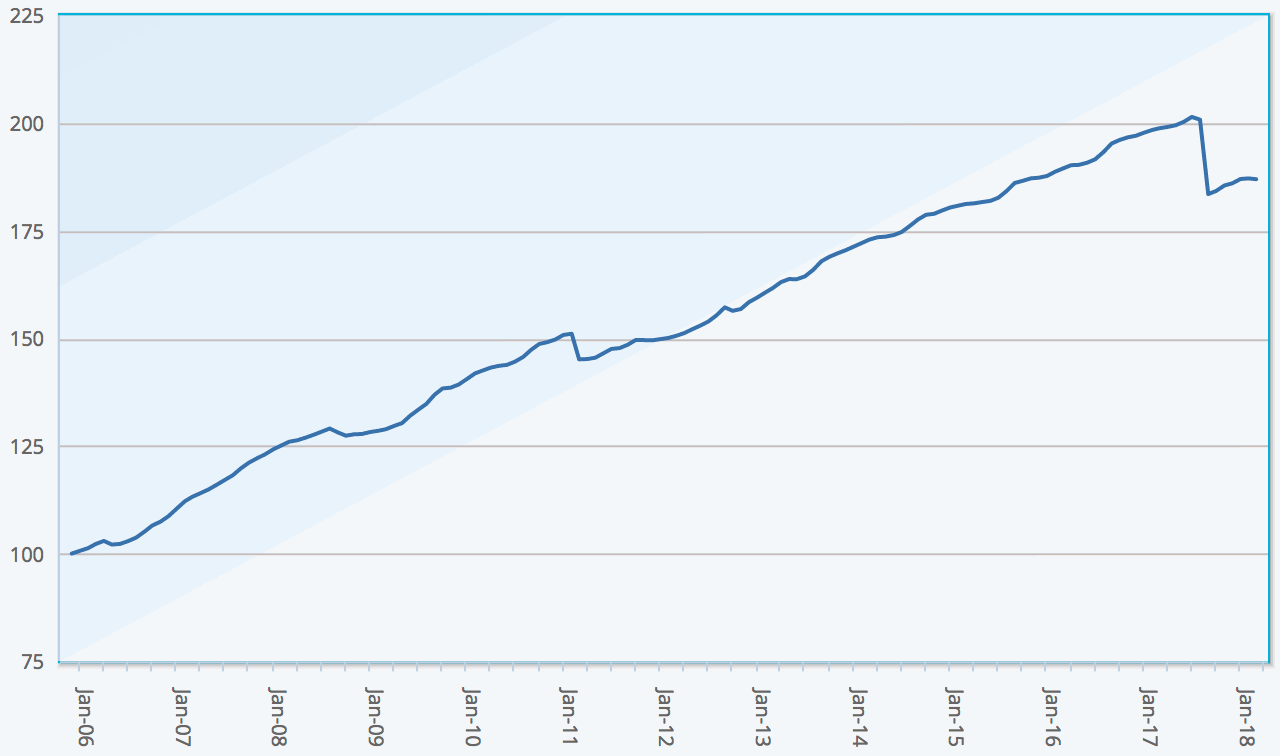

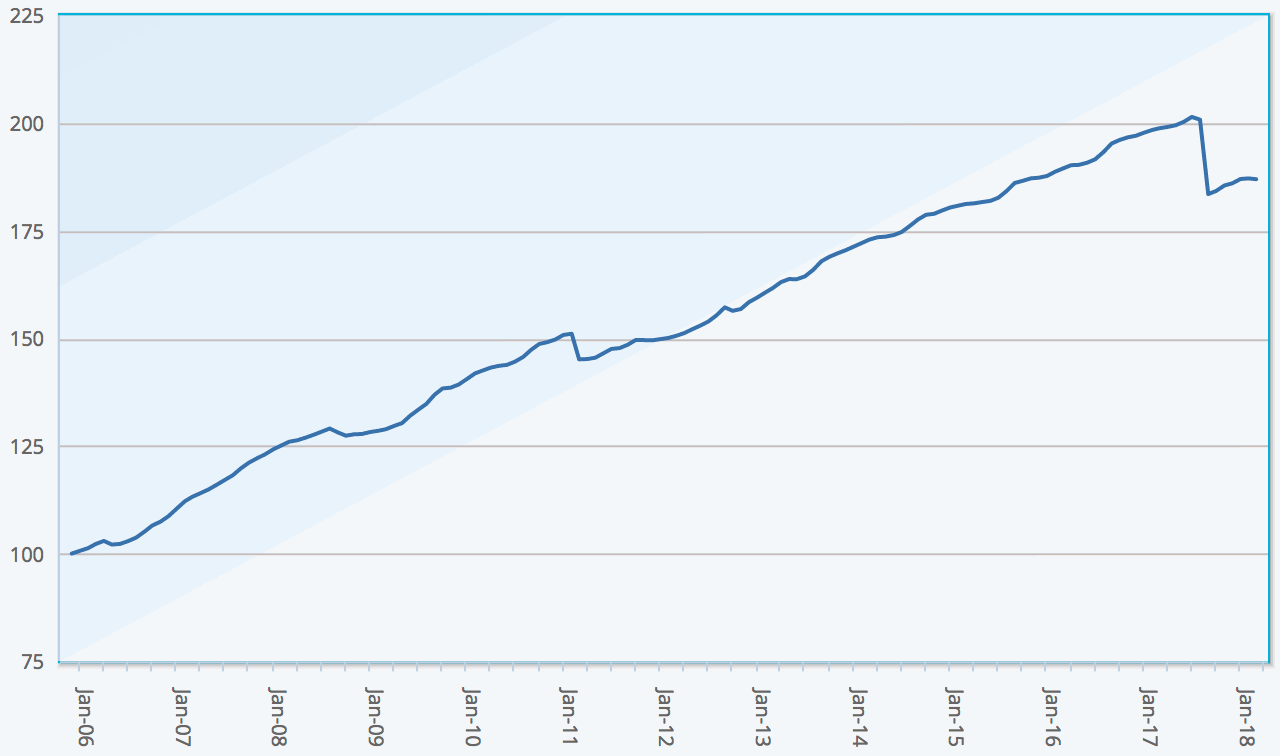

The overall -0.24% return of the Eurekahedge ILS Advisers Index is the worst month this year and the third lowest March return since 2006. Across the first-quarter of 2018 the Index has recorded a positive return of 0.37%, which is the third lowest Q1 on record.

It wasn’t all negative in March though and out of the 34 ILS fund strategies tracked by ILS Advisers, 21 reported a positive return for the month.

But with the gap so wide between best and worst, some of those that were negative have in some cases likely wiped out Q1 returns completely.

Of the 13 negative ILS funds in March, 4 were pure catastrophe bond investment funds, while 9 are funds that invest in private ILS or collateralized reinsurance as well. The pure cat bond funds as a group scraped a positive return of 0.01% while the subgroup of funds also invested in private ILS returned -0.43%.

The private ILS funds continue to underperform the pure cat bond funds, on average, as the effects of the 2017 catastrophe losses continue to influence returns in 2018.

In fact, the group of ILS funds investing in private ILS and collateralized reinsurance now trail the pure cat bond fund group by -3.65 percentage points on annualized basis year-to-date, according to ILS Advisers.

The stark difference between strategies reflects not just the type of assets they invest in, but also the levels of risk assumed as well.

“It can be explained by the portfolio composition as well as by the assumptions managers make in their valuation process,” Kräuchi told us. “Another factor is the timeliness of cedents updating their loss data, which is used to revalue the positions of private ILS funds.”

Of course this is what makes the ILS asset class so interesting, the breadth of strategies, risk levels assumed, assets invested in and range of counterparties available to trade with. All of which is where the ILS fund managers will try to generate their alpha, using their expertise in risk selection, underwriting and relationships to construct portfolios that can outperform.

But when losses like 2017 strike, there is really no option but to work through the ramifications and try to gain as much clarity on losses as quickly as possible. This process remains ongoing and there could be further hits to some ILS fund returns in months to come, as the true size of the 2017 catastrophe losses continues to develop.

Looking back on the first-quarter, Kräuchi said that the strong inflows witnessed into the ILS sector has dampened premiums to a degree.

“We believe it is safe to say, that rate improvement has failed expectations of ILS investors from late last year and this is becoming more obvious now after the index results for the Q1 2018 are out,” he explained.

Kräuchi also highlighted an important point to note, that some ILS fund managers only report the results of their main fund series, so excluding the influence of side pockets that reflect the actual loss development on the returns.

That means in some cases the returns can technically be worse than we get to see, leading Kräuchi to say that the Index return, as far as private ILS funds are concerned, does not always fully reflect the experience of those invested before the hurricanes of 2017 struck.

The results will flow through, as the year progresses and in many cases ILS fund managers will have reserved conservatively, meaning there will be profits that can be released from side pockets to the benefit of the funds returns and the investors, in quarters down the line.

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.