The ILS fund market is going to suffer its largest draw-down on record for the month of September 2017 and the full-year is set to be the worst year on record for insurance-linked securities (ILS) investments, after the impacts of recent major hurricanes and other catastrophe losses.

Following on from a negative August, in which the average return of 34 constituent insurance and reinsurance-linked investment funds sank to -0.34% on the impact of hurricane Harvey, September is set to be significantly more negative.

Following on from a negative August, in which the average return of 34 constituent insurance and reinsurance-linked investment funds sank to -0.34% on the impact of hurricane Harvey, September is set to be significantly more negative.

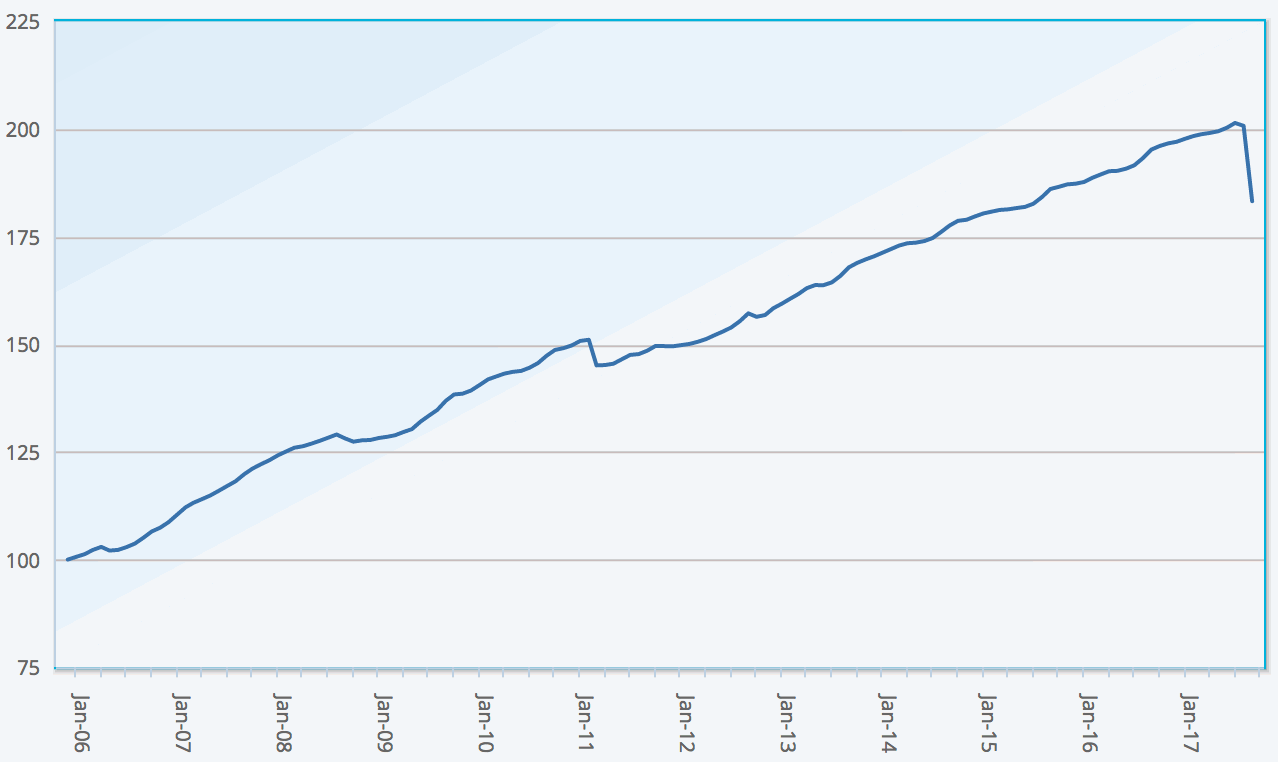

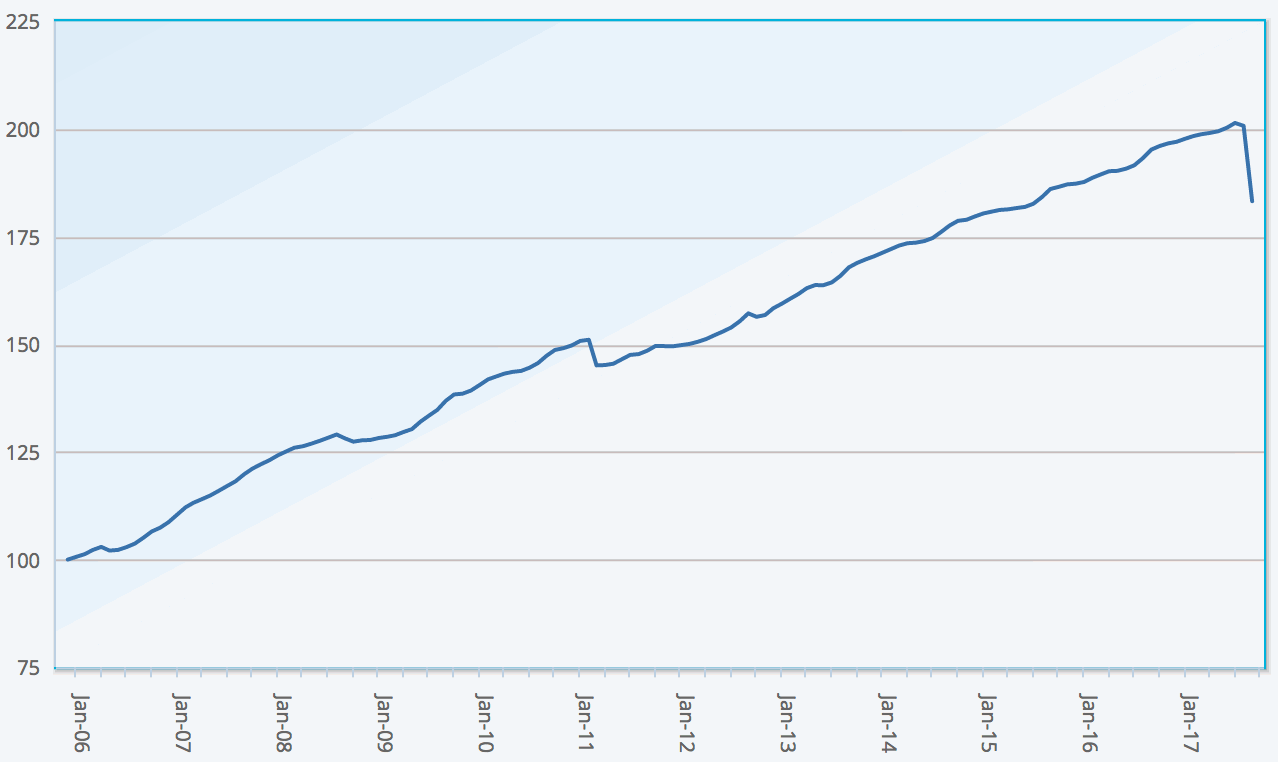

Right now (as at October 25th), the Eurekahedge ILS Advisers Index shows a negative return of -9.02% for the ILS fund market, with almost 97% of the 34 constituent ILS funds having reported their returns already.

The range of ILS fund returns in September 2017 will be extremely wide. A number of ILS funds that underwrite collateralised reinsurance and retrocession will report losses for the month in the -20% and greater range. While at the other end of the risk-return spectrum, some ILS funds will report negative returns in the low single digits, especially the pure catastrophe bond funds and the lower volatility collateralised reinsurance players.

The ILS Advisers insurance-linked securities fund index, that tracks the performance of 34 leading ILS funds, points to just how negative this year could be for ILS investors, with the year-to-date return to September 30th 2017, based on those ILS funds that have reported already, now showing a -7.31% decline.

The ILS Advisers Index provides a good proxy for the performance of the ILS market, across a range of risk-return strategies from cat bonds to retrocession. Broadly this can help third-party investors to understand how an allocation across a number of ILS fund managers may perform and 2017 will provide important learnings for the space.

This year could see the highest insurance industry losses ever witnessed in the sector, while the fact these have come from a number of events that occurred close together, rather than one single event dominating, has exacerbated the effects and made estimating losses and reserving a little more tricky.

Because of the way the aggregation of catastrophe losses has hit the ILS fund market, there will be the potential for those who have reserved prudently to release some of these reserves in months to come.

On the collateralised reinsurance and retrocession side this could mean that some ILS funds can flow capital back into their funds in months to come, as losses crystalise, meaning some of the negative impact of recent events could be recouped and boost their returns in future months.

On the catastrophe bond fund side of the market, portfolios have been marked down using broker pricing and it’s clear that not every marked down cat bond position is going to face a loss, meaning that there will be mark-to-market gains to be had further down the line.

However, on the catastrophe bond investments side, there is still the potential for certain cat bonds to suffer losses greater than where mark-downs currently sit, should the industry loss estimates for hurricanes Harvey, Irma and Maria rise considerably in the weeks to come.

It’s no surprise that September is set to be the most negative month ever for the ILS fund market.

The month saw the first Mexico earthquake that caused the complete loss and write-down of a $150 million earthquake exposed tranche of the IBRD / FONDEN 2017 catastrophe bond.

September then saw hurricane Irma strike the Caribbean and Florida, with industry loss expectations pointing to a much greater impact for reinsurance and ILS fund interests was seen with hurricane Harvey, given the ILS sectors concentration in Florida. One catastrophe bond has already been confirmed as a loss from Irma’s impact and it’s possible we could see some more cat bonds triggered once the industry loss is better understood.

Soon after we saw the second Mexico quake, this time focused on Mexico City, which is likely to create some small losses for a number of ILS funds, although far from a broad impact.

Finally, hurricane Maria’s impacts on the Caribbean and Puerto Rico, which could still be the most expensive single loss of the month has caused a further impact to certain ILS fund assets.

Add up these losses and then factor in the impact to aggregate contracts where a number of events have qualified as losses under the terms of the reinsurance, particularly retrocession, and it’s easy to see why September 2017 has been such an impactful month for the ILS fund market.

Some of the decline could be recouped in October, as the magnitude of losses becomes clearer, particularly for cat bond focused funds. But there is also the potential for further negativity to be seen, as any worsening of loss estimates could result in some ILS funds needing to bolster their reserves for specific events.

2017 is set to be the most negative year on record for the ILS investment fund market. The only other year when the ILS Advisers Index was negative was 2011, but even the heavy losses suffered in March that year only pushed that month down to -3.94% and the average ILS fund return for the year to -0.14%.

ILS investors are facing the biggest losses they have ever suffered and it’s not just in ILS funds, the third-party capitalised sidecars and other collateralized reinsurance vehicles will also be taking their share of 2017’s catastrophe losses.

We continue to believe that the market will come out the other side of 2017 as a larger, better tested, and more robust asset class. As we wrote before, it’s how the ILS market reacts to recent losses, responds, pays its claims and trades forwards that really matters.

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.